What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help you preserve and grow your wealth.

Market views

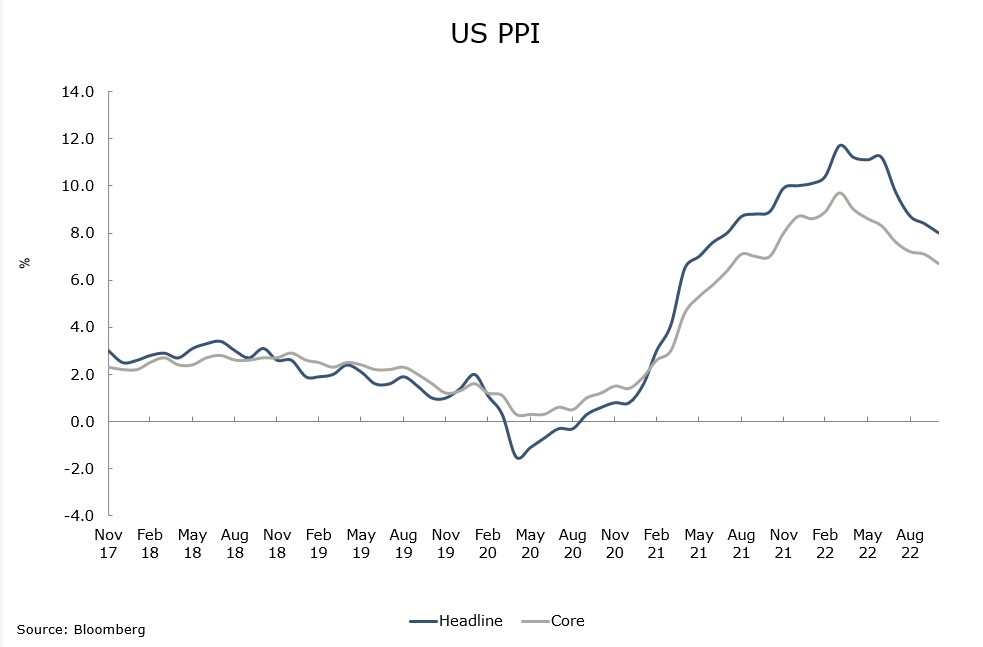

- It was a more subdued week across financial markets as we digested some of the sharp moves we had the previous week. Inflation remains the primary concern and we had mixed news about it. A strong positive came from a weak Producer Price Index but this was partly offset by a strong Retail Sales figure, suggesting activity is not slowing fast enough to make the Federal Reserve change course. Weaker inflation data is helping all markets, but we need softer growth from the US to take us up the next leg of the journey.

- The fixed income markets were stronger during the week with both the US and euro area markets delivering about 1% during the week. In the euro area, sovereigns still lead as they have longer duration, and the growth outlook is grimmer in the euro area than elsewhere in the world. We would not be chasing duration here. There is still a large negative gap between longer dated yields and where policy rates are expected to peak. You would want to be very confident policy rates are coming down by the start of 2024 at the latest to justify this.

- Equity markets were down slightly during the week. Slight change to the leadership positions as Defensives took the lead (Consumer Staples, Utilities, Healthcare) although the gap in performance was small. Month-to-date, it is still a case that the losers from September/October are the winners in November. We still favour a defensive bias as we should start to get some softer growth data, which will undermine the cyclical sectors.

Macro views

- Economic data from the US once again was showing resilience. Core Retail Sales were up 0.7% month-on-month and there were upward revisions to the August and September figures. The outcome has been accelerating growth in Retail Sales and there is now upward pressure on economic growth forecasts for the US in 2022. It was not all good news, Industrial Production was flat month-on-month but this was not enough to offset the positive impulse from the stronger Retail Sales figures.

- In less than two months we have seen the UK pivot from fiscal stimulus to fiscal rectitude. The Chancellor of the Exchequer’s Autumn statement outlined increases in taxation and spending cuts equivalent to just over 2% of GDP in 2027/2028 implying a difficult backdrop for the UK economy over the next couple of years. So far, the market response has been muted but Gilt yields and Sterling have already recovered to their ‘pre mini-budget’ levels so perhaps there was nothing more to expect. The weakness in the Statement is that most of the fiscal correction happens from 2024 onwards. The markets patience could be tested before then.

- In last week’s Pulse we outlined concerns about the Chinese economy given the continuation of its zero-tolerance Covid policy. Retail Sales dropped 3.5% month-on-month in October. Restrictions on mobility are impacting and it looks like growth forecasts will be coming down.

Chart of the week: More downward pressure

More good news on US inflation, the Producer Price Index (PPI) was released last week and, similar to the CPI release both core and headline were down and weaker than expected. The index peaked in March and has been steadily decelerating since. CPI did not follow the same path so there is not a perfect linkage between the two. However, it is further evidence that inflationary pressures are easing, and in this case quite rapidly. Core Goods prices fell in the CPI report, and this index says there is more of that to come.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |