What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Another dramatic week in financial markets with memories of 2008/2009. Credit Suisse was forced to sell itself and another regional bank in the US, First Republic, has put itself up for sale. The main difference between now and 2008/2009 is the speed of the reaction of authorities in ensuring that there is sufficient liquidity for banks to carry on their normal activity avoiding a financial crisis. World equities are flat over the week, although the euro area was down almost 5% and world financials are down nearly 7%. This may seem complacent, but the markets do not see the problems as threatening to the financial system. From what we know, this seems a fair assessment, but it is an evolving situation and conditions could change. These events are typical of the latter stages of an economic cycle and adds a headwind to the global economy. That is why we have a defensive mix to our equity exposure. Over the last week these sectors are up as investors switch away from the cyclical sectors. We believe this process will continue as we travel through 2023.

- The news of the forced acquisition of Credit Suisse by UBS over the weekend, has had a unique feed through to the bond market. The treatment of some Credit Suisse bonds, has led to knock on implications for bank debt, leading to a higher cost of capital for banks this morning. Within government bonds, yields continue to fall, extending last week’s moves. The move lower in bond yields directly translates to lower expectations for central bank tightening going forward, with markets now pricing for last week’s move to be the last hike from the ECB for this cycle. Focusing on a bigger picture perspective, this is reflective of late cycle dynamics within markets. Eventually, Central Bank hikes feed through to tighter banking conditions helping to bring a slowdown which should have knock on implications for growth and inflation. All eyes this week will be on the Federal Reserve meeting.

Macro views

- The European Central Bank Council Meeting was the highlight of the week, especially given the background of fears about stability of the financial system. The Bank followed the course that it set out at its last meeting increasing the policy rate 0.5%. It updated its inflation forecasts (core inflation at 4.6% in 2023; 2.5% in 2024 and 2.2% in 2025) and said that inflation is staying too high for too long, indicating more interest rate increases will be needed. In the press conference afterwards, President Lagarde said that there was no trade-off between price stability and financial stability, different tools are used to address each. Key take away: interest rate policy will be driven by the inflation out-turn.

- We had another inflation update from the US last week with the monthly Consumer Price Index (CPI) and Producer Price Index (PPI) reports. The CPI report was mixed. Both headline and core annual inflation were down from January but only by 0.1%. The main negative core services ex rent inflation (a measure the Federal Reserve watch) was up 0.5% month-on-month. The PPI report was more positive. Core inflation was flat on a year-on-year basis, but this is better than expected and headline inflation came in well below forecast. Combining the two reports amounted to mildly good news on the inflation front.

- The Retail Sales report for February was released in the US. After a strong January when core sales jumped almost 3% month-on-month, February was more subdued with core Retail Sales flat month-on-month. The Federal Reserve will be pleased to see a cooling in the monthly data, but the annual growth is still very high at 8.6%.

Chart of the week: Keep in context

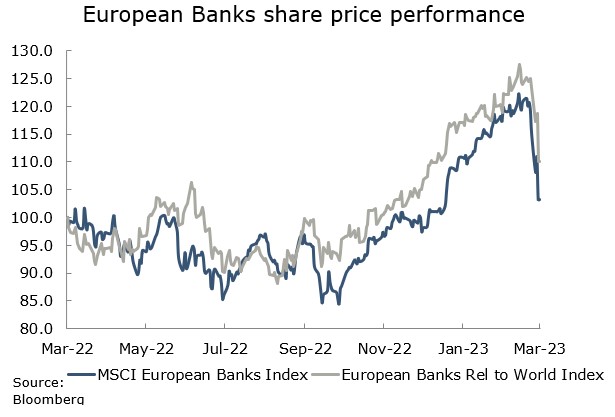

The last week was a torrid time for the European Bank Sector falling nearly 15% hit by the Silicon Valley Bank closure and the forced sale of Credit Suisse. However, as you can see from the chart above, this is after a very strong move since last October, up almost 50%. Recently investors focused on higher net interest margins due to rising interest rates. We felt this was over-done because higher interest rates will have to be passed on to depositors putting net interest margins under pressure in the future. Higher rates will have some credit quality and credit growth implications. This is what is being factored in at the moment, so even without the current headlines, a correction does not look out of place.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |