What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Monetary policy remains the key market driver. Equity and bond markets initially rallied last week after the US Federal Reserve (Fed) was no more hawkish than anticipated. The rally was short lived as bond yields then rose and equities gave it all back and more. The Fed expects inflation to plateau and then trend lower, and it sees longer-term expectations as well anchored. It noted that the inflationary impact of recent supply shocks was beyond its powers to control e.g., Russia’s invasion of Ukraine and China’s Covid lockdowns. Nonetheless, it remains ready to act appropriately to rein in inflation.

- Equity markets are back near March lows and more than 10% below recent highs. Defensive sectors have outperformed, while more speculative stocks have been particularly hard hit. This reflects rising recession risks, tighter financial conditions and higher interest rates.

- Bond yields in the US and Europe have moved sharply higher over the last six months, discounting accelerated monetary policy tightening. After the FOMC announcement, US bond yields declined initially (bond prices rose), and the yield curve steepened. The curve steepened again after the monthly jobs report.

Macro views

- The US Fed raised rates by 0.5%. Details of plans to begin reducing its balance sheet next month were also consistent with market expectations. Commentary on future rate hikes - 50 bps increases at the next couple of meetings and Chair Powell saying 75 bps moves are not under active consideration – was no more hawkish than markets expected.

- Employment indicators were the big releases last week. US payrolls increased by over 400 thousand in April. The US unemployment rate of 3.6% is flat month-over-month near 50-year lows. The Fed hopes to curb labour demand from current levels where job openings are at historic highs of about twice the level of unemployment. In the euro area, the March unemployment rate of 6.8% is the lowest it has been on record.

- Survey indicators were generally softer than expected, reflecting slower but still good growth. Euro area manufacturing and services PMIs were stable month-on-month. The US ISM Manufacturing and Services Indices both came in lower than anticipated and were down month-on-month. China’s Caixin Services Index was down sharply reflecting regional Covid lockdowns.

- The EU has announced additional planned sanctions on Russia, although a potential ban on oil imports is contentious.

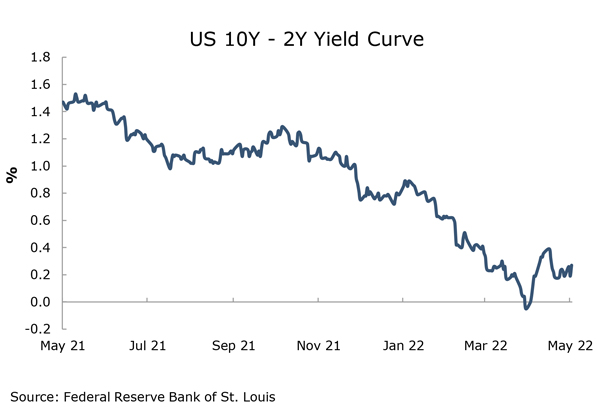

Chart of the week: US yield curve

The US yield curve (10-year bond yields minus 2-year bond yields) has typically inverted (gone negative) ahead of US recessions. The lead time varies and can be years. The acceleration of expected US monetary policy tightening over the last six months has seen the yield curve flatten, with a couple of days of inversion. Market moves after the FOMC meeting suggest much of the repricing has likely occurred. Recession risks have clearly increased but economic growth is still likely to remain strong, supporting earnings growth. We have a neutral stance on equities, while parts of the fixed income market are looking more attractive.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |