What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help you preserve and grow your wealth.

Market views

- Minutes from central bank meetings were the main focus point in markets during the week. The notes from the ECB meeting were a little more aggressive than expected. The growth implications of policy changes were discussed and a technical recession in 2023 is now part of the ECB’s outlook. However, it does not see this as sufficient to bring inflation down to target levels. Interest rate policy will be decided on a meeting-by-meeting basis, there is too much uncertainty to plan much further ahead, but it will be focussed on the inflation data with growth implications taking a ‘back seat’.

- Minutes from the FOMC (the Federal Reserve’s interest rate setting body), gave markets a boost. There was some relief that they indicated a slowing in the pace of interest rates rises and some suggestion that a pause is not too far away. No change to where the Fed Funds rate is expected to peak but there was a reduction in the expected level of interest rates in 2024.

- It was a truncated trading week with the Thanksgiving holiday in the US reducing trading days. Nonetheless both equity and bond markets made further progress, world equities +1.5% and euro area bonds +0.5%. The outlook for interest rates remains the major driver. This has been improving due to better inflation data. We believe there is further to go as we should start to get softer growth data and thus we remain fully invested.

Macro views

- The primary data released last week came from the euro area. The business sentiment surveys (the PMI’s) for November were released for the region. Surprisingly these showed slight improvements from the October reading. The manufacturing survey improved month-on-month and the services survey was flat. There seemed to be three main reasons behind it. Firstly, the energy situation is not turning out as bad as feared. Secondly, delivery backlogs fell to a two year low and thirdly, input prices fell to a 14-month low.

- The better news from the euro area PMI’s was echoed in the IFO survey from Germany which rose in November. Germany is viewed as the poster boy for the difficulties facing the region’s economy. It is more manufacturing based than the rest of the region and more exposed to energy imports from Russia. What the data is telling us is that the euro area is not suffering as much as feared from the energy shock so far this winter and there is now an upward bias on growth forecasts for 2022. However, it does not detract from a challenged 2023 and the probability of a recession in the region.

- China is facing some difficulties as protests against the restrictive Covid policy sweeps through the major cities. We do not know how extreme this will become but it does provide a further hurdle for the Chinese economy. On the positive side the property sector is getting some relief with the Peoples Bank cutting the Reserve Ratio by 0.25% and instructing the banking system to give some support to property developers. Troubled times continue for China.

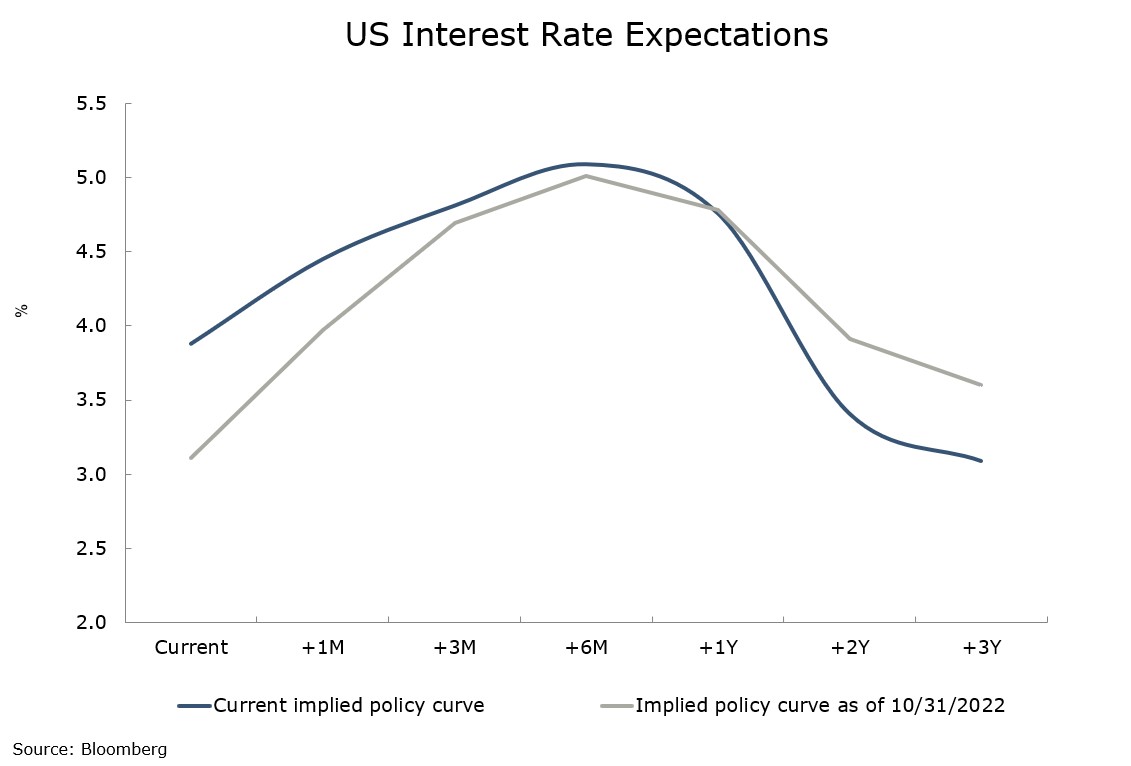

Chart of the week: Enough for now?

This month there has been an adjustment to interest rate expectations in the US and this has been the driver of better bond and equity markets this month. In the chart above, we map out the current Fed Funds forecasts in one month’s time out to 3 years’ time and where these forecasts were at the end of October. As we can see, there has been no change to where the market expects the Fed Funds to peak but it now expects interest rates to be cut by 2% in 2024. Inflation could get there but it looks difficult to be more optimistic than that.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |