What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

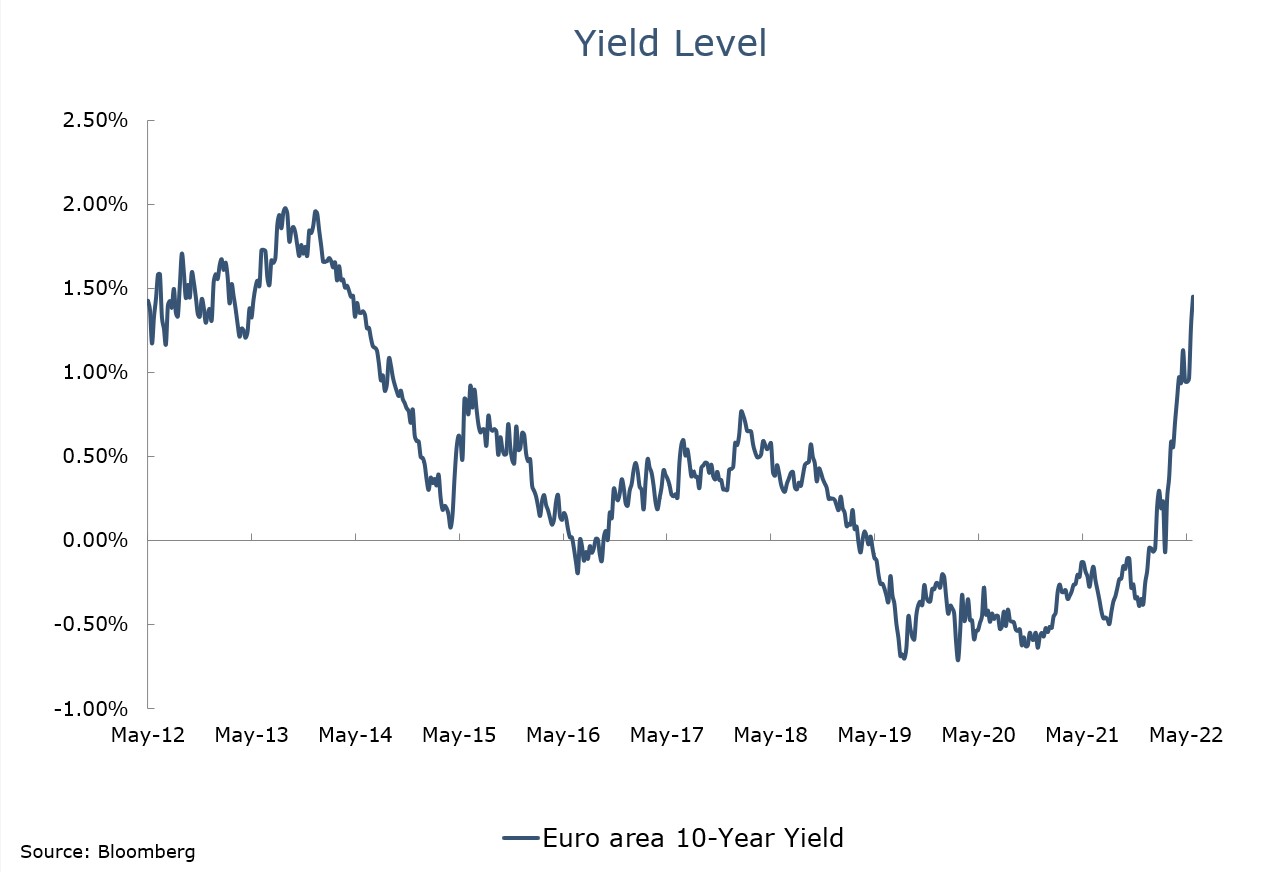

- It was a tough week for financial markets, with world equities down over nearly 3% in euro terms and bond markets also under pressure. Euro area 10-year yields were up 25bps and US 10-year yields were up 20bps. An aggressive change in policy by the European Central Bank (ECB) and a strong inflation figure in the US were the principal drivers.

- In equity markets there was a switch back towards defensive sectors (Consumer Staples and Healthcare fell the least), but Energy was the best performing sector. Cyclicals and financials were under pressure with the prospect of faster rising interest rates and what that implies for growth weighing on these sectors. We would expect these trends to continue, and we favour defensive and quality sectors.

- The ECB took centre stage last week as it updated markets on the likely course of monetary policy. The outlook is towards the more extreme levels of expectations. Bond buying ends next month and interest rates will be increased by 25bps, as expected. But it indicated that a 50bp hike is likely in September and that there will be gradual increases after that. Its updated economic forecasts have inflation remaining above target until the end of 2024 which allows it to raise rates a number of times over the next 12 months.

- The fixed income markets were falling going into the announcement and a strong inflation figure from the US added to the gloom. There were bigger moves in the peripheral markets (Spain, Italy etc.) as there was no indication of a plan to avoid disorderly moves in parts of the euro area fixed income market (so called fragmentation). Presumably, this is a matter of time rather than intent. There has been a reasonable increase in yields, and it is worth adding to exposure now. Euro sovereigns have been the weakest segment so increasing exposure here seems to make sense although we still have a preference for corporate credit. We are only at the beginning of the interest increases, so we would keep duration short.

Macro views

- The inflation report from the US was the highlight of the week and it produced a strong reaction on Friday. Core inflation was down slightly but not near as much as expected and accelerated month-on-month. It will keep the Federal Reserve in aggressive mode, but we feel that is what markets are priced for at this stage.

- The news flow from China had been very encouraging. In May, exports were up 11% year-on-year and imports were up 4%. It looked like the country was on a pathway to reopening, boosting domestic growth but also reducing supply chain pressures across the globe. However, following further Covid outbreaks over the last week, parts of Beijing and Shanghai were put under lockdown. The disruption this will cause is unclear. President XI said that the ‘zero-tolerance’ policy must be adhered to ‘while maintaining a balance with the needs of the economy’. It probably means some disruption but not as much as in March or April time.

- The World Bank released its updated economic forecasts last week. As with all other agencies, it reduced its growth expectations. It is now expecting global growth of 2.9% in 2022 and 3% in 2023. Tightening monetary policy, elevated commodity prices and disrupted trade networks were the main drivers of the downgrade. This is slightly lower than consensus but not materially so. We have gone to a neutral position on equities as we saw growth forecasts coming down towards trend. The change from the World Bank is in line with this.

Chart of the week: Fixed income in attractive territory

The last month has seen a dramatic move in bond yields in the euro area, up over 0.5%. The yield is now back to levels we last saw in the early part of 2014. Since then, we have spent a lot of time with yields at unattractive levels. This is now changing. The euro bond market is now moving to price in a more aggressive ECB, which is sensible, and yield levels across all maturities are now providing scope to add some value to investment returns. We are adding to our fixed income exposure as sentiment is very low and interest rate expectations now seem more realistic. We could see further weakness in the bond market, so we are targeting shorter-dated maturities.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |