What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

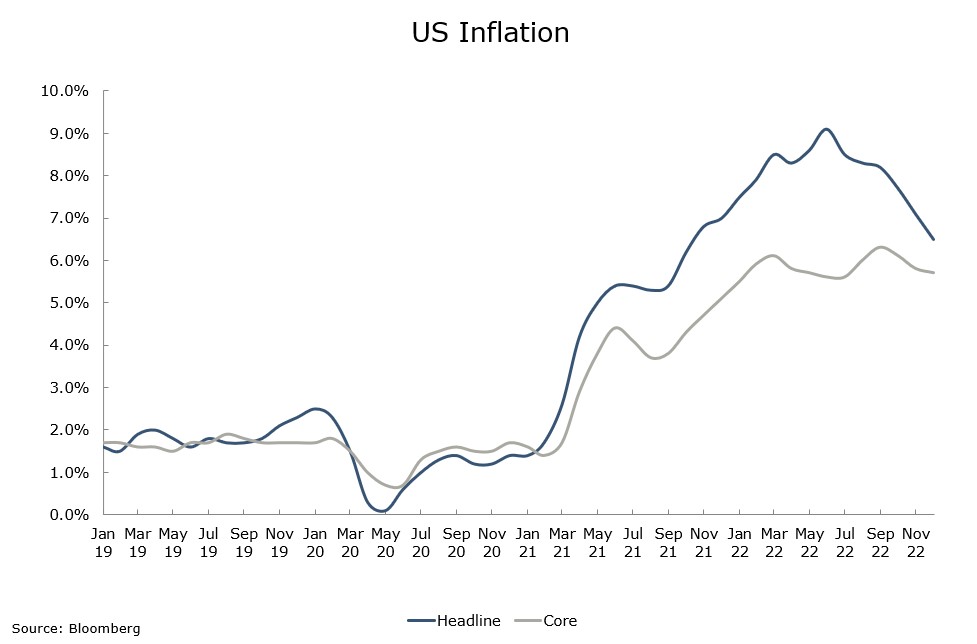

The New Year has started with some cheer but a portion of this is a rebound from extreme weakness at the end of 2022. Bond yields had a big move up in December but much of that has now unwound. The US 10-year yield is back to where it was in the middle of September and the euro area yield is now at end of Q3. This has been supported by better inflation indicators: headline inflation is down in both the US and the euro area. Wage growth has also slowed in the US.

World equities are up over 4% since the start of the year, recouping over half of December’s losses. Lower bond yields have helped, as have a better energy out-turn in Europe. Natural gas prices are down to 2021 levels and storage levels are close to maximum. Consequently, the euro area equity market has been the leader, up almost 9% year to date. China is rapidly moving to a more ‘normal’ Covid policy, and the People’s Bank of China are providing more support for the property sector, giving an indication of recovery potential in Q1/Q2.

There has been a strong recovery in asset markets in the early weeks of this year, but this is now likely to slow. In the short term, bond markets face the challenge of a potential change in Bank of Japan policy. It is the only major central bank that has not followed a restrictive path. Equity markets could get another boost from the results season which has just started. The fourth quarter was relatively robust across the global economy so figures could be good. However, forecasts for 2023 continue to be cut and this could weigh on equity markets once actual results are out of the way.

Macro views

Last week the World Bank updated its forecasts for global economic growth. In June, it was expecting the world economy to grow by 3% in real terms, it has now cut this to 1.7%. The reasons are familiar: tighter financial conditions; elevated energy prices; disruption from Russia’s invasion of Ukraine. The biggest downgrades have taken place in Europe and the US which are most vulnerable to these threats. The direction of change is the same as we have seen elsewhere in forecasts. 2022 outcome will probably be a bit better than expected but 2023 is turning out tougher.

This year the US Government is forecast to reach its debt ceiling and will need Congress to vote to increase the limit. The vote comes up every few years and is rarely an issue. However, with a divided government in the US, the opposition (the Republicans) might try to make some political capital out of the vote. The last time there was a major ‘debt ceiling crisis’ was 2013 when the Federal authorities had to shut down for nearly 4 weeks, causing some volatility. Raising the debt ceiling was not expected to create headlines this year but given that it took 15 rounds of voting to elect a Speaker in the House of Representatives, Congress might be in for a fractious period.

The earnings season kicked off last Friday with several financials reporting. The results were satisfactory but forecasts for 2023 were reduced on balance. The share prices were up on the day but that is coming from very depressed levels. Overall earnings are expected to be down 2% - 3% in the quarter. We will be watching what happens to the 2023 outlook rather than what the historic results are like.

Chart of the week: The downward path continues

The inflation report from the US did not produce as many ‘fireworks’ as previous months mainly because it was as expected. Headline inflation was down month-on-month as energy prices keep dropping, which is good news for consumption growth. Core goods prices were down month-on-month again leaving only the rent related measures as the only ones that have not shown any cooling. The annualised core inflation over the last three months is now 3.1%, rapidly moving towards the Federal Reserve’s target of 2%. It strengthens the argument that we are in the last stages of tightening in the US which will help all asset markets.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |