What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Last week it was the turn of the European Central Bank (ECB) to update us on its views. It disappointed people as there was an expectation that it would soften its stance given the risks around the growth outlook. However, it did not change its opinion: bond purchases are set to decline, and it left the possibility of interest rates hikes this year. In the press conference, ECB President Lagarde sounded less ‘hawkish’ which means we could yet see a change of heart.

- Inflation remains a very ‘hot’ topic. Last week US CPI figures were released: core CPI rose 0.5% month-on-month which was no higher than expected, but it is not showing any easing in inflationary pressures, just levelling off for the moment. The Federal Reserve is likely to remain on course unless there is a material deterioration in the growth outlook.

- A few investment banks updated their economic growth forecasts last week. The main driver of the changes has been the assumption of a higher average oil price – and how that impacts on consumption. The global growth rate has been reduced by 0.8% but at 3.5% - 3.75%, it remains above trend. There are regional disparities: the euro area growth rate has been reduced by 1% while in the US, the growth rate has been cut by a much more modest 0.3%.

Macro views

- Equity markets remained under pressure last week but there was some relief in the second half of the week as Ukrainian and Russian foreign ministers met. There was little agreed at the meeting but the Russian ‘shopping list’ has shown some flexibility which could indicate movement towards a resolution.

- Last week, fixed income markets gave up all of the gains achieved since the outbreak of the war. There was doubt about whether central banks would maintain the course that they had outlined before the conflict began but the news from the ECB removes that doubt, for now. However, fixed income markets still have to contend with the withdrawal of support by central banks.

- In reviewing our asset allocation during these times, we have kept to the discipline of gauging how the conflict impacts on global growth. We knew that the conflict would lead to a lower growth rate but that it was unlikely to push the growth rate down towards trend. Looking at the changes to forecasts, this is the case so far and it appears we need a much higher oil price on a sustained basis to alter this.

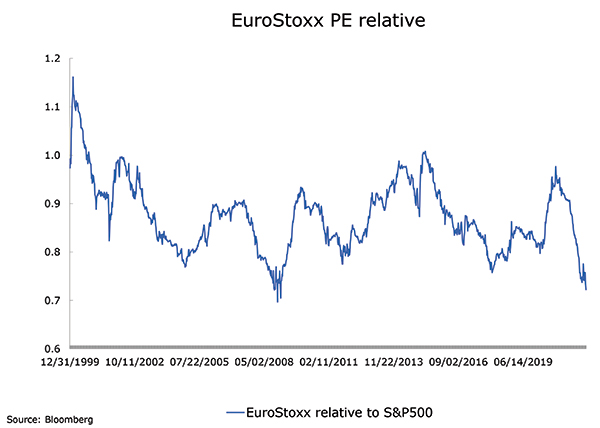

Chart of the week: the euro area is hard hit

The euro area is, economically, the hardest hit of the major regions by the war in Ukraine. It is a net importer of energy products and Russia is the major source of them. The region has experienced the biggest cuts to economic growth forecasts. However, the equity market has reacted to that. The euro area equity market now stands close to its lowest valuation relative to the US since the launch of the Euro. The region will be under pressure while the conflict rages. But in a recovery, it will probably lead the world.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |