What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Market moves in May were relatively subdued but ended on a better note. World Equities were down 0.2% in local currency and the euro area fixed income market delivered a positive return of 0.4%. The debt ceiling negotiations in the US pressured markets during the month and the resolution led to a relief rally, particularly in the fixed income markets. 10-year yields dropped by 20 – 30bps from their highs during the month.

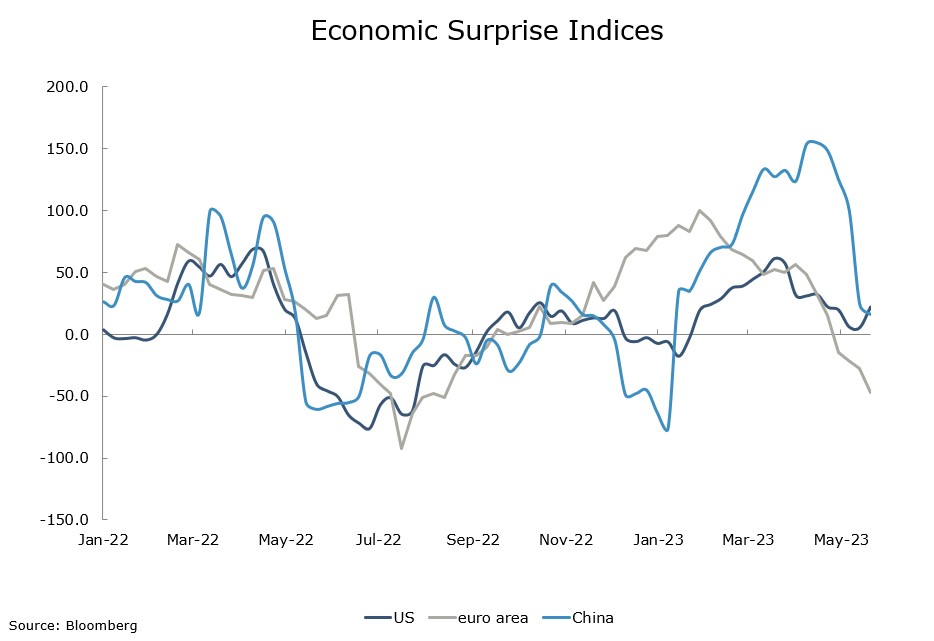

- Equity markets were close to flat in May, but the detail was not as encouraging. Of the major regions only the US and Japan were up in May and practically all of this was down to a few companies in the IT and Communication sectors. The S&P 500 was up 0.4% during May but the equal weighted S&P 500 was down nearly 4.0%. While the resolution to the debt ceiling debate is a relief for equity markets, the turn in economic growth data across the world undermined them during May (see chart of the week below).

- It is not surprising that we are rallying post the debt ceiling deal. We have avoided what could have been a very messy period for markets, but still face some challenges. The US Treasury will now have to rebuild its deposit account through issuing a large number of Treasury bills. By some estimates to get its deposits back to ‘normal’ would entail issuing up to US$ 1.5trn worth of bills which means less cash for other asset classes. The global economy got a shot of momentum from China's reopening, but this is now fading, and growth statistics may not look so good over the next few months leading to a tougher environment for equity markets.

Macro views

- The important data from the euro area last week was the inflation report, which, for the first time this year, was good. Headline inflation fell to 6.1% year-on-year (a 15-month low) against forecasts of 6.3% and core inflation fell to 5.3% year-on-year against a forecast level of 5.5%. All components of the report were lower than expected so the deceleration in inflation is very broadly spread. The report was well received and another reason why the euro area fixed income markets delivered a positive return in May.

- Chinese data remains weak. The business sentiment surveys (PMIs) were released last week and they were down month-on-month and lower than expected. The Manufacturing PMI was the weakest dropping to 48.8 which suggests month-on-month declines in activity. The non-Manufacturing PMI is still well in expansion territory, 54.8, but is declining faster than expected as the reopening impulse fades.

- The key release from the US was the Employment Report and it gave conflicting messages. The non-Farm Payrolls report was very strong, 339k jobs created against the consensus forecast of 187k. The Household survey on the other hand showed job losses of 310k and a jump in the unemployment rate from 3.4% to 3.7%. The truth probably lies somewhere between the two, but it leaves us waiting another month for clarity. If the Federal Reserve is inclined towards the move up in the unemployment rate would support that.

Chart of the week: Turning Fortunes?

One of the major surprises in the early part of this year was the performance of the global economy. The chart above shows how economic releases compare against forecasts. If the lines are above zero than the actual data is better than forecast. As you can see all regions were performing better than expected since the start of the year putting upward pressure on forecasts which has been a support to equity markets, but that is changing now. All regions are close to performing in line with expectations. We expect this process to continue as the China reopening fades and the implemented monetary tightening creates a more challenging environment for equity markets.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |