What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- It was a strong week across the financial markets capping off a strong month. In November equity markets are up 3.5% in Euro terms. Bond markets have also been strong with 10-year yields down 50bp in the US and 40bps in the euro area. The main driver over the last week was the speech given by Chair Powell, the last one before the next FOMC meeting (the interest rate setting committee of the Federal Reserve). He said that there is still work to be done to get inflation under control but that the pace of interest rate increases could be reduced. This has increased the belief that we are not too far away from a pause in interest rate policy in the US.

- Data releases were mixed. The biggest relief came from the inflation report from the euro area. For the first time this year there was a decline in the headline rate of inflation, the core rate was flat. Growth indicators were soft. The Manufacturing ISM dipped below 50 helping the expectation of a pause in interest rate increases in the not-too-distant future. However labour market statistics are still strong. Unemployment dropped to a new low in the euro area and the jobs report was the US was again stronger than expected. This will keep central banks on guard.

- We have had a good rally in both bonds and equities over the last couple of weeks largely down to better inflation data and indicators. We felt that fears about where interest rates would go in the US and euro area were somewhat overdone. These have declined from the extreme levels. We also believed that we should get some soft economic data which would also help bring those expectations down. We have not really seen any of these so there should be some more left in this rally. However, we have travelled a long way already, further moves are likely to be more muted.

Outlook 2023

- We held our annual Investment Outlook event this week (you can watch the recording here) where we outlined our expectations for 2023. We think that 2023 will be another volatile year but that the out-turn for balanced portfolios should be notably better than the experience in 2022. Central banks are likely to remain on watch, but we think that inflation has probably peaked and that interest rate moves will be far less in 2023 than in 2022. The global economy will, at best, skirt with a recession. However, given the strength in labour markets if we have a recession it is likely to be a shallow one.

- One of the messages that came from the discussion was that although the outlook for 2023 is challenging, asset markets had moved to reflect some of this concern and valuations are now becoming more realistic. This is certainly the case in the fixed income markets. This year was a brutal year for fixed income with yields rising steeply. The good news about this is that the higher yield levels are now pricing in the harsher interest rate environment and are offering attractive opportunities for balanced portfolio construction. Next year we believe the focus will be on the level of economic growth rather than inflation. When we have ‘growth scares’, fixed income does well and thus should regain its ‘safe haven’ status in 2023. We have been increasing fixed income exposure in our multi-asset portfolios and will continue to do so. Yields have risen notably most in core sovereign markets so while we retain a preference for corporate debt (higher yield and shorter duration), there is more balance between exposures.

- Equity markets face a more challenging outlook. In the short-term they will get a boost from the levelling off in interest rate expectations, but as we travel through 2023 they will face the impact of declining EPS forecasts as the weaker economy impacts. True, equity markets have de-rated and are pricing in some element of earnings decline in 2023. But we believe until get a better sense of where and when earnings will trough, equity markets will be under pressure. We have been reducing our equity exposure as the growth outlook has become more uncertain, and we will continue to do this in the early part of 2023. Earnings dependability will be key in the short term, so we have a preference for the defensive sectors, Healthcare and Consumer Staples. Regionally we still favour Europe / US over Asia but if China can get on a sustainable reopening path we may adjust this (see Chart of the Week).

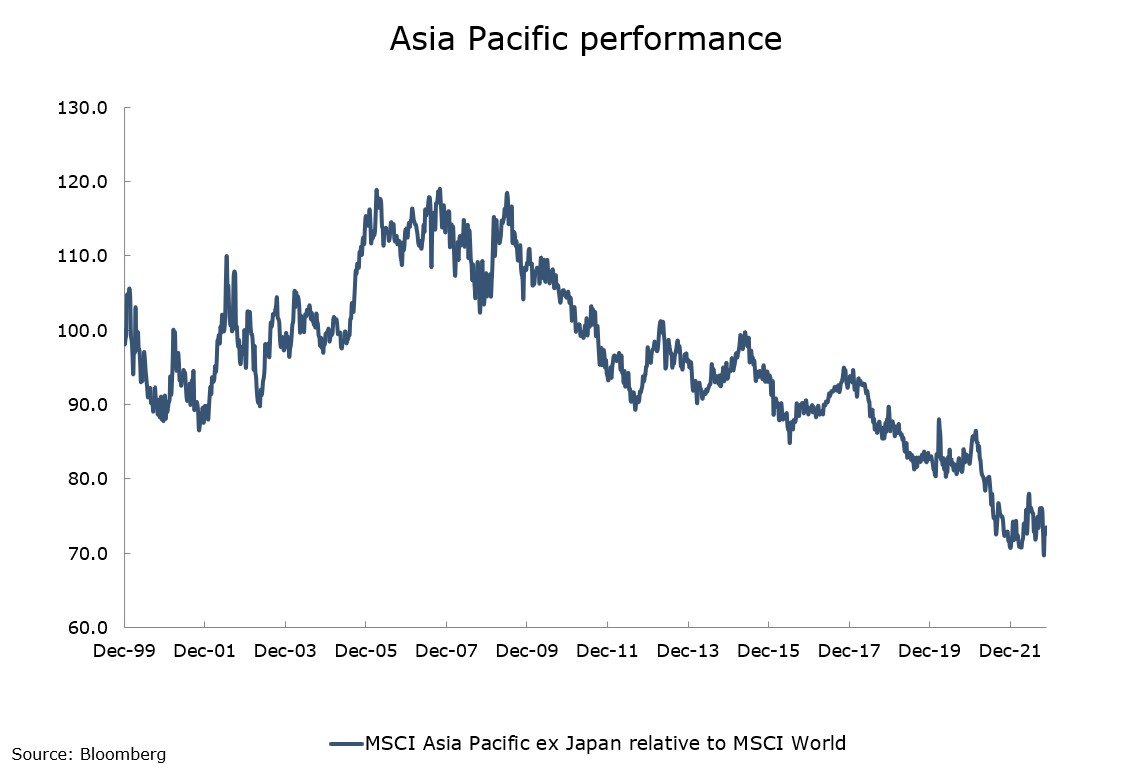

Chart of the week: It is very low

It has been a difficult 10 years for the Asia Pacific region delivering consistent under-performance against the world index. Some of the negative factors are structural, including a poor record at converting economic growth into profit growth, which are not going to go away. Some are more cyclical, including a strong US Dollar and rising US interest rates, which could now be passing. Some are hard to call, namely China’s path to reopening. The degree of underperformance reflects some of those negative drivers and some of the headwinds could become tailwinds. We will be keeping the region under review and what we need is a better sense of how the Chinese can reopen. It has been stop-start so far.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |