What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

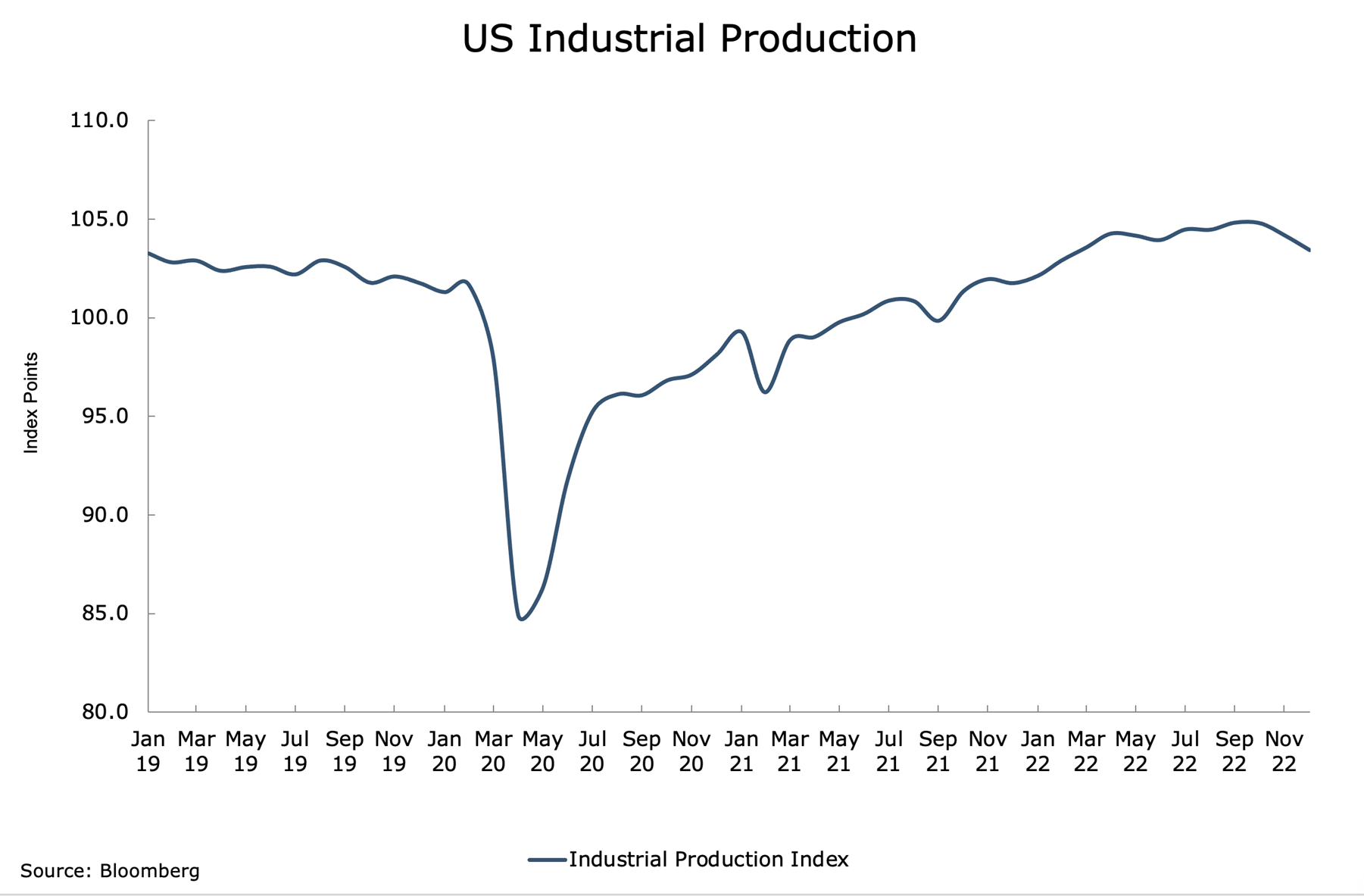

- A change in tone last week as poor reports were viewed as bad news. The growth data from the US (Industrial Productxion and Retail Sales) was weaker than expected and put a pause on equity market recovery. Fixed income markets on the other hand responded well to the weak data although the moves were modest.

- Central Banks were a focus of attention again. There was a growing fear that the Bank of Japan would tighten policy further, but thankfully it was left unchanged. This threat may return with the appointment of a new Governor in April. The minutes of the last policy meeting of the European Central Bank were released during the week. A ‘large number’ of policy makers wanted to raise interest rates by 75bps rather than 50bps, squashing opinions that the ECB would not take aggressive action in 2023.

- We expect markets to behave in the coming months like they did last week. Growth data is likely to start weakening again after a robust performance in Q4 2022. Equity markets will focus more on what that means for profits and less on what it might mean for interest rates. Bonds will get support from this but will be capped by central banks remaining in aggressive mode.

Macro views

- The growth updates from the US caught investors’ attention last week. December’s Industrial Production (see chart of the week) and Retail Sales were released and they made for some gloomy reading. Both have declined month-on month. The Retail Sales covers mainly goods consumption and data suggests there is a switch going on from consuming goods to consuming services. There were some severe weather conditions last month in the US, therefore overall consumption could be stronger in the states than this report suggests. Still, it was enough to raise recession fears again.

- The inflation news from the US was better. The Producer Price index for December was released and the monthly figures were lower than expected. The headline figure was down 0.5% month-on-month as both food and energy prices fell more than expected. Core PPI increased by mere 0.1% as did services prices, which was also up only 0.1%. The latter is encouraging as it is that section of the CPI report that is proving most sticky.

- There were many data releases from China because Covid-19 shutdowns disrupted December, but the out-turn was not nearly as bad as feared. Industrial Production was down again month-on-month, but only by 0.4%. More surprising was that Retail Sales actually increased in December. The result was that Q4 GDP came in much stronger than expected at +2.9% year-on-year against expectations of 1.6%. Of course, the more robust China’s economy is in the face of Covid-19, the lower the potential rebound as the pandemic subsides.

Chart of the week: Slowdown gaining momentum

Last week we got the non-Manufacturing ISM (Institute for Supply Management), which indicated that the Services element of the US economy could be getting into difficulty. The level of output from the manufacturing section of the economy shows a definite decline over the last three months. For some time, the sentiment indicators, like the ISM surveys, have been flashing warning signals but the actual data is proving more robust. Industrial Production fell more than the expected downward revisions compared to previous months, bringing it into contraction territory. At the moment, it pays to be cautious.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |