What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help you preserve and grow your wealth.

Market views

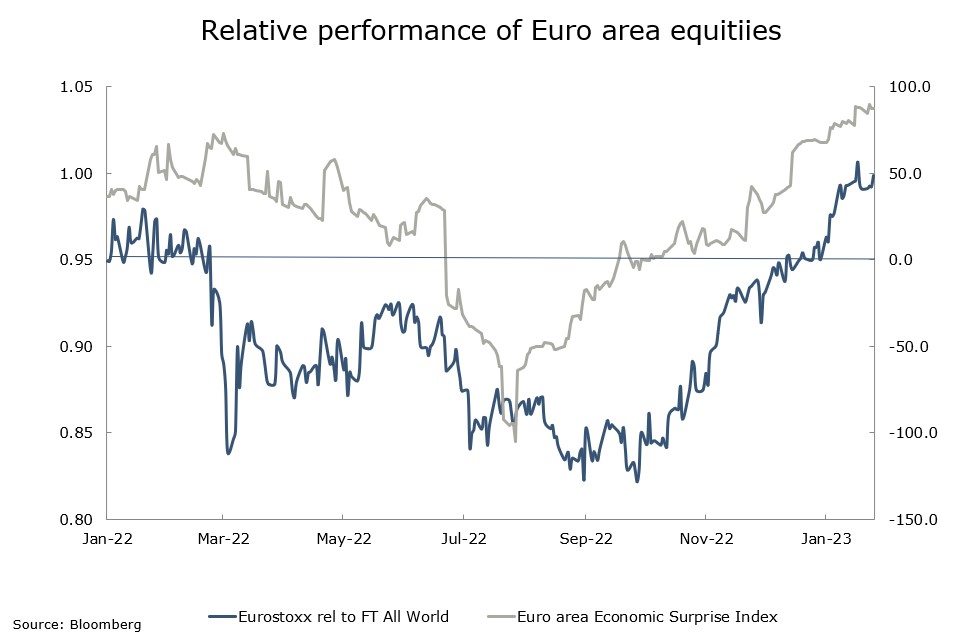

- Equity markets are back in recovery mode. The reporting season is helpful, but the major driver is a better mood around economic growth. The euro area economy has held up better than expected during the winter and there are upgrades for growth in 2023 now being put through. However, the euro zone equity market is relatively higher than the rest of the world compared to the start of 2022, despite a difficult year. Last week, following the reopening, a lot of attention was on the relatively strong data from China. But if the economy is not weak, is a strong rebound possible? Not likely. It seems that growth is shifting around from quarter to quarter but the total is not moving by much. In summary, we feel much of the better news is in the market.

- The performance of equity sectors tells a similar story. Cyclicals have been leading equity markets in this recovery, and it is due to the same better mood about economic growth. They have managed to recoup a lot of lost ground. Since the end of 2021, global financials are flat, Industrials are down 5% and Commodity sectors are up. This has happened despite a material decrease in expected economic growth rates (both real and nominal) in 2023 and 2024. If you believe recovery is on the horizon: IT, Communications and Consumer Discretionary look like the ‘happier hunting grounds’, all down c.25% over the same period. We still favour the defensive sectors until we get a better idea of how earnings are going to behave in 2023.

Macro views

- The U.S. Gross Domestic Product (GDP) fourth quarter report was released last week. On an annualised basis the US economy grew by 2.9%, ahead of the consensus expectation of 2.6%, a great outcome. The details, however, were not as encouraging. Inventory build accounted for more than two thirds of the growth. Imports were down during the quarter, which is strange if the economy is expanding, so net trade added 0.6% to the growth. Stripping these out, final domestic sales grew at only 0.5%. Government spending was unusually strong (+3.7% annualised). Adjusting for this private sector domestic sales grew by only 0.2% annualised, one of the weakest quarters on record.

- Inflation news from the GDP report: the Personal Consumption Expenditures (PCE) price indices (which the Federal Reserve watches closely) were in line with expectations. On an annualised basis, the headline index was up 3.2% and the core index was up 3.9%. This is a bit higher than the CPI report and will keep the Federal Reserve on its current path.

- More good news from the euro area: the PMI’s (the main business sentiment indicator) for January showed that the overall index continued its recovery and moved above 50, back into expansion territory. The Manufacturing survey showed the biggest improvement but remains below 50. The Services survey is back in expansion mode at 50.7. Economists have been increasing their 2023 growth forecasts for the euro area and this release will give them comfort around those changes. The downside is that it will also make the European Central Bank comfortable about maintaining an aggressive tightening bias.

Chart of the week: Full recovery

As we can see in the chart above, euro area equities have staged a strong recovery since October of last year. They have outperformed the rest of the world by nearly 20%. There are number of factors, but as we can see from the Economic Surprise index, the euro area economy has been performing better than expected (Surprise Index above 0) since September of last year. At nearly 100 it is very elevated. Over the last number of weeks there have been upgrades to euro area growth in 2023, which will put extra downward pressure on the Surprise Index making outperformance more difficult for the euro area from here.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |