What is private equity?

Private equity refers to investment made into companies or securities that are not listed on public exchanges, but rather held in illiquid (not easily tradeable) form by one or more private investors.

Many companies have of course always been private, such as family businesses or partnerships, but with the proliferation of leveraged buy-outs as a tool, private equity (PE) has become a sub-asset class of its own.

There is now a legion of specialist private equity managers (general partners) leading and managing buy-outs or venture capital allocations on behalf of other investors (as limited partners.)

How and why does it work?

Private equity is associated with high expected returns on investment over a long-term time horizon. These expected returns may stem primarily from the additional premium that an investor should earn simply by taking a higher risk and committing to an illiquid, non-tradeable investment.

But there are other sources of potential excess return.

Firstly, private ownership means fewer stakeholders, which can allow for more efficient and nimble management and decision-making, alongside active use of balance sheet leverage, with strong focus on cash flow and margins. Private equity also often focuses on smaller-scale companies, with substantial growth potential.

Perhaps most importantly, unlike traditional business management, the PE manager is singularly pursuing a buy-to-sell strategy – seeking to acquire undermanaged or undervalued companies, where there’s an opportunity for a skilled manager to increase a business’s value and then sell at a higher price.1

Has private equity really delivered excess returns?

The comparison of public and private market performance is fraught with caveats, but worth reviewing.

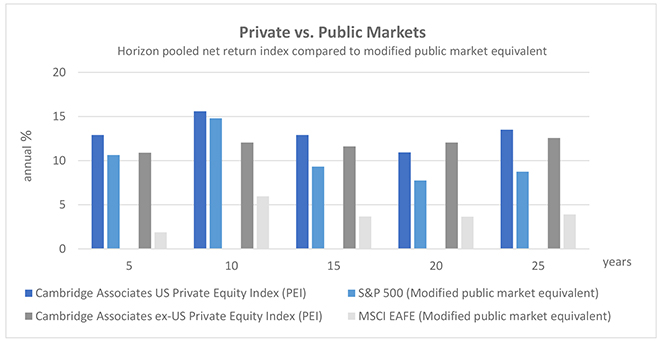

The illustration below shows pooled private equity performance (after fund fees) data compared with equivalent return calculations2 for major US and non-US public stock market indices3 over the past 5, 10, 15, 20 and 25 years, all measured in US dollars.

On this basis, private equity investment has consistently generated internal rates of return over and above the equivalent returns that would be obtained in public markets. This contrast is particularly stark outside the US. While non-US public markets have seen lacklustre returns in recent decades, non-US (mainly Europe) private equity has seen a much stronger return profile – comparable in scale to equivalent returns in US markets.

Source: Cambridge Associates LLC, as of 30 June 2020; included with approval from Cambridge Associates LLC. See footnotes 2 and 3.

How to access private equity

So, private equity looks attractive in principle, but how is it accessed? The answer is – with great care, and mindfulness of the risks and costs.

Within the pooled performance data, there can be large differentiation between the best managers and the rest. In addition, there is a significant divide between the type of private equity products that are available to large-scale institutional clients like sovereign wealth funds and those available to the individual investor. The latter is most often limited to either a lesser-known manager or a fund-of-fund investment that carries several layers of manager fees, sometimes cumulating to annual fees of 3 or 4% or more. 4

High, layered fees mean that even if those fund-of-funds are investing with the best private equity managers, the after-fee return to individual investors might not be as compelling. Access to the right opportunities at the right price is thus critical to make the illiquidity and riskiness of a private equity investment worthwhile for the investor.

Co-investment as an efficient path to private equity

There are many different styles of private equity fund - direct, fund-of-fund, secondaries - but co-investment with an experienced manager is in our view one of the most attractive routes for the individual investor to access private equity expected returns, without unnecessary layers of fees and charges.

In a professional co-investment strategy, a private equity manager makes minority investments in privately held companies, investing their capital alongside other private equity managers. The co-investment manager builds a portfolio of these direct company investments, and has the opportunity to invest alongside a diverse set of selected private equity peers.

This co-investment approach thus offers the opportunity for an experienced PE manager to navigate across sectors and opportunities, co-investing with a network of selected specialist and regional managers at opportune times.

Moreover, co-investment funds benefit from no management fees or performance fees being attached to participation in a deal – and they typically charge lower fees on their funds than managers of direct strategies. So the investor in a co-investment fund will face just one layer of fund fees, that are also typically lower than other private equity fund fees.

Accessing private equity in Europe

The relatively strong performance of non-US (mainly European) PE relative to equivalent public markets is also worth keeping in mind, especially since the introduction of the European Long-term Investment Fund (ELTIF) regulation5 in 2015.

The ELTIF regulation allows individual investor participation in institutional, illiquid investment in the European real economy, under a number of restrictions and conditions. It opens up a part of the market that was previously only accessible to institutional investors, allowing individuals to access companies that are possibly smaller or earlier in their growth than those in public equity markets.

ELTIFs can offer “well-informed” individual investors6 access to quality private equity, which can play an important role in constructing a diversified portfolio with long-run potential. ELTIFs’ legal structures and investment strategies can vary however, and so can their tax treatment, so do seek professional advice before considering investing, and take clear heed of the high risk and illiquidity that are attached to any long-term private equity investment.