What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Last week was one of recovery across financial markets with fixed income taking the lead. There was a big drop on 10-year yields in the euro area, c.25bps, with peripheral spreads narrowing. The US also performed well with 10-year yields down nearly 10bps. The main driver was weaker economic data; perhaps central banks do not have to do any more than is expected at the moment to cool the economies. The next thing to look for is whether this cooling in activity is feeding into inflation data.

- Equity markets took their lead from the bond market; world equities were up over 5% in euros last week. A weaker oil price also helped; it is down nearly 15% from its highs in June. While growth expectations remain under pressure, a hint that interest rate expectations may be peaking is the first step in stabilisation for equity markets.

- The Bank of Japan is still the only central bank that has not changed policy, and, at its last meeting, it confirmed that remains the case despite the impact it is having on the exchange rate. The Japanese yen is down almost 15% against the US dollar so far this year. The bank seems content to see the currency depreciate which will likely have two implications: currencies elsewhere in the Pacific Rim are likely to remain weak; and we should see Japanese flows supporting bond markets elsewhere as they ‘hunt for yield’ despite the hedging. This is good for US and euro area bond markets.

Macro views

- The Purchasing Managers’ Index (PMI) sentiment surveys from Europe were the key releases last week. For the euro area, the composite index dropped over three points to 51.9. It is still denoting expansion, but is weaker than expected. The weakness was in manufacturing and services, although both still remain above 50. The New Orders sub index in the manufacturing survey dropped below 50, so the immediate outlook is challenged in the euro area economy. Higher energy bills are biting on consumers.

- The US PMI surveys were also released; they missed expectations. The manufacturing survey was particularly weak, dropping five points to 52.4. All remain above 50 – that is, in expansion territory – but the decline was steep.

- There was some relief in inflation figures last week with core inflation in the UK coming in lower than expected. The thought had been that as the reopening spread, there would be a decline in goods inflation that would more than offset the higher service inflation that would ensue. This is the first report we have seen that supports this thought process. Goods inflation dropped from 8.0% year-on-year to 7.2% year-on-year, more than compensating for the rise in service inflation from 4.7% to 4.9%. Combine this with a weak retail sales report (which fell nearly 1% in May), and we could be close to the peak in interest rate expectations.

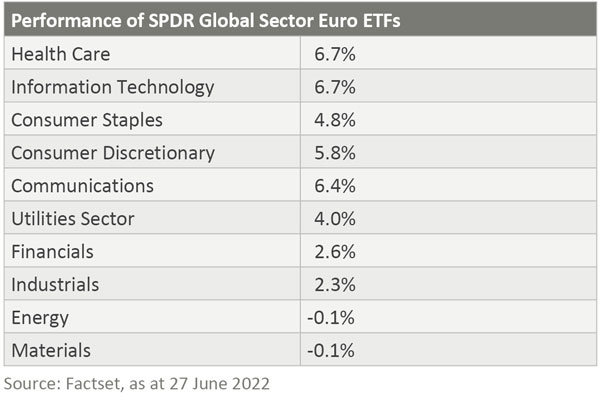

Chart of the week: defensives lead the rebound

The recovery in equity markets last week was not led by the high beta sectors but rather by the defensive sectors (Healthcare and Consumer Staples) and structural growth (IT and parts of Consumer Discretionary). This is the normal pattern of performance during the latter stages of an economic cycle. What had been getting in the way of this happening was that real economic growth expectations had been declining but nominal forecasts had not. We expect this to change as inflation subsides and brings nominal growth expectations down and, as a result, this sector performance pattern will likely be maintained.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |