What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- It was a challenging week for financial markets as participants continued to grapple with the uncertain environment. Concerns about inflation and its potential impact on growth via tightening monetary policies were the dominant themes.

- World equities slipped for the sixth consecutive week and are now below the recent lows reached just after the invasion of Ukraine. Defensive sectors continue to outperform while growth companies in IT and consumer sectors as well as energy were among the worst performers last week.

- In fixed income markets, there was a sharp decline in US and German 10-year bond yields, which reflects the growing concern of investors that central banks will fail to tame inflation without impacting economic growth.

- Despite high US inflation readings released last week (see our macro views for more details), current expectations around the pace and scope of rate hikes by the US Federal Reserve (Fed) as well as other central banks around the world remain the same. It is also notable that US inflation has likely peaked and the Fed downplayed suggestions that it would steepen the pace of its tightening in the coming months. That could change of course if commodity markets were to materially tighten further, but for now long-term expectations for inflation settling closer to 3% rather than the 1-2% of the last decade should be manageable.

Macro views

- The calendar was dominated by US inflation data last week because of the possible implications for Fed policy. First out of the blocks was consumer price inflation (CPI) followed by producer price inflation (PPI) – a measure of selling prices received and an important inflation measure for the Fed.

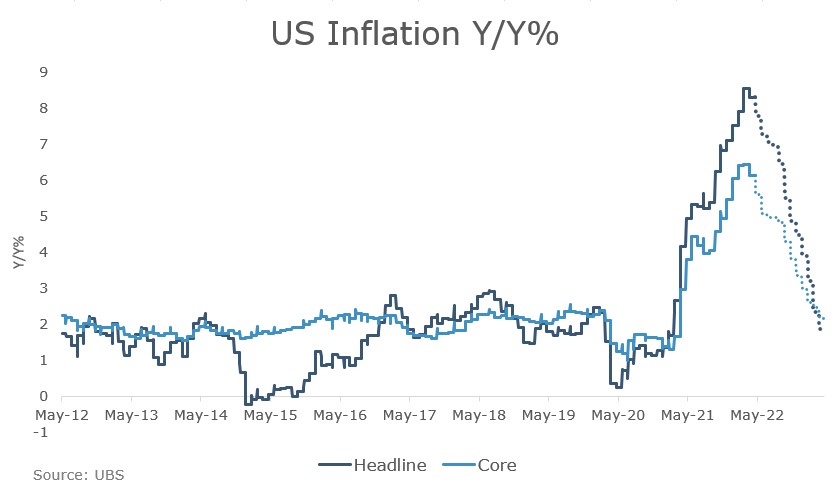

- The headline annualised rate appears to have peaked in March at 8.5%, but the April rate still came in at 8.3% year-on-year ahead of expectations of an 8.1% rise. Looking at the core measure, which excludes the more volatile food and energy prices, the surprise came from transportation services, specifically airfares, which jumped nearly 19% over the prior month. This was much stronger than expected (around 5%) and followed an already strong 10.5% in March. Other goods and services inflation came in either in line or slightly below expectations and it was notable that goods inflation in total rose just 0.2% on the month, suggesting that supply-driven inflation may be cooling for now.

- PPI data showed selling prices up 0.5% on the month, which is still high but was in line with expectations and lower than the rapid 1.4% last month. It also suggests a peak in inflation and a gradual slowing in the months ahead.

Chart of the week: Will US headline inflation continue its descent?

Headline annualised CPI slowed in April to 8.3% from 8.5% in March, however this was a modest deceleration and still above expectations of 8.1%. Nevertheless, it seems likely that we have reached a peak and it should continue to descend from the multi-decade highs of last month. Some of this will come from strong base effects as last year’s numbers are lapped, and outside of energy and food prices, the core rate should slow because of gradually easing supply constraints that have been caused by the pandemic, particularly for the motor vehicles segment.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |