What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help you preserve and grow your wealth.

Market views

- Market performances were dominated by the release of the CPI data in the US. For the first time since Q2 there was a decline in inflation readings which was also lower than expected. What buoyed market sentiment most was the drop (-0.4% month-on-month) in Goods prices. World equities were up 5.1% but a decline in the $US brought this down to 2.2%. Bond markets were also buoyant, the Euro Agg Index delivered over 1% over the week. The Pacific Basin was the strongest region as hopes were raised again about an easing in Covid policy in China and supports were announced to get outstanding property developments completed. A short term boost but we would be cautious about the durability of the rally in the region.

- In fixed income markets corporates did slightly better than the sovereign market as risk aversion dropped during the rally. In equity markets, the sectors that had been weakest in the recent past were the ones that led last week (IT and Communications). Defensive sectors and Energy were weaker.

- We were expecting inflationary pressures to ease and this would be a boost to both equities and bonds. We would caution that it is one data release, so we need to see this become a trend. The other element that is needed is some softening in the growth data in the US. The changes in GDP forecasts indicates we should be getting these. If this happens, both bonds and equities should get another boost.

Macro views

- The US mid-term elections are going in a very market friendly direction. Markets feared a one-party sweep and this has not happened. Democrats will control the Senate and the indications are that the House of Representatives will be held by the Republicans but with quite a slim majority. Consequently at a policy level, gridlock looks like the outcome which will please the markets. A split Congress probably makes the debate about raising the debt ceiling, due next year, less confrontational which will also please markets.

- Data released in the euro area was again better than expected with retail sales rising in the month of September whole Industrial Production in Germany also rose in the month of September despite the energy constraints. The recent data releases indicate that the euro area economy is a little bit more resilient in the short-term, GDP growth forecasts for 2022 have been increased. However, looking out to 2023 the outlook remains bleak for the region due to tighter financial conditions and constrained energy markets.

- China remains gripped in its stop-go path due to continual outbreaks of Covid. Vaccination levels are still low in the population and there are concerns that the health service would not be able to cope with a widespread outbreak. The Chinese market has been out of favour this year and with the persistence of Covid outbreaks, it does not look like this will change.

Chart of the week: Has the turn arrived

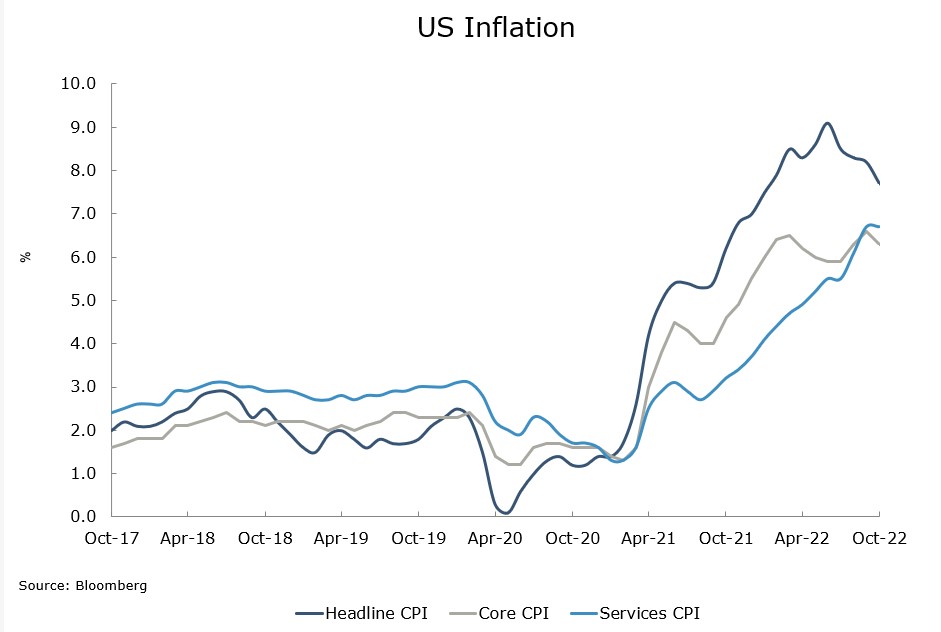

The release of the CPI data in the US showed a drop in the year-on-year rate at both the headline and the core level. This is not the first time inflation has decelerated in the US so one remains somewhat cautious. However, there are some signs that we may have passed the peak. Firstly, headline inflation has been coming down for a number of months as the impact of higher commodity prices is now passing. The other sign is the flattening in Services inflation. This is the last component of inflation to turn. Goods inflation was negative month-on-month. It is still early to call whether we have hit the peak in Services inflation but at least we now have an indication it may have happened.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |