What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Macro views

- The non-Manufacturing ISM for March was released last week. This had been falling since November as the Omicron variant led to reductions in mobility, although it remained at very high levels. It was hoped that as the infection rates declined, we would see a pick-up. So far, there has been a strong rebound in the index to 58.3. The survey was taken after the invasion of Ukraine began so there will have been some impact. But despite this, strong economic momentum was returning.

- Euro area retail sales for February increased month-on-month and there were upward revisions to the December figure, showing that there was momentum building in the euro area as the pandemic-related restrictions were being lifted. This data relates to the period before Russia’s invasion of Ukraine – and while it will have a negative impact, it does indicate that strong momentum existed in the euro area economy prior to the war. This should help offset some of the negative impact stemming from it.

- The first round of the French presidential election took place over the weekend. President Emmanuel Macron led the field, beating Marine Le Pen by 5%. The run-off happens in two weeks and the polls are predicting a similar margin of victory for Macron. There is relief that the polls were accurate, and that President Macron still leads. However, there is nervousness as the lead has been declining. A victory for Le Pen would be negative for French and euro area assets but there would be little implication outside of that.

Market views

- The release of the Federal Reserve’s FOMC meeting minutes was one of the highlights last week. At the margin, they were slightly more ‘hawkish’ than expected. It was a much closer call between a hike of 25bps and one of 50ps than people thought. There was talk of the pace of balance sheet reduction, and the committee seems to be moving to a bigger figure, $95bn per month compared to the $80bn that had been expected.

- Reaction on the day was muted but it added to the pressure that bond markets have been under. In the US, 10-year yields rose 30bps last week. The euro area held up better, with 10-year up ‘only’ 10bps. It was interesting to see one of the major US investment banks move their multi-asset models to a neutral weighting in US Treasuries and seeing value at these levels. We have similar views and are reducing the scale of our underweight position in fixed income.

- Equity markets were also under pressure last week but ended flat in euro terms. There was a big shift towards the defensive sectors with Healthcare, Utilities and Consumer Staples up between 3% and 5% in euro terms. We favour Healthcare most amongst the defensive sectors. It has a better profit growth track record and is relatively immune to the cost pressures we see across many sectors.

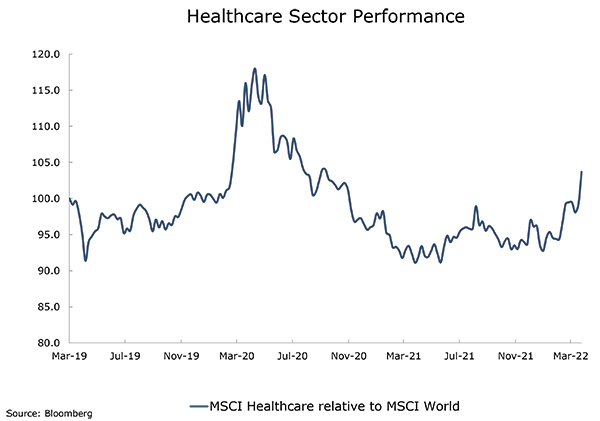

Chart of the week: Healthcare is in recovery mode

After a dull 2021, when Healthcare delivered close to world index returns, the sector is starting to attract investors. A dull 2021 was not surprising given the scale of the profit recovery across the broad market. Healthcare delivered only about half the level of growth in global earnings. This year, it is looking different. Currently, the sector is expected to deliver slightly higher growth than the market but with much less risk around that forecast relative to the rest of the market. This is starting to attract investors, and we expect that to continue.

Please note: There will be no Market Pulse on Easter Monday. We will be back with the next edition of Market Pulse on Monday, 25 April.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |