Key points:

- Make the cash work for you. If you’ve surplus cash that you do not have an immediate need for, look for low-risk alternatives.

- There will be some volatility over the coming year – but with volatility comes opportunity. Consider what to do with your medium-term surplus cash.

- Remember negative interest rates could be around in the euro area for another 18 months or more. So, if you have a plan with the appropriate risk, stick with it.

Negative interest rates dominated news flow and sparked much debate in recent years.

But the sea-change by the European Central Bank (ECB) earlier this year, signalling less accommodative policy ahead, led to a shift in investor expectations. What’s more, last month, ECB president Christine Lagarde refused to rule out a potential interest rate hike this year amid the central bank’s “unanimous concern” about inflation.

The narrative has changed, but

negative interest rates remain a reality for many corporates and their reach to

more and more depositors continues to widen today.

That’s why we’re returning

to the topic of negative interest rates to examine the current environment

and the best options and strategies available for those seeking alternatives to

negative interest rates on cash today.

Negative rates persist

As mentioned briefly, there has

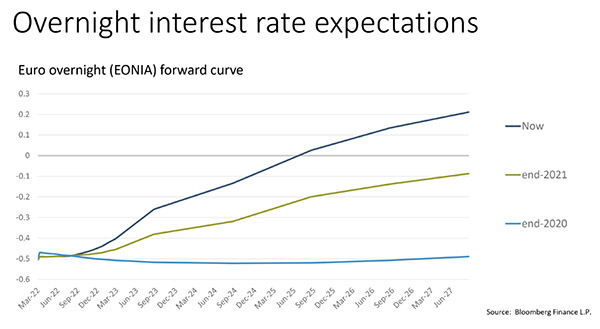

been a significant shift in interest rate expectations – much of this occurred

in Q4 2021 driven by hawkish signals from the US, but it has extended into the

eurozone given the stubbornness of inflation.

As a result, euro interest rate expectations have tightened significantly (see the chart below) – even so, we are still facing a situation where it is likely that we will have to live with negative overnight deposit rates perhaps until 2024.

That’s a considerable period of time, and from a corporate perspective, the loss that negative rates represent are still material on a quarter-to-quarter and year-to-year basis.

Meanwhile, term rates – deposit rates for three months, six months and so on – will likely cross into positive territory earlier, perhaps as early as the end of this year or in the first half of 2023, because they contain some embedded expectation of what is going to happen in the future.

Options for corporate and personal cash

Against this backdrop, there is still no one single solution to resolve this dilemma. Indeed, in the last 18 months, we’ve met a number of clients with different circumstances, and for some, it has made sense to leave cash on their balance sheets to ensure certainty and liquidity for business needs. Meanwhile, for others, finding alternatives to cash has been necessary. For those clients, it’s important to consider three principles:

- Do you have short-term cash requirements? If so, you may have to accept negative interest rates. Don’t take chances with cash that is needed to meet liabilities.

- What about the liquidity of your funds beyond what is needed immediately? If you have cash in excess of foreseeable needs, you may consider how much to keep on your balance sheet at negative rates, and then consider placing the balance in a low-risk strategy with either a neutral outcome or a small positive yield. That way, some additional credit risk can be taken while still maintaining liquidity for unforeseen circumstances. For example, Goodbody has a positive income portfolio (PIP) strategy which combines a diversified range of short-dated, high quality, liquid credit instruments which together generate a modestly positive yield in euro, after all hedging and management fees are allowed for.

- For cash holdings well in excess of foreseeable needs and precautionary balances, more risk and less liquidity could be considered, in exchange for higher expected returns. This can incur high volatility and is thus not suited to most corporates, outside of dedicated investment companies.

Much of our conversations with clients have focused on the second principle – highly liquid, relatively low-risk strategies that focus on capital preservation. In our view, strategies like these, which include short-dated, highly-rated corporate bonds, are a credible alternative to holding cash.

It is however worth highlighting that bonds in general have suffered in late 2021 and early 2022. Much of this loss in value has been driven by rising interest rates and a shift in the ECB’s tightening expectations. The current market volatility following Russia’s invasion of Ukraine has also caused a widening of spreads between corporate and government bond yields.

Against this backdrop, there will be more volatility as the year progresses and this will likely impact any fixed income strategy in the near term. But it’s important to remember, it’s a medium-term strategy.

Make your cash work for you

So, as a reminder, while interest rates look likely to increase, even in the eurozone, it may take 18 months before overnight deposit rates move into positive territory. In the meantime, it’s important to make your cash work for you: if you have surplus cash that you do not have immediate need for, look for low-risk alternatives because doing nothing is a plan to lose money.

But in doing so, you must accept that a move away from cash incurs some risk. As I’ve mentioned, volatility is expected this year, but with volatility comes opportunity – don’t panic, consider what to do with your medium-term surplus cash.

And finally, if you’ve embarked on a plan over the last 18 months, stick with it if the risk is appropriate for you – if you haven’t made a plan yet, now is the time to consider one. Otherwise, negative rates will erode your cash for the next 18 months – and let’s face it, none of us want to pay to keep cash in the bank.