What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Macro views

- China was a big feature over the last couple of weeks. First quarter GDP was much better than expected: the economy grew by 4.8% year-on-year, topping expectations of a 4.0% increase. However, there was significant weakening in activity in March due to the impact from sporadic lockdowns. Industrial production, retail sales and exports all fell month-on-month, and this trend has continued into April. As a result, despite the strong GDP figure, some investment banks have cut their forecast growth rate to a range of 4.2%-4.8%.

- China’s policy response was disappointing. The People’s Bank of China cut its reserve ratio, but it did nothing with interest rates. President Xi spoke about the lockdown policy but did not indicate any change to it – and so, it looks like it will remain somewhat haphazard. The Politburo meets this week so there could be more announcements after that.

- The International Monetary Fund updated its January forecasts last week. Like others, it too has made cuts to its expected growth rate for this year and next. It now expects 3.6% growth in 2022 and 2023, which is still a respectable level of growth, but it is below the consensus growth rate for this year. It has a weaker out-turn for China and slightly worse for the euro area. However, given the comments, above consensus forecasts may be coming down to join it.

- There was some relief in Europe. Firstly, we had the re-election of President Macron in France. This means France remains a co-operative member of the EU. Secondly, the euro area PMIs for April were released showing an improvement month-on-month. Despite the moves in energy prices, the reopening is delivering a lot of momentum to the region’s economy.

Market views

- Markets were down during the last couple of weeks but were more focused on central bank speak than on changes to forecasts for the Chinese economy. This put further pressure on bonds as 10-year yields approached 1% in the euro area and 3% in the US. Equity markets are reacting to this with sharp falls last week. Encouragingly, bond markets have strengthened in the face of this equity weakness. Perhaps they will behave as safe haven assets again.

- Federal Reserve members have been making more aggressive comments, with some talking starting to talk about the possibility of 75bps rate hikes. Meanwhile, the European Central Bank (ECB) is more compromised by the growth outlook. Some ECB Governing Council members suggested that rates could rise in July. However, President Lagarde subsequently said that growth forecasts will have to be cut and called on council members to stop expressing personal or dissenting views. We have not seen any changes to the terminal level of interest rates which is more important than the pace at which we get there.

- Earnings season has kicked off in the US and Europe. Although we are at the very early stages, the indications have been good. Actual results in the US are over 8% higher than forecast at this stage and, more importantly, outlook statements have been relatively upbeat. Of course, cost issues and supply blockages are still there but corporates are managing their way through these issues.

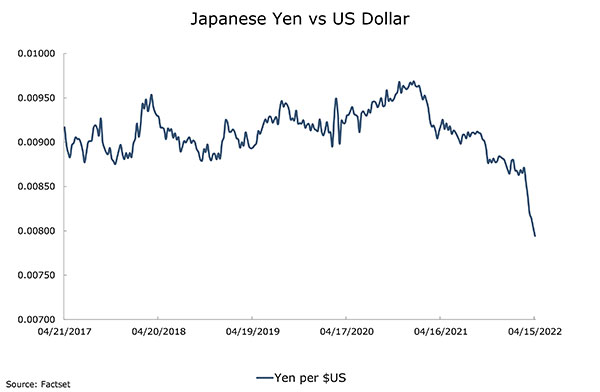

Chart of the week: Yen falls 10% in six weeks

The Japanese Yen has been having a tough time against the US dollar over the last 12 months because the Japanese economy has struggled more with recurring waves of the Covid-19 virus. The change in policy from the Federal Reserve has accelerated this trend and the Yen has dropped 10% over the last six weeks – a very large move in currency markets. With the Bank of Japan committed to maintaining low rates, this trend is not likely to change. This could induce some capital flows from Japan into the US Treasury and help stabilise yields there. China is reacting. Last week, it started to manage the Renminbi down against the US dollar – and this is not good for the region.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |