What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Macro views

- Last week, all focus was on the initial Purchasing Managers' Index (PMI) readings for developed economies – the first data set released since Russia’s invasion of the Ukraine. The survey was carried out from 11-23 March. The report surprised with the all-industry index rising 1.4 to 56.2. The positive impact of the fading effect of Omicron outweighed the negative shock from the Ukrainian war. It was the same outcome for both manufacturing and services.

- The new orders sub-indices, which are forward looking, were more mixed. Manufacturing declined by a very modest 0.7 to 54.9 – still well in expansion territory. The services new order index rose again, highlighting the impact from re-opening. As one would expect, Europe was weaker than the rest of the world. The all-industry index declined modestly from 55.5 to 54.5.

- Inflation indicators deteriorated: the output price index rose two points and there was a deterioration in the delivery times index. There were also drops in the future output indices, which look 12 months out. For all industries across developed markets, this fell from 72.9 to 66.8 but a lot of it is concentrated in Europe where it fell nearly 20 points.

- The report was better than expected showing much greater resilience. However, it is likely to decline next month as the reopening impulse fades. This supports our view that the global economy was gaining some momentum as the war started which should give it resilience during the crisis and help maintain growth levels above trend.

Market views

- It was a torrid week for fixed income markets. US 10-year yield up 35bps and in the euro area it was up 25bps. Federal Reserve Chair Jerome Powell opened the door to 50bp increases in rates, keeping bond markets under pressure. Several forecasters have pencilled in 50bp increases at the next two meetings and terminal forecasts have moved up from 3% to 3.25%.

- Equities fared better last week rising about just over 1% despite a recovery in energy prices. The inflation hedging attributes of equities are appealing at the moment.

- The Commodity sectors led last week following stronger product prices, while IT and Communications were next as dependable growth remains in vogue. Financials got no great benefit from the higher bond yields. Investors are now looking at the growth implications of these higher interest rates and bond yields.

- We had been looking to increase the quality-growth element of our equity exposure. What had been holding us back was the impact of higher bond yields. Quality-growth companies and sectors are higher rated and most exposed to the valuation pressure from higher bond yields. It looks like this is passing now and the attraction of the reliable growth increases.

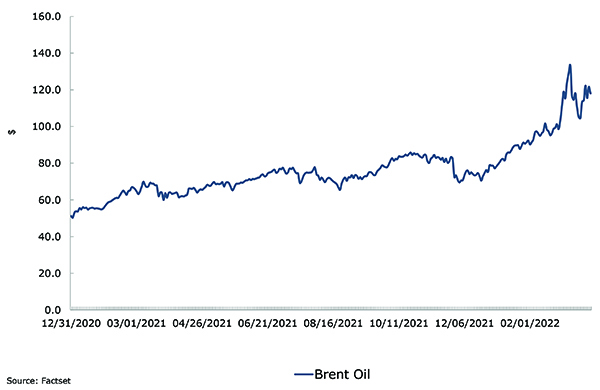

Chart of the week: spot oil price

The oil price is the mechanism by which the Ukrainian war could derail the global economy. It spiked rapidly after the invasion but there has been some easing in it since. Current economic forecasts are based on $120 on average in Q2 and then subsiding to a range of $90 – $100 in the second half of the year. So far so good, but we need to watch it.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |