What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Last week ended on a more positive tone compared to previous weeks despite mixed macro readings and related fears about the path of the global economy.

- World equity markets broke their seven-week losing streak to end up on the week. Cyclical sectors performed best led by Energy, Financials and Consumer Discretionary while the defensive sectors lagged (Healthcare, Real Estate and Utilities). Hopes that inflation may have peaked, and better company results aided cyclical performance.

- In fixed income, US and euro area government bond yields remain well off recent highs reflecting concerns that economic growth could continue to slow.

- Growth scares are more common than actual recessions and declines in excess of 15% in equities are normal. In equities, we hold a neutral view and remain focused on defensive and quality styles. In fixed income, bonds are starting to look more attractive after this year’s sell off.

Macro views

- Purchasing Managers’ Index (PMI) surveys in the US and the euro area as well as US housing and inflation data were released last week and speak to the economic slowdown theme, although we would note that the PMI surveys remain in expansionary territory.

- In the euro area, the flash May PMI declined 0.9 points to 54.9, marginally below 55.1 expected. This was led by the domestic manufacturing sector (supply shortages), but the services sector is benefiting from tourism and recreational activities.

- In the US, the flash May PMI declined 2.2 points to 53.8 versus 55.7 expected, driven by both services (high prices) and manufacturing (lower exports and high input prices).

- US new home sales fell 16.6% in April, much faster than the 2% decline expected as higher mortgage rates appear to be having an impact.

- Core personal consumption expenditures (PCE) data, the Federal Reserve’s (Fed’s) favoured measure of inflation, showed a 0.3% monthly increase, bringing the core year-on-year change down from 5.2% to 4.9%. Although in line with expectations, it still feeds into the peak inflation narrative – a positive for markets.

- The minutes from the last meeting of the US Fed were released last week and were noted for their lack of incrementally hawkish views. That, the slowing macro and falling inflation expectations, sparked a narrative about a potential shift in policy.

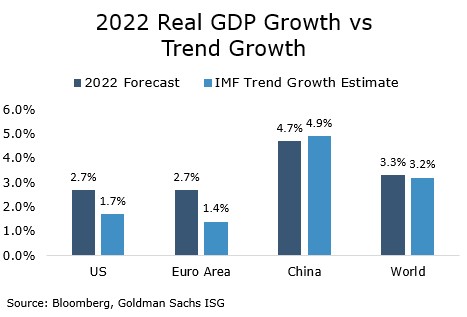

Chart of the week: slowdown, not recession

The market is increasingly concerned about the risks of a recession over the next 12 months. This chart shows that although GDP forecasts have been coming down this year, the US and euro area are still expected to grow above trend. This is also the case for 2023. China is an outlier this year due to lockdowns but is expected to resume above-trend growth in 2023. Long-term inflation forecasts in the US have been coming down in the last few weeks and, if we see evidence of cooling prices in the coming months, this would be in line with our view that we are travelling through a growth scare.

Please note, there will be no Market Pulse on Bank Holiday Monday, 6 June. We will be back with the next edition on Monday, 13 June.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |