What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Tensions around Ukraine dominated the index moves last week. Equity markets were slightly weaker with defensive sectors leading the way. We continue to believe that there will be little lasting impact on the global economy. So, there is little chance of adding material value by positioning for the current elevated volatility.

- The earnings season is progressing strongly. In the US, 77% of companies have reported, with earnings 6% ahead of forecasts and sales 3% better than expected.

- In the euro area, we are over half way through the earnings season: earnings are 9% better than forecast and sales have beaten expectations by 2%. While supply chain issues remain, companies can pass on the costs. Earnings are still providing a good inflation hedge.

- Earnings growth is still strongest among cyclical sectors. That said, the more defensive and structural growth sectors (such as Healthcare, IT and Consumer Staples) are performing best against expectations. As the year progresses, this should become more pronounced and push those sectors towards the top of the performance table.

Macro views

- The minutes from Federal Open Markets Committee (FOMC) offered some relief last week. The language was more subdued than expected and leaned towards 25bp moves rather than using a 50bp at any time. The Federal Reserve (Fed) is moving but not at the extreme pace some forecasters are predicting.

- Last week, retail sales data showed consumers are bouncing back strongly in 2022. In the US, core retail sales jumped almost 5% month-on-month, more than making up for a weak December. Meanwhile, we had a better-than-expected industrial production figure in the euro area: there was a strong rebound in motor production which indicates easing supply chain pressures.

- US producer prices were released for January: it showed that the inflation story remains the same. It is subsiding, down 0.1% year-on-year, but not as fast as expected and certainly not at a pace at the moment to change any central bank’s mind.

- The rebound in economic activity is an important issue for us. If it stays above trend, as it is doing at the moment, then an equity bias in asset allocation remains appropriate despite the changes in the monetary background.

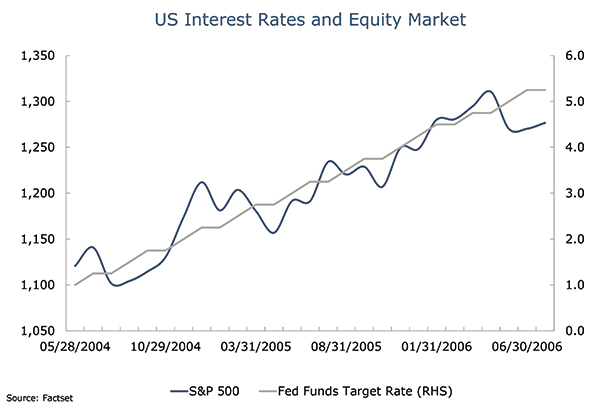

Chart of the week: We've been here before

There has been a significant change in the number of rate hikes expected in the US: consensus now expects eight hikes over the next 12 months. We have maintained a pro equity bias as strong economic growth is prompting this change in the interest rate outlook. Let’s revisit the 2004 interest rate cycle, when we had a similar situation. The Fed increased rates by 25bp on a continual basis and almost at every single meeting – and for the same reason as now, an economic recovery that became self-sustaining. However, as you see in the chart the equity market continued to rise in the face of interest rate hikes as it reacted to the better growth background.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |