What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help you preserve and grow your wealth.

Market views

- World equity markets fell almost 5% last week, as the same issues – moving towards quantitative tightening and the timing of US interest rate rises – put them under further pressure. Bond yields rose modestly – up 3bps in the euro area suggesting the arrival of some stability.

- While the timing of US rate hikes has been brought forward, the expected peak rate has not changed; it is still 2.25- 2.50%. That’s an important issue for us as it will determine longer term performance and it is a relatively benign level.

- Leadership remains with cyclicals and yield-sensitive sectors. This usually changes after the first interest rate rise because investors will start to focus on the implications of the change in monetary policy for economic growth. Consequently, defensive and quality growth sectors – IT, Healthcare, Consumer Staples and Utilities – will likely be back in vogue. It may be painful to hold them now, but they should be the place to be in 2022 – we will look to increase our exposure here.

Macro views

- Chinese data and policy updates were in focus last week. Q4 GDP was better than expected as industrial production growth topped forecasts. The Omicron variant entered the country, and this was reflected in slightly slower than expected retail sales growth. Overall, it is reassuring to see data from China beginning to beat forecasts but the states’ reaction to the spread of Omicron remains the key short-term risk.

- More importantly, the People’s Bank of China announced further policy changes last week. It cut longer term interest rates and is ready to use ‘other tools’ to support the economy. Regulation around property development was also eased. It appears that China has put economic growth above the moral hazard of further investment in the property sector. Just as the developed world starts to pull back policy support, China is going in the opposite direction which should help smooth that transition.

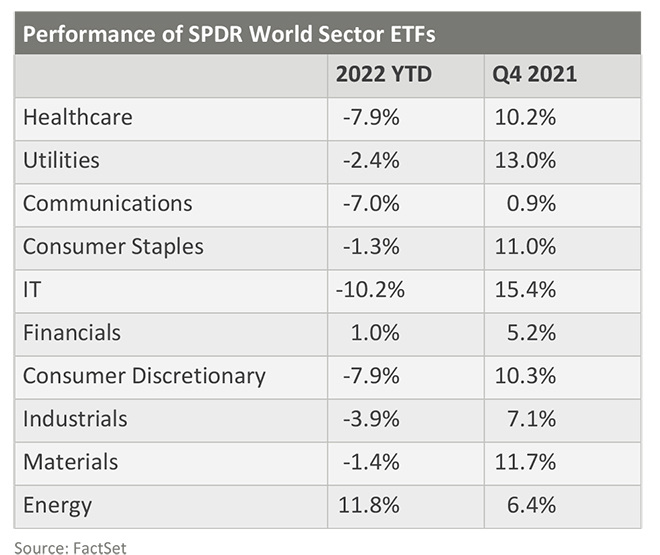

Chart of the week: A shift towards cyclicals and yield-sensitive sectors

Performance to close of business 21.01.22

Looking at sector performances in Q4 and year-to-date, there

has been a big swing towards cyclical and yield-sensitive sectors this year –

that is, Energy, Materials, Industrials, and Financials. Conversely, defensive

and structural growth sectors – that is, IT, Utilities, Consumer Staples and

Healthcare – were the top performers in Q4 2021 even though many of the issues

that we are dealing with this year were with us in Q4. So, some of the shifts

we are seeing this year are a reversal of the extreme moves in Q4.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |