What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Leading central bankers met at the European Central Bank (ECB) Forum in Sintra, Portugal last week – and the comments that emerged from the annual forum have left investors thinking that the Federal Reserve (Fed) will be more aggressive than thought and the ECB will be perhaps a little bit softer.

- Fed Chair Jerome Powell reaffirmed that controlling inflation is the main target and that if that causes economic pain then so be it. On the other hand, ECB President Christine Lagarde seemed to rule out a more aggressive 50bp interest rate increase at the bank’s July meeting, opting for a more softly approach of a 25bp increase.

- In the US, the timing of interest rate increases was brought forward owing to these comments. However, this quicker tightening is expected to yield a faster economic slowdown, and thus the expected peak level fell, down 0.5%. In the euro area, the expected peak level also dropped 0.5% due to lower growth expectations.

- Growth fears gripped markets last week. There was improvement in the bond markets: the US 10-year yield dropped to 2.85%, while the euro area 10-year yield is down to 1.25%.

- The same driver pulled world equities down over 2%. The factors that are going to change these trends in the short-term are declining inflation, which is happening but not fast enough, or a drop in energy prices which would give some relief to the pressured consumer. Oil prices are easing back from recent highs, but progress is slow.

- We felt that we were coming close to pricing in the prospective interest rate increases in the US and euro area and that recent movements would support this – thus, our increase in fixed income exposure. We have held our neutral position in equity markets because they generally peak close to the onset of a recession. With labour markets still close to peaks, this does not seem likely in the near term and current growth fears seem overdone.

Macro views

- The standout macro data release came from China last week, with the Purchasing Managers’ Index (PMI) sentiment surveys moving back above 50. The increase in the services survey was large, up 6.9 points to 54.7 – well above an expected reading of 50.5. The manufacturing survey was more subdued, up 0.6 to 50.4. It was lower than expected but it moved back into expansion levels. A more interesting feature of the manufacturing survey was the significant improvement in delivery times, up over seven points. The reopening in China is gathering momentum – that’s good for the local economy but also for the global economy as it eases supply chain pressures.

- There was soft data released in the US last week. Personal consumption barely moved in May while the ISM Manufacturing Survey dropped more than expected but still remained at expansion levels at 53. The switch from goods consumption to service consumption as the re-opening takes hold and mobility increases continues to deliver a weak mix for overall consumption which is feeding through to manufacturing. One benefit is the decline in core PCE prices, which the Fed watches as a gauge of inflation. It fell for a third consecutive month to 4.7% year-on-year. It is falling, but not fast enough to change the Fed’s thinking.

- The inflation report for the euro area was released last week. Headline inflation was up again compared to the previous month as strong food and energy prices feed through. Core inflation declined but only by 0.1%. With headline inflation running at 8.6% year-on-year, the pressure on consumers continues. Meanwhile, the core rate, which looks like it has peaked, is not declining fast enough for the ECB to alter plans.

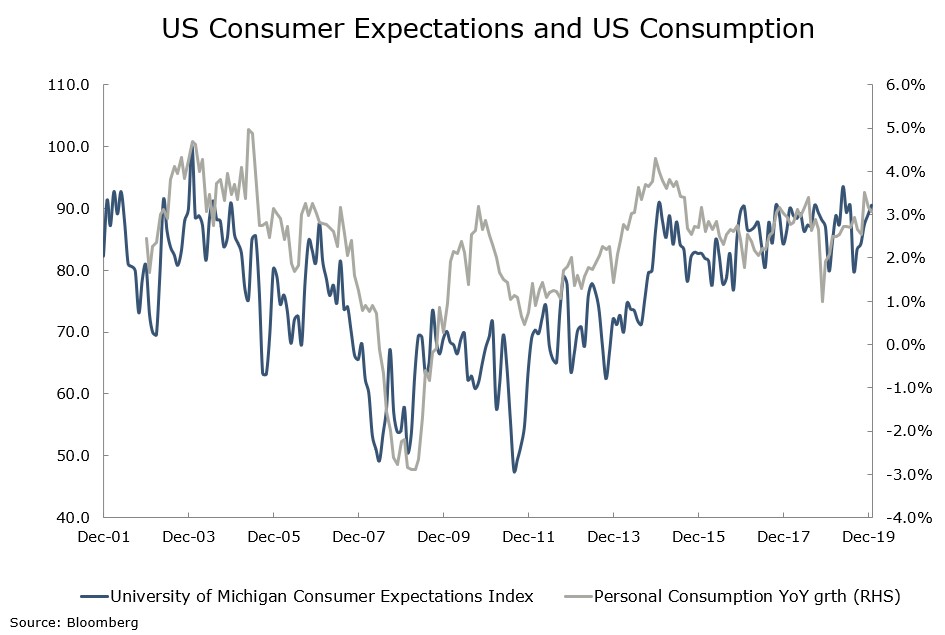

Chart of the week: US consumer - do as I do, not as I say

A deterioration in consumer sentiment in the US has been a factor behind the rise in recession fears. As the largest component in the US economy, and indeed the largest group within the global economy, a stressed US consumer would be a major drag. In the latest consumer survey for the University of Michigan, the expectations sub-index dropped to its lowest level since 1980 adding to concerns. Our chart of the week puts the Consumer Expectations Index against actual consumption pre-COVID. As you can see, the two lines are coincident. The expectations index tells you very little about what consumption will be like in the future, it reflects what is happening at the moment.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |