What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Financial markets have been moving within a tight range in recent weeks, but the overriding sentiment remains bearish. Notwithstanding this, world equities traded up almost 2% during last week but it was notable that market leadership came from the mega cap IT sector and other areas of the market where quality and structural growth are the key characteristics. Traditional defensive sectors like Utilities, Healthcare and Staples lagged. Bond markets sold off with 10-year government yields in the US and Europe rising c.20bps during last week. The key debate is still between a soft landing versus hard landing narrative. Better news around debt ceiling talks and US regional banking aided the former this time around. Ultimately, central bank policy and its impact on the economy is what should matter most.

- Investor positioning is at its most bearish for this year so far, according to the latest Bank of America Global Fund Manager Survey. This is usually a positive signal but the recent lack of volatility in the market suggests investors are in a wait and see mode for the time being.

- The US debt ceiling talks continue with 1 June increasingly seen as the so called “X-date” by which something must be agreed. The consensus is that this will happen, but the closer we get to the “X-date” without an agreement, the more volatility we are likely to see.

- US retailers Home Depot, Target and Walmart were among the last important companies to report their quarterly earnings last week, which broadly reflected a softening in sales trends but nothing severe. This also fed into the soft-landing narrative.

Macro views

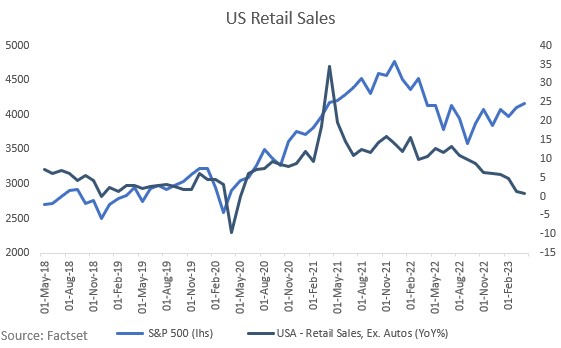

- April retail sales in the US were up 0.4% month on month (m/m) at the headline level, which was weaker than consensus (0.8%). However, stripping out autos and gasoline, the core discretionary group was up 0.7%, which was well above consensus of 0.3%. Bottom line, it signals a softening trend in US consumer spending on discretionary since the beginning of the year, but with no sharp deterioration. The US consumer is still alive and kicking for now.

- Initial jobless claims in the US fell more than expected to 242,000 from the prior week’s recent high of 264,000. This indicates a stronger than expected jobs market, which implies a resilient consumer.

- US Industrial Production in April rose by 0.5% m/m versus expectations for a flat print (no change). Despite this, industrial production is still down 0.7% on a six-month annualised basis. So, the goods producing sector of the economy is in a downturn, as reflected in the ISM manufacturing surveys, but it remains a modest one by historical standards.

- US Housing starts picked up in April, growing 2.2% m/m in line with expectations. Starts are down 22% on a year on year (y/y) basis but activity in February and March suggest that they are moving sideways after bottoming out in December and January. In the second-hand market, existing home sales fell 3.4% m/m in April, for the second consecutive monthly decline. On a y/y basis, sales are down over 23% but the three-month average picked up slightly, indicating its close to finding a bottom.

Chart of the week: Weakening or Normalising?

One of the key standouts over the last 12 months has been the resilience of the US consumer. Since the US consumer comprises around 70% of the world’s largest economy, this has been a big reason why no recession has materialised there so far, as many predicted last year. Full employment levels and post-pandemic spending of excess savings have been the main drivers of the consumer’s resilience. Is it about to crack? The Federal Reserve wants to see core services inflation come down and for that, it needs a weaker consumer. It is hoping to achieve this via the jobs market. While core services inflation has been trending lower, it is still historically high. The risk now is that a more resilient consumer encourages the Fed to stay higher for longer, or even hike rates further. That could be a nasty surprise for markets and helps explain why we remain cautious.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |