What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- May has got off to a cautious start for financial markets. World equities traded down with defensive sectors such as healthcare, staples and utilities outperforming while bond yields fell in response to concerns about the US regional banking crisis as well as a broader economic slowdown. Central banks continued with their hawkish messaging despite nearing the end of the hiking cycle.

- The US regional banking crisis continued and several banking stocks in this space saw their values fall significantly as the week progressed. This is not entirely unsurprising and incidences like these can be expected in the late end of a cycle. They appear to be limited to a specific sector of the market and there is little evidence, if any, that they are indicative of something more systemic akin to the 2008 banking crisis.

- In the background, the US debt ceiling impasse is gaining attention. Democrats and Republicans need to agree to raise the US debt ceiling over the next several weeks to avoid a US default. We think ultimately a way forward (similar to 2011) will be found, but the path there could keep markets subdued.

- On the plus side, earnings season continues to surprise positively. The US and Europe are both tracking 3-4% higher than expectations at the start of the season, with higher prices helping to boost profits.

Macro views

- The US Fed raised its target range for the Fed Funds rate by 25bps to 5.00-5.25%, as expected. The policy statement removed the reference to additional policy firming, instead making it more contingent on economic data. However, Fed Chair Powell indicated after that this was not a pause as such, that there was still a long way to go in meeting the Fed’s goals and more data was required before the US hiking cycle could be declared over.

- Looking at the most recent data, the US manufacturing Institute of Supply Management (ISM) survey improved to 47.1, which was ahead of expectations of 46.8. It indicates that the manufacturing sector in the US is still in a mild recession but may be finding a trough. In contrast, the US services ISM is still in expansionary mode and printed at 51.9, which was above the 51.5 consensus.

- The latest monthly jobs report showed that the US added 253,000 jobs in April, more than the 185,000 expected. Although there were downward revisions to the prior two months, the average monthly gain over the last six months is still a healthy 290,000. Wage growth also came in stronger than expected at 4.4% year-on-year. This will be watched closely by the Fed and is likely to keep its message on the hawkish side.

- In the euro area, the European Central Bank (ECB) also raised its benchmark deposit rate by 25bps to 3.25% and it said it would increase the pace at which it reduces its asset holdings from €15bn to €25bn per month, as part of quantitative tightening. Expectations are for the ECB to continue to increase the rate towards 3.75%.

- Eurozone headline inflation ticked up to 7% in April from 6.9% the month before, although after stripping out energy and food prices, core inflation fell for the first time in 10 months to 5.6% from 5.7% the month before. Nonetheless, these rates are still higher than the ECB would like and keeps their message on the hawkish side.

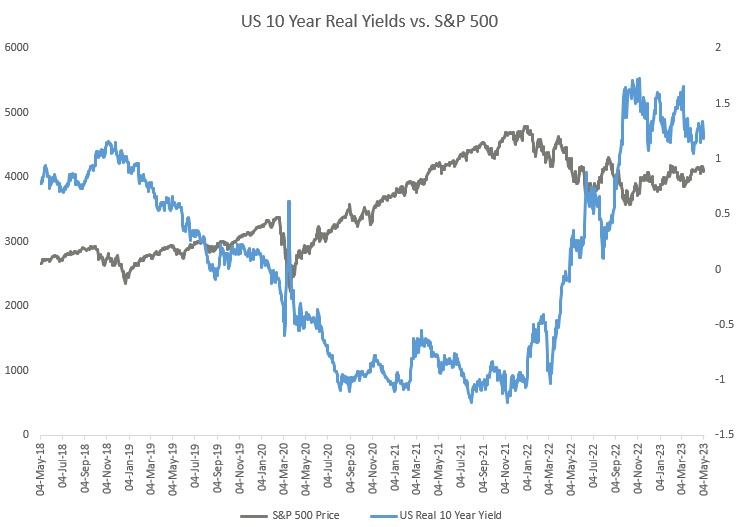

Chart of the week: Falling Bonds

Real bond yields in the US have been falling since the beginning of the year as the bond markets price in rate cuts by the Fed in the second half of the year and in response to a growth slowdown. This has helped boost the equity market since the real yield is the discount rate used to value equities. However, the Fed’s hawkish pause signal suggests one should remain cautious. We continue to be cautiously positioned across the various asset classes with a bias towards defensive and quality equities as well as a shorter duration in fixed income.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |