What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help you preserve and grow your wealth.

Market views

- Financial markets started the year on a weak footing: world equities fell by more than 1% and 10-year bond yields rose 10bps to 20bps as the timing of US interest rate increases were brought forward and the number of hikes increased. ‘Lift-off’ is expected in March and three-to-four rate rises are now anticipated this year. This is happening because of strong aggregate demand which is a help to equity markets.

- Leadership in equity markets has moved towards cyclicals and yield-sensitive sectors. Energy, Financials and Materials are outperforming, but we feel that this is the last gasp for these sectors. As such, we are looking for opportunities to reduce exposure in these areas rather than chase it.

- With the Q4 reporting season gathering pace, it should provide some support for equity markets. In the US, earnings are expected to rise 19% year-on-year, but very early indications suggest it may be stronger than this. Companies are still performing very well.

Macro views

- Much of last week’s data releases focused on inflation: all eyes were on the US consumer price index, which for the first time since the middle of last year was little different to expectations at both the headline and core level.

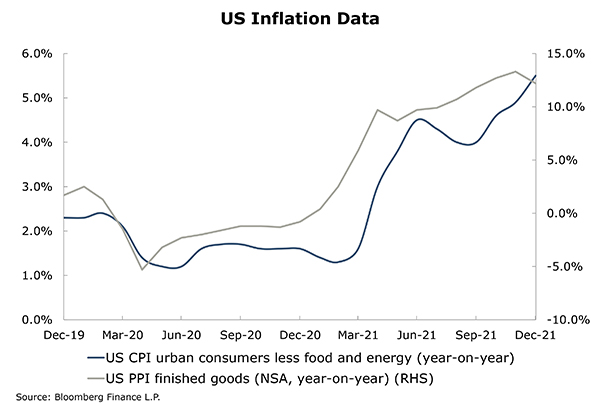

- Meanwhile, for the first time since mid-2021, the US Producer Price Index showed a slight decline on a year-on-year basis. This may indicate a peaking of inflationary pressures.

- In China, data showed a decline in the core and headline Consumer Price Index. There was also a notable step down in producer price inflation, indicating some easing in supply-chain bottlenecks.

- US retail sales were weaker than expected in December with core retail sales declining 2.7% month-on-month. The weakness was broad-based with 11 of 13 categories down. As the Omicron variant spread rapidly in December, most investors and the Federal Reserve will look through this weak figure. Perversely, it may help with the recovery of supply chains.

Chart of the week: Inflation may be close to peaking

The chart illustrates that US Producer Price Index (PPI), which is more sensitive to supply-chain bottlenecks, began to show that inflationary pressures were building with the first step up in February 2021. Meanwhile, the Consumer Price Index (CPI) registered its first major increase in April 2021. Last week, data revealed the first decrease in PPI since the middle of 2021. If this continues, CPI could start to subside by March which would be a relief to all.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |