What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- It was a down week for equities amid uninspiring results from US banks and a negative reaction to the US Consumer Price Index (CPI) reading. However, a stronger US retail sales figure and a drop in inflation expectations gave markets some relief.

- Following the CPI release, there was chatter of a one percent increase in US interest rates at the next Federal Reserve (Fed) meeting. However, this quickly unwound as two of the more ‘hawkish’ members of the Federal Open Market Committee indicated that a 75bp increase seemed sufficient – that’s no different to where we were at the beginning of last week.

- Bond markets also wobbled after the US inflation reading was released, but core sovereigns ended the week higher due to the lower inflation expectations.

- Sector performance continues to move in the direction we expected. With growth concerns increasing, there has been a shift towards defensive and structural growth. Month-to-date there has been much better relative performance from Healthcare, Consumer Staples and Utilities. Lately, IT and Communication – sectors where you find a lot of the structural growth – have also started to perform. We expect this trend to continue.

- The US dollar continues to strengthen and is hovering around parity with the euro for the first time in 20 years. On a trade weighted basis, the US dollar is very extended. We need some good news on energy supply or the war in Ukraine to shore up the euro in the short term. Meanwhile, risk aversion and an aggressive Fed keeps the US dollar propped up.

Macro views

- The major release last week was the US inflation reading. Both headline and core inflation came in higher than expected although fears of a poor CPI report had been increasing. Headline inflation surpassed 9%, with no impact from the recent weakness in commodity prices feeding through yet. Core inflation declined on a year-on-year basis by 0.1%. On a month-on-month basis, it rose 0.7%. It is still showing broad inflationary pressure.

- The Producer Price Index (PPI) data provided for better news. The headline index was ahead of expectations, but the core reading was lower. It was still up month-on-month, but the annual rate has dropped from a recent high of 9.6% to 8.2%. While it states that inflationary pressures have peaked, we do need to see that coming through in the CPI figures.

- China’s GDP figures for the second quarter was a tale of two halves: the economy barely grew on a year-on-year basis (+0.4%) owing to the impact of lockdowns in April and May. There was however a strong rebound in June. Industrial production was up 3.9% year-on-year and retail sales was much stronger than expected, up 3.1% year-on-year. The figures confirm the strong momentum in the Chinese economy that surveys have been indicating.

- There was better news from the US consumer last week. Retail sales were strong with core demand up 0.8% month-on-month despite the shift to services consumption as a result of increased mobility. Along with this, the University of Michigan Consumer Confidence Survey showed a large drop in consumer’s long-dated inflation expectations, which is good news for the Fed and future consumption.

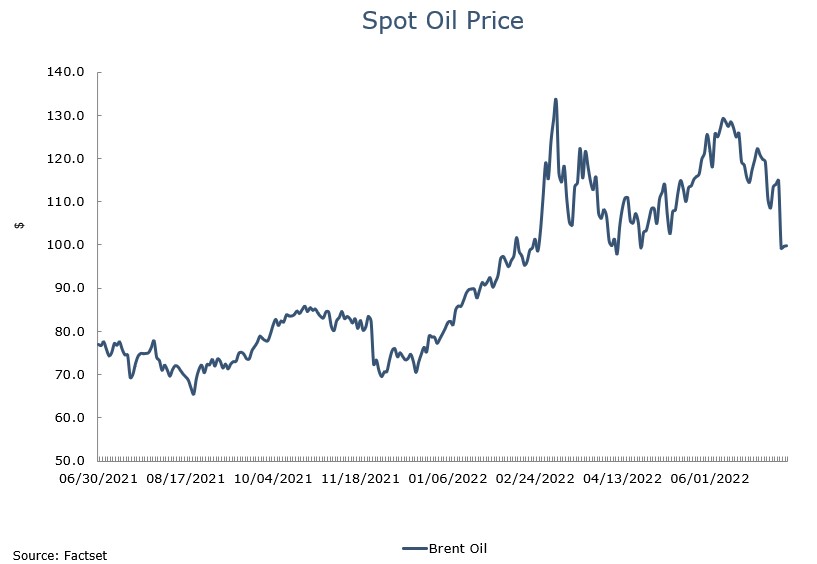

Chart of the week: Oil, has it turned?

Since the end of May, the oil price has corrected by just over 20% as the Brent price breaches $100 per barrel. We are close to the lows we have seen since Russia’s invasion of Ukraine and $100 per barrel is an important psychological level. Concerns about the economic growth are starting to weigh on the commodity, later than we thought would be the case. This price drop is only starting to feed into end prices and, if it continues, it should provide some relief for consumer sentiment which has been depressed by fears about rising prices.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |