What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Macro views

- Last week, the European Commission issued its Economic Sentiment Survey, the first since the Russian invasion of Ukraine. There was a significant drop in consumer sentiment, hitting levels not seen since the outbreak of the Covid-19 pandemic. On the positive side, corporate sentiment fell marginally, and it improved in the services industry. A large drop in consumer sentiment was expected, but how much of this translates into actual consumption remains to be seen. It is encouraging that business sentiment is holding up and employment intentions were little changed. Meanwhile, inflation keeps moving up, with core inflation now at 3%. This keeps the European Central Bank in a bind: it cannot do much to support the economy with elevated price pressure.

- The PMIs from China showed the impact of the Omicron variant. Both the manufacturing and non-manufacturing indices dropped below 50. As one would expect, non-manufacturing was the weakest dropping 3.2 to 48.4. There is likely to be further disruptions in the short term as there are temporary lockdowns being imposed. Looking further out, the authorities have made it clear that they want to bring some stability to the economy, so we expect policy announcements over the coming months.

- The latest US Non-Farm Payrolls survey was robust. The headline figure was slightly below expectations but the revisions to previous months made up for that. Total employment is now only 1.3m below the pre-Covid levels, so the Federal Reserve will continue towards normalisation.

Market views

- It was quite a subdued week in markets as both bond and equity markets were close to flat over the week. The end quarter rebalance will have helped bond markets and hindered equity markets, but the impact was quite limited. Headlines from negotiations between Ukraine and Russia were modestly supportive but scepticism abounds.

- Commodity prices were weaker, oil was down over 10% and agricultural prices were down over 5%. The decision by the US to release a trance from the strategic oil reserves was the major driver of this. As a result, the commodity sectors were the weakest across equity markets.

- There were a mix of influences driving sector performances in equity markets. Stable bond markets helped Utilities recoup some recent under-performance. Lower agriculture commodity prices led Consumer Staples to outperform. In fixed income markets, investment grade bonds in the euro area logged a positive return against zero for sovereigns.

- In the sector performances, we are seeing a continual drift towards the mid-cycle type sectors – those that are less sensitive to the level of economic growth. These are generally higher valued sectors and thus suffered from rising bond yields – that influence seems to be waning now, removing the main headwind for these sectors.

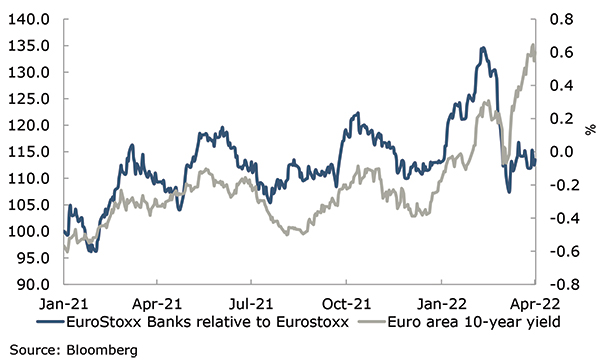

Chart of the week: The performance of euro area banks relative to the EuroStoxx

The chart above shows how the bank sector in the euro area has performed relative to the EuroStoxx. As you can see, the sector has generally outperformed when the 10-year yield in the euro area rose. At some stage, this relationship breaks down as people worry about the growth impact of higher rates. Given the recent relative performance – flat despite a significant spike in the 10-year yield – it looks like we have reached that point and banks will behave more like cyclicals going forward.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |