What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Equity markets were turbulent last week and ended down 1.5%. The S&P 500 flirted with bear market territory. Energy and Materials were up. IT and the consumer sectors were particularly weak. Benchmark bond markets were little changed last week. US 10-year yields fell (prices rose). Short term euro area bond yields moved up. Credit spreads and European peripheral government yields rose.

- Last week’s poor market tone was set by the mid-week earnings of major US retailers, despite strong retail sales figures which boosted markets earlier in the week. Sales were stronger than anticipated, but margins were weaker due to shifting consumer buying patterns (more lower margin essentials, less home appliances and furniture), higher logistics costs (storing and discounting overstocked items), and higher shipping and fuel costs. Markets took the news as demonstrating the negative impact of inflation on consumer spending power. The results highlight corporate earnings can be challenged even outside of a recession and the importance of pricing power in an inflationary environment.

- Markets are going through a growth scare due to inflation and policy changes. Our view is that economies and markets have shifted later cycle. We do not expect a recession as our central case, but with full employment and tighter policy, we expect growth to slow, higher volatility and lower returns. In this environment, we have a neutral equity position. We have added to fixed income recently given higher starting yields and more diversification benefits. Within equities, we are likely to continue to increase our exposure to more defensive sectors, defensive growth and higher quality exposures.

Macro views

- US April retail sales figures released last week were stronger than anticipated against upwardly revised March figures. This provided markets some comfort that US consumers were carrying on despite the impact of inflation. Retail Sales were up 0.9% month-on-month in April (8.7% year-on-year); retail control (excluding volatile items such as gasoline) were up 1.2% month-on-month (9.8% year-on-year), with particularly strong growth in restaurants, online retail and motor vehicles. US industrial production was also stronger than expected in April, up 1.1%, and showing some acceleration from March. However, initial regional manufacturing surveys point to slower growth ahead.

- China released weak economic data early in the week, showing the impact of Covid lockdowns. April retail sales were down 11% year-on-year and industrial output was down 2.9% over the same period. China also announced some economic stimulus by cutting mortgage rates.

- The EU unveiled additional details of its REPowerEU plan to reduce reliance on Russian fossil fuel imports: energy efficiency, diversification of supply and accelerating investment in renewables. The plan is necessary and ambitious for achieving decarbonisation plans, although significant execution risks remain.

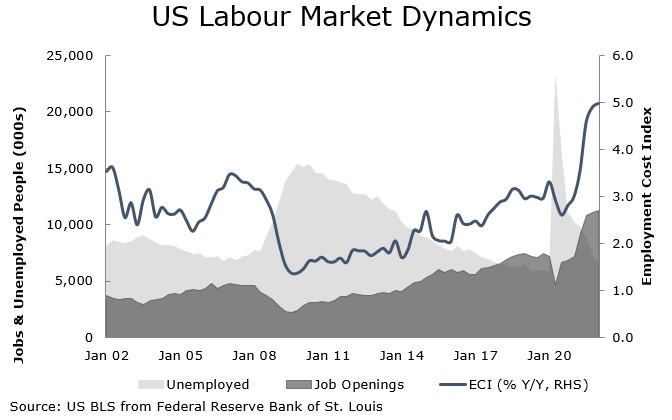

Chart of the week: US labour market and wage inflation

The chart shows why the US Federal Reserve (Fed) has become more aggressive in 2022. It is looking to pre-empt a potential wage-price spiral. The US labour market is tight, and wages are rising. There are over 11 million job openings in the US, an historic high, compared to six million unemployed people. Rising labour force participation may help as post-pandemic issues are resolved but that’s uncertain. The Fed hopes to curb labour demand from historic highs, rather than pushing up the unemployment rate from long-term lows. Markets are questioning whether the Fed will be forced to act more aggressively even as consumers are already being squeezed by inflation.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |