What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help you preserve and grow your wealth.

A message from Joe Prendergast, Global Strategic Advisor, after a volatile week for markets

Market views

- The US Federal Reserve (Fed) was centre stage last week as it moved to clear the way for ‘lift off’ in March. Chair Powell’s press conference sounded aggressive leaving all options open, but it remains data dependent and therefore could end up quite different.

- More persistent inflation pressure is the reason for the change in tone. But most of the excess inflation is still being caused by excess demand rather than cost push, so equities still provide the best hedge against this.

- In the US, the yield curve flattened with the main weakness in the one to five-year spectrum. This led to some reversal of equity trends. Developed markets held up better in the last week than Asian and emerging markets. Sector leadership was also changing. Rising interest rates and a flattening yield curve favour quality and dependable growth. But what is performing poorly in January is probably what you want to hold for 2022.

Sector special: US banks

- Recently, US banks reported their 2021 results, which were generally better than expected, supported by loan loss provision releases. Meanwhile, their outlooks for earnings are good.

- Bank revenue is geared to interest rates and the Fed is poised to hike rates. Consumer balance sheets and incomes are strong, and they are spending. What’s more, companies are investing in production capacity and inventories. Loan growth is now positive, banks are deploying excess liquidity and interest rates are higher.

- Capital markets activity has slowed but remains well above pre-pandemic levels. Together, this should drive revenue growth, while credit quality remains strong.

- However, some guidance has spooked markets, resulting in share price weakness and the reversal of some recent gains. For the most part, the issues are company specific, rather than general themes, but there has been a lot of disappointment.

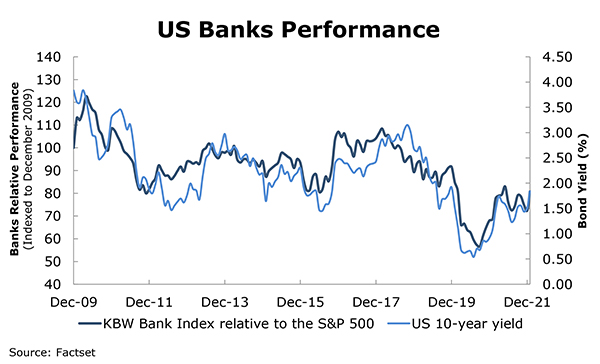

Chart of the week: Banks are moving with bond yields

This chart illustrates the strong positive correlation between US bond yields and US banks’ performance compared to the US equity market. We expect yields to trend higher as the Fed raises rates and reduces its balance sheet. However, higher rates are already factored into market expectations, earnings forecasts, and valuations. As the economic expansion matures, growth scares and credit quality concerns will increase. A faster or greater increase in policy rates could accelerate this. The banks’ party probably isn’t over yet, but we are standing close to the door.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |