What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- The European Central Bank (ECB) Council meeting was the centre piece last week. It opted for a 50bp increase in interest rates citing the weak exchange rate as well as inflation concerns for the faster rate of increase.

- This move does not help the credibility of ECB President Christine Lagarde as she had been vocally in favour of a 25bp hike. We are left wondering if the exchange rate is now also a factor in the interest rate outlook.

- Encouragingly, Lagarde was clear that although the move in interest rates was larger than expected, it did not affect the terminal rate; it is a matter of timing.

- The ECB’s announcement about the Transmission Protection Instrument – an anti-fragmentation tool which allows the ECB to try and control peripheral spreads – was sparse on details and gave no indication of the target levels of spreads. As a result, peripheral spreads widened last week. However, the amount of support that can be given has been left ‘unlimited’ which is a good sign.

- It was a good week for financial markets; both bonds and equities were up despite the larger-than-expected ECB rate rise. There was no change to the terminal rate, which was helpful. The weak Purchasing Managers’ Index (PMI) in the euro area could bring the terminal rate down.

- The results season was more encouraging last week. Earnings are now running almost 6% better than expected which is above average. The strongest sectors are the more defensive ones (Healthcare and Consumer Staples), with the most cyclical sectors (Energy and Industrials) performing worst. This week is a big one with over 50% of the companies in the S&P reporting, so the statistics could be different. So far, profitability is resilient and defensive growth is performing best.

Macro views

- The euro area was in the spotlight last week with all eyes on the ECB Council meeting, but there were other hurdles to be faced. The outcome was mixed. The first hurdle was the Italian government: as I write, Prime Minister Mario Draghi has resigned for a second time and an early election is now the probability. Coming at a time when the ECB is beginning its tightening process and there is elevated geopolitical risk in the region poses greater problems trying to manage peripheral spreads within the euro area.

- The second hurdle was whether the Russian gas pipeline, Nord Stream 1, would reopen. It resumed operations at 30% capacity, which is lower than the 40% achieved prior to the closure, but not dramatically so. However, Russia said another turbine needs maintenance, so energy supply concerns remain with us.

- The PMI sentiment surveys, released on Friday, were worse than expected. The composite figure dipped below 50 led by the Manufacturing Survey, where there was a big drop in the New Orders Index. The Services index remained above 50, but just about.

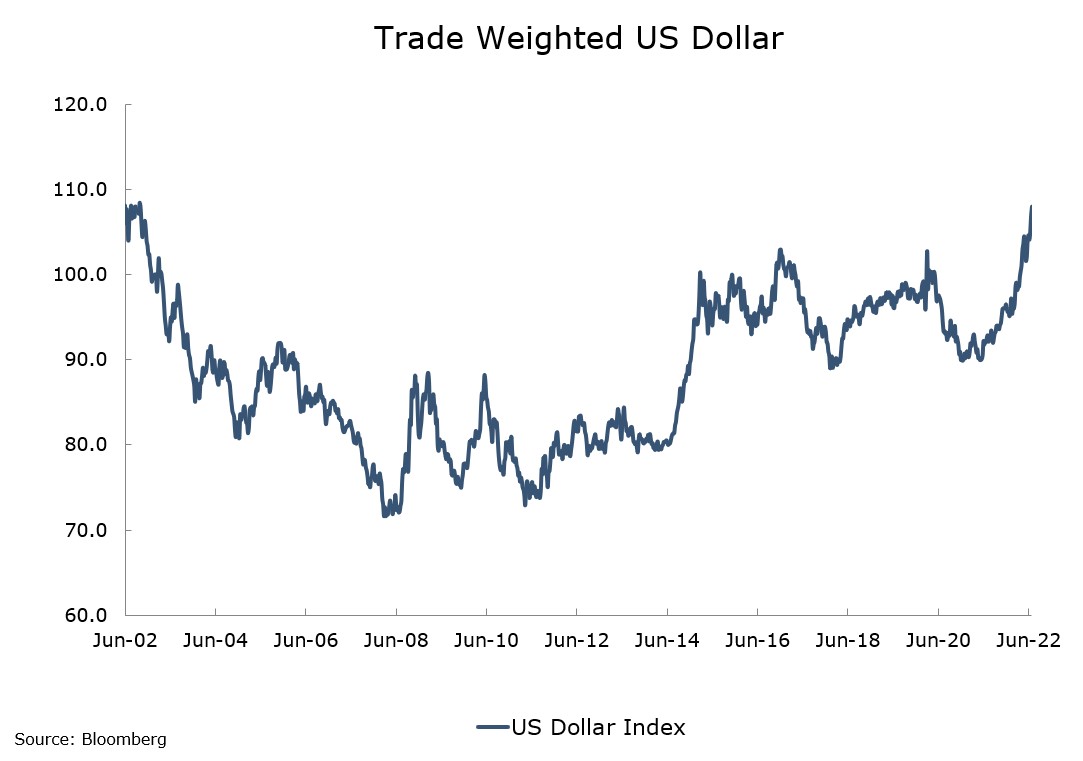

Chart of the week: is the US dollar too high?

The US dollar has moved to a 20-year high on a trade-weighted basis and added to the inflation pressures in other countries as commodity prices are set in US dollars. Not only are other countries facing the inflation pain of higher commodity prices, but the strength of the US dollar is adding to that pain. It is tempting to think the only way is down from here but that may not come as quickly as one thinks. Firstly, last week the Bank of Japan recommitted itself to its low interest rate policy despite the weakening effect it is having on the yen, and the other Pacific Basin currencies (in particular, the renminbi) will follow that. In the euro area, geopolitical risks undermine confidence in the currency. The US dollar may be high, but it looks like it will stay there in the near term.

Please note: we are taking a break from Market Pulse in August. Our next edition will be published on Monday, 5 September.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |