What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Macro views

- All eyes were on the Federal Open Market Committee (FOMC) meeting last week. The Federal Reserve (Fed) was expected to increase interest rates by 25bp and did so. It is going to begin the process of reducing the balance sheet ‘at a future meeting’ i.e., the next one or the one after that. The 'dot plot’ is predicting another six hikes this year. The output was more ‘hawkish’ than expected. However, it still expects inflation to be above target in 2023, it is trying to curb it, not kill it.

- The Bank of England also increased interest rates last week, but it is looking at a much more modest tightening going forward, maybe another two hikes this year. It is more concerned about the growth impact of rate hikes than the Fed.

- Data releases last week were reasonably robust, but we have yet to see the impact of the Ukrainian war on activity. In China, industrial production and retail sales grew much stronger than expected, showing that the country is getting out of its 2021 slump.

- In the US, industrial production was as strong as forecasted, with manufacturing production jumping over 1% month-on-month. Retail sales disappointed in February but there were large upward revisions to January’s figure, so the current level of retail sales is close to what was expected.

- While the data is backward looking, it does indicate the global economy was in a robust condition coming into the current crisis.

Market views

- It was a strong week for equity markets with developments in the Ukraine the main focus. Through the week there were signs of improving diplomatic measures – and at the end of the week, there were pronouncements from China that indicated, at least, less support for Russia. Any signs that the conflict will remain short pushes equities onto a recovery path. Along with this, the Chinese authorities committed to restoring stability to China’s financial markets. This is looked on as a ‘we will do whatever it takes’ statement, including direct purchases of equities by the State.

- The reaction to the FOMC meeting was better than expected. Certainly, much of what was announced was expected but some of the targets indicated a tougher policy line than was thought. The idea that the Fed is trying to curb inflation rather than kill it probably gave some relief.

- The sectors followed global themes: greater hope for a settlement in the Ukraine pushed the Consumer Discretionary sector to the top. Next was IT, although the sector not like higher bond yields has derated and it gives non-cyclical growth. The losers from these themes were Energy and Utilities. Dependable growth will become more important in equity portfolios.

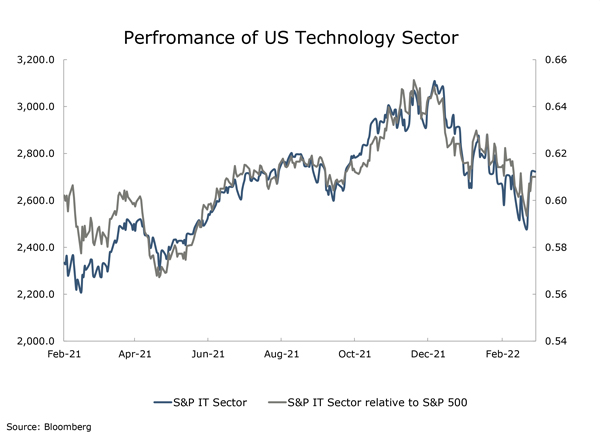

Chart of the week: looking interesting

The IT sector had a tough start to the year and was down nearly 20% year-to-date at one stage. Rising bond yields undermining high valuations was the primary culprit. Over the last week, bond yields have continued to rise but the Technology sector outperformed. At some stage in the cycle the attraction of the higher relative earnings growth outweighs the negative of rising bond yields. Perhaps we have reached that point.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |