What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- In financial markets, it was a mixed close to a dull month. World equities were down slightly in euro terms, but the euro area bond market managed a small positive return over the month of April. There was a defensive slant to performance within the asset markets. In fixed income, returns from sovereign were higher than investment grade but the difference was small. In equity markets it was more marked. Many of the defensive sectors (healthcare; consumer staples; utilities) produced positive returns during the month while cyclical sectors (materials; industrials; consumer discretionary) were down.

- A major prop for equity markets during April was the first quarter reporting season. In the US, half the companies have reported and earnings are 7% better than forecast. Just over one third of companies in Europe have reported and profits are coming in 11% higher than expected. These strong figures failed to get equity markets moving. Part of this is because forecasts had been cut going into the result season thus reducing the hurdle. The other factor is that it has not led to upgrades for the year, so we remain concerned about the earnings outlook for 2023.

- The new Governor of the Bank of Japan chaired his policy meeting and surprised many by reiterating current policy quite forcefully. As a result, expectations of any change are being pushed out to the second half of the year which will help bond markets everywhere. On the negative side, in the US, there was no progress in the debt ceiling negotiations. The Republicans passed a bill in the House of Representatives linking any increase in the ceiling with spending cuts. This is not acceptable to the Democrats, so there is a potential source of volatility.

Macro views

- First quarter GDP for the US was mildly disappointing. The growth rate of 1.1% was well behind consensus expectations of 1.9%, which is confusing given the strong data we were getting. However, the main drag was the drawdown of inventories; Final Domestic Demand grew by 2.9%. This figure is prone to revision so there are health warnings around it but there is nothing in it to make the Federal Reserve alter its course.

- The more concerning part of the GDP release was the pricing information from the core PCE (Personal Consumer Expenditure) index. This is one of the main measures the Federal Reserve look at to judge inflationary pressure in the economy. For the quarter, core PCE came in at 4.9% year-on-year against the forecast of 4.7%. There was some relief that it eased toward the end of the quarter with March’s year-on-year rate down to 4.6%. This will encourage the Federal Reserve to keep interest rates high.

- First quarter GDP was also released in the euro area. Much the same as the US, while it turned out better than feared six months ago, it also marginally disappointed, relative to recent forecasts. The euro area grew 0.1% quarter-on-quarter against consensus 0.2%. In Germany however, both public and private demand were down in the quarter. While the outcome may halt any upward revisions to growth forecasts it is not weak enough to alter the ECB’s tightening course.

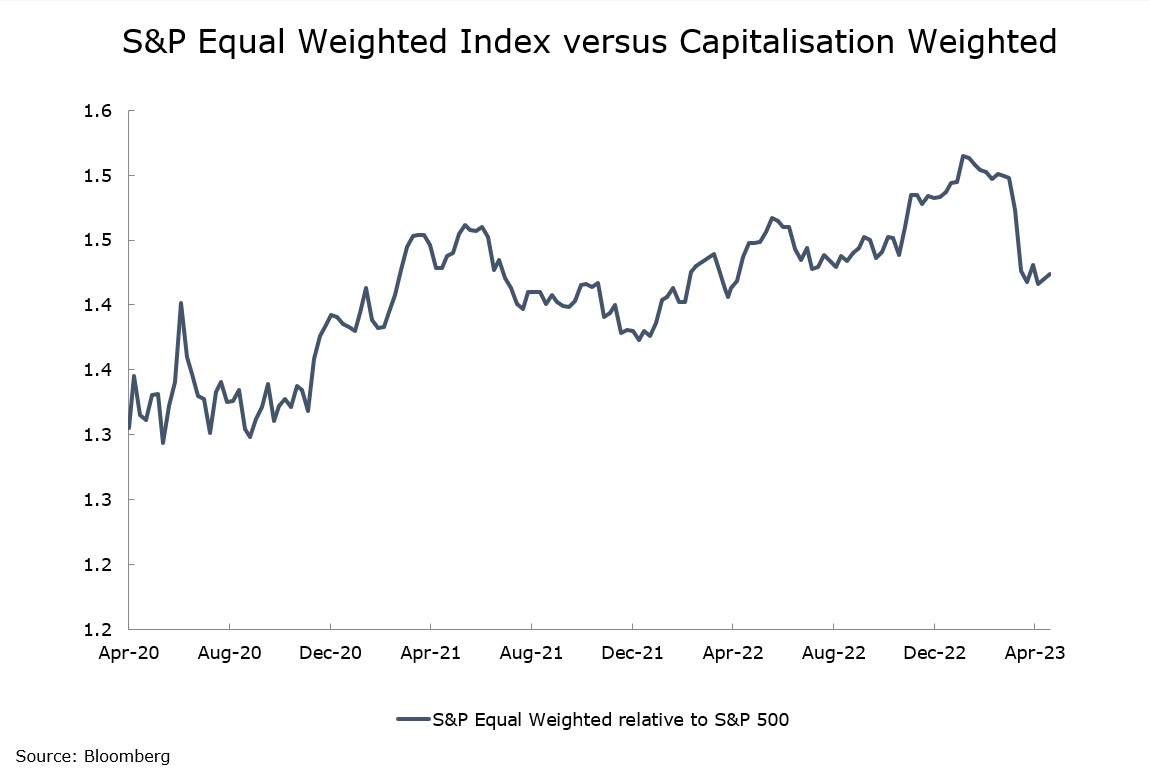

Chart of the week: Just normalising?

Many commentators have worried recently about the breadth of the move in the S&P 500, i.e., the rise in the index has been driven by a small number of companies. The chart above shows the performance of the equal weighted index relative to the S&P 500. When the bigger companies are doing better than the average company, the S&P 500 Equal Weighted is underperforming the S&P 500 (the line is going down), and vice-versa. You can see that the bigger companies have been outperforming since March, but that is after a long period of underperforming. From the chart you could say that all we are seeing is some normalisation in the relative performance rather than anything untoward going on.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |