What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- It was another week of inflation watching: a high US consumer price index (CPI) reading sent a shudder through financial markets and US interest rate expectations rose again. Until we get some indication that inflation is peaking, this volatility is going to continue. There was one bright spot in the report: goods inflation was in line with expectations, indicating that much of the inflation pressure is demand led.

- Fixed income markets bore the brunt of the pressure as 10-year yields in the US breached 2%. The yield curve is still flattening but we will stick with shorter duration exposure. As the short-dated bonds mature, we will reinvest at the higher rates and improve potential returns. There is some short-term pain, but we should get the benefit as the year progresses.

- Equity markets ended the week under pressure as the Ukrainian situation deteriorated. History shows that these types of geopolitical crises end up being contained with both sides pulling back from broadening the engagement. Hence there is limited impact on the global economy and little lasting impact on financial markets, although the short-term moves can be unsettling.

- Over the week sectors and companies exposed to the reopening theme were the strongest performers. We feel there is further potential return for this theme, and it is not central bank sensitive.

Sector special: US consumer staples

- The majority of US consumer staples companies have reported their Q4’21 results. Sales grew 6.1% year-on-year – that’s considerably slower than the overall market, where sales are expected to grow by just over 15%, and places it among the slowest-growing sectors (only utilities rank worse).

- That said, most companies have reported better-than-expected sales. In Q4, earnings grew by 4.2% and more than a third of companies reported worse-than-expected earnings per share.

- Like other sectors, consumer staples companies are facing higher costs across energy, commodity, packaging, transport, and labour, and so, margins are being squeezed. Some companies, such as beverage and beauty firms with strong brands, are faring better than others. They are benefitting from stronger pricing and better volumes or cost reduction plans.

- Meanwhile, weaker food, home or personal care brand companies are struggling to raise prices without impacting volumes. Looking ahead, sales should benefit from a recovery in away-from-home consumption, while input cost growth may ease.

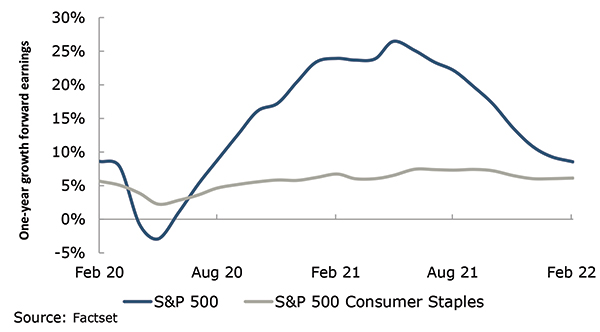

Chart of the week: Defensive growth convergence

Consumer Staples tend to be viewed as a defensive sector – sales and profits vary less through an economic cycle than the market. In a recession, they tend to be resilient, whereas in the recovery that follows, other sectors benefit more. This can be seen in the chart. The one-year growth rate (forward earnings) of the market (and cyclical sectors within it) fell sharply during the Covid-19-induced recession and rebounded strongly in the recovery. Meanwhile, Consumer Staples experienced a shallower dip and smaller recovery. Since then, the growth rates have almost converged – and so, the consumer staples sector’s future growth is almost as attractive as the market.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |