What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help you preserve and grow your wealth.

Market views

There has been a sharp turnaround in equity markets since mid-December. Fears the Omicron variant would adversely impact re-opening activity proved unfounded as US and Chinese data revealed robust activity in November.

In December, sector leadership was defensive with a focus on Consumer Staples, Healthcare and Utilities. But the better-than-expected data has provided an impetus for the ‘re-opening’ theme since mid-December.

A turn in policy from the European Central Bank and the Federal Reserve has put fixed income markets under pressure. But the moves are still manageable. In December 10-year yields were up 0.25% in the euro area and nearly 0.4% in the US.

In the short-term, we’re likely to see fixed income markets struggling, equities grinding higher and equity leadership moving away from quality defensive towards beneficiaries of the reopening and interest rate rises.

Macro views

Since mid-December, Chinese and US data has shown greater resilience than expected. The manufacturing Purchasing Managers’ Index (PMI) rose in the Pacific Basin, including China, while consumer confidence rebounded in the US.

In the US, a disappointing reading of the ISM Manufacturing Index was driven by lower input prices and shorter delivery times, possibly indicating some easing in supply-chain bottlenecks.

The US employment report was mixed: Non-Farm Payrolls missed expectations in December, but the Household Survey showed very strong job growth and a drop in the unemployment rate below 4%.

Inflation indicators remain elevated, with more high inflation readings expected from the US and euro area. And so, central bank watching will remain high on the agenda. That said, we expect growing evidence that inflation is peaking in Q1.

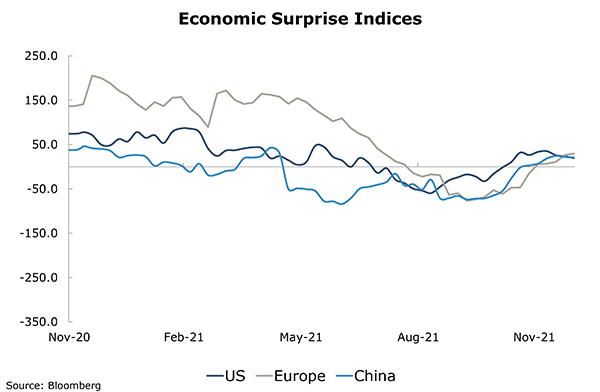

Chart of the week: Firing on all cylinders

The Economic Surprise Indices provide an indication of how an economy is performing against expectations. A reading above zero indicates that the majority of data releases are better than forecast. As the chart shows, the three major economies were struggling relative to expectations as the Delta variant spread. The same is not true for Omicron: these economies started to accelerate relative to expectations from late November onwards, pushing equity markets higher.