What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- A third 75 bp increase in the Federal Reserve’s (Fed’s) policy rate is a near certainty at this week’s meeting after US inflation data for August came in higher than anticipated. Indeed, the Fed move could be 1%, with additional upsized moves at subsequent meetings. Markets now anticipate the Fed moving to a peak, i.e., terminal rate, where it stops raising rates, of about 4.25% in early 2023. The question is whether this is the terminal rate, or if persistent inflation will force the Fed to stand harder on the brakes.

- The US inflation data released on Tuesday drove an extreme daily decline of 4.3% for the S&P 500. US two-year bond yields, which are particularly sensitive to Fed policy rates, hit their highest level in over 15 years. US 10-year bond yields moved up but by less, so the US 10-2 yield curve is inverted by a near record amount.

- Global equities declined 4% (euro terms), and euro area bonds fell 0.5% last week. Equities are -2.7% so far this month, while euro area bonds are down 1.2%. Coincident declines in equities and bonds are difficult for multi-asset portfolios, but we expect diversification benefits to be higher in future given where bond yields are now.

- While we would caution against reading too much into any single data point, or short-term market moves, central bank hawkishness is unlikely to subside soon. The pace of expectation changes is much slower than we saw earlier in the year, but markets are likely to remain volatile until policy expectations begin to inflect.

Macro views

- US inflation surprised to the upside last week, disrupting the view it would subside quickly. Headline consumer price inflation (CPI) declined to 8.3% year-over-year from 8.5% last month. However, core CPI (ex Food and Energy) was up 0.6% month-on-month, compared to consensus expectations of 0.3%, bringing it to 6.3% year-over-year. Services, such as housing (which comprises about a third of the inflation index) and medical care, as well as new cars were key drivers of the upside surprise. Food prices were up 11.4% year-over-year.

- US retail sales, also reported last week, were up 0.3% month-over-month and 9.1% year-over year, which compared to expectations for a flat reading and a decline of 0.4% last month (which was revised down from flat). However, below the positive headline the figures were relatively weak with control group sales flat month-over-month when expectations were for a 0.6% increase.

- The UK consumer is showing the impact of higher food and energy costs. Retail sales volumes declined 1.6% compared to last month (-5.4% year-over-year), while total spending value declined 1.7% versus last month (+5.4% year-over-year).

- China reported some relatively strong economic data last week. Retail sales were up 5.4% compared to expectations for 3.3% and 2.7% last month. Industrial production rose to 4.2% year-over-year from 3.8% last month and fixed asset investment rose 5.8%.

- The European Commission has outlined plans to address the current energy crisis with electricity price caps and windfall taxes of around €140 billion. Analysts note there is little political agreement between EU countries about this and that the proposals are complex and difficult to see being implemented in a timely fashion.

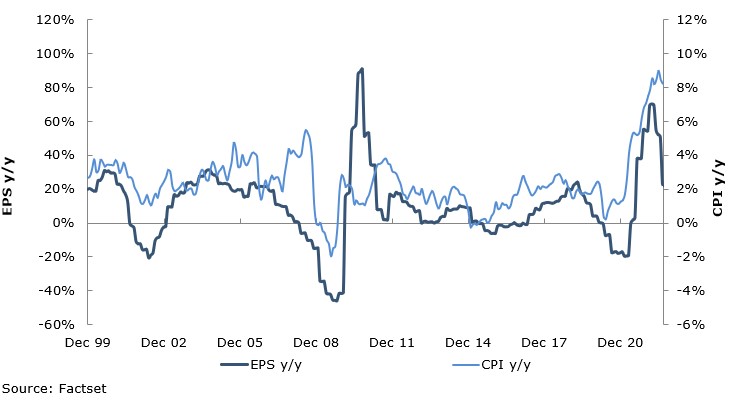

Chart of the week: S&P 500 growth vs inflation

Inflation is the current hot topic. Global central banks are almost all in tightening mode to bring it to heel. This has put pressure on asset markets as the shift to higher interest rates drives lower valuations. However, while bonds typically have fixed future cash flows, equities appear to get some benefit from inflation. Our chart of the week shows a strong positive relationship between S&P 500 earnings per share (EPS) growth and US consumer price inflation (CPI). Earnings growth was modest in the post-financial crisis period of low real growth and low inflation, but it accelerated sharply after the Covid-19 pandemic on cyclical drivers including inflation. This makes intuitive sense – companies that cannot increase prices to maintain profits will fade and be bypassed by those that can. While real GDP growth forecasts have been cut through 2022, higher inflation has offset this for nominal GDP growth, which has supported earnings forecasts. Of course, if central banks have to inflict sufficient pain to halt inflation so that it drives a hard landing, then earnings will fall, and credit losses will rise.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |