What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Equity and fixed income markets were under pressure last week, starting September on the same weak note as they finished August. European energy security was a renewed cause for concern. US labour market strength, accelerating euro area inflation and renewed China Covid restrictions heightened fears of more restrictive central banks and lower growth.

- Global equities declined 2.8% in August, and 3% last week. Euro area bond markets declined 4.9% in August as bund yields had a record monthly move up.

- Europe and the US were the weakest regions for equity markets. Within equities, the performance of cyclical sectors compared to defensive ones was mixed, while only Energy generated a positive return in August, despite recent oil price weakness.

- Recent market moves seem to be echoing what happened earlier this year when monetary policy expectations shifted rapidly to catch up to inflation. We have seen another concurrent decline in equities and bond markets as bond yields shift higher. However, so far, market-based indicators of inflation expectations have not moved as much as in the prior episode.

- US inflation expectations have rebounded again recently, but at 2.4% (on a five-year forward basis) are about the same level as they were coming into summer. Still, this could change, and it will take a consistent trend to lower inflation levels to convince central banks they have tackled the issue.

Macro views

- The US employment market remains strong. It does not yet appear to be responding to the Federal Reserve’s intentions to dampen demand through rising interest rates. The Job Openings report, which was published last Wednesday, showed openings near historic highs at 11.3m, up month-over-month and 900k ahead of expectations. This was followed by Friday’s report that non-farm payrolls were up 315k in August, less than July’s stunning 530k increase, but still strong and more than expected. The US unemployment rate ticked up to 3.7%, which was well received as the labour force participation rate increased.

- The US ISM Manufacturing Index, typically a reliable cyclical indicator, was stronger than anticipated in August at 52.8, and stable compared to July. The new orders component, which tends to lead the overall index, bounced back to expansion territory in August.

- Euro area inflation surprised to the upside last week, accelerating to 9.1% in August compared to 8.9% in July. Excluding energy (which is up 38% in August) inflation accelerated to 5.8% from 5.4% in July. This is pushing up euro area bond yields in anticipation of a stronger monetary policy response.

- China’s official manufacturing and services Purchasing Managers’ Indices (PMIs) were both slightly above market expectations but still relatively low. The Caixin manufacturing PMI came in lower than anticipated at 49.5, down from 50.4 last month. Power supply issues and new Covid lockdowns are disrupting the reopening theme.

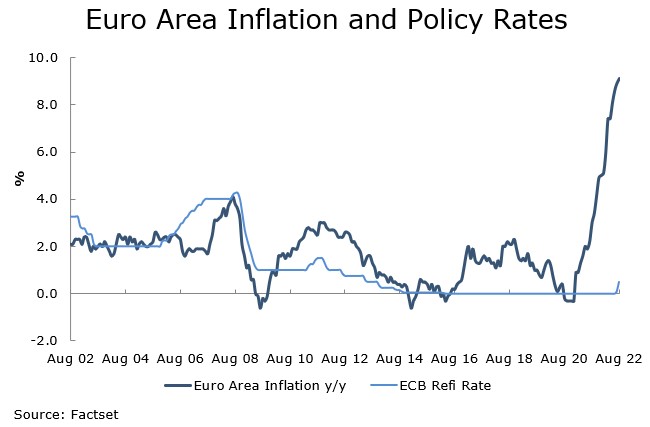

Chart of the week: Will the ECB move faster?

The European Central Bank (ECB) is expected to raise its policy rates by 50bps this week. Expectations are moving towards a 75bps increase given how far behind inflation the ECB is. Euro area residents are currently challenged with unprecedented levels of inflation since the introduction of the euro. Energy costs have been a significant driver of recent inflation, but even excluding energy, euro area inflation is still running near 6%. ECB moves are unlikely to address some of the fundamental drivers of current inflation, but it will be seeking to defend the currency, which has been weak, particularly against the dollar. With euro area unemployment at historic lows, it will also be looking to curb second round effects of wage demands to offset the sharp increase in cost of living.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |