What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help you preserve and grow your wealth.

Market views

- The Federal Reserve took the lead last week in central bank announcements. As expected, it raised the policy rate by 0.75% to 4.0%. The comments afterwards however were what spooked markets as there had been hope that Chair Powell would signal that the pace of increases will decline and/or a pause is within the forecast horizon. He dashed hopes on both fronts. The FOMC (the interest rate setting body of the Federal Reserve) expects interest rates to go higher than it thought last month and ‘it is very premature to talk about pausing’.

- The UK was in the news again this week but with little ‘fireworks’. The Bank of England held it policy setting meeting and as expected, raised interest rates by 0.75%. The comments in the minutes were somewhat softer in tone than expected. The minutes seemed to be suggest that interest rates will peak closer to 4% rather than the 5% level that is priced into markets at the moment. This is quite a different outcome to what looked likely a month ago. The UK is back on an even course.

- Market sentiment turned somewhat sour as the Federal Reserve indicated no change in thinking. Euro area bonds and World Equities were both down just over 1% but rallied at the end of the week as the Jobs report included a rise in the unemployment rate. We remain fully invested as we believe we will get more evidence of a slowing in the US economy which will allow interest rate expectations to decline, boosting both bond and equity markets.

Macro views

- It was a busy week for data in the US. First, we had the ISM surveys which still showed a resilient economy. The Manufacturing Survey remained above 50, indicating continued expansion. The weak parts of the survey were the areas we would like to see: a large drop in the delivery index (improving supply chains) and the pricing index. The Services index did show a meaningful dip but at 54.4, it is still well into expansionary territory. Not enough here to shift the thinking of the Federal Reserve.

- The other big item from the US was the jobs report. All eyes are on this to show some softening in the labour market which would give the Federal Reserve the opportunity to soften its tone. It turned out to be a mixed report. The non-Farm Payrolls were stronger than expected but the Household Survey had fewer jobs created and showed a rise in the unemployment rate. We have to wait for another month to see which is giving the right trend.

- The newsflow from elsewhere around the world indicates loss of momentum but not extreme. China surprised the most with the PMI surveys (measuring business conditions) remaining below 50 for both large and small enterprises albeit a small gap of one to two points. There had been some hope that there would be some reopening boost, but the sporadic lockdowns still seem to be causing dislocations and thus the managing of the Covid pandemic remains a big influence on China’s economic performance.

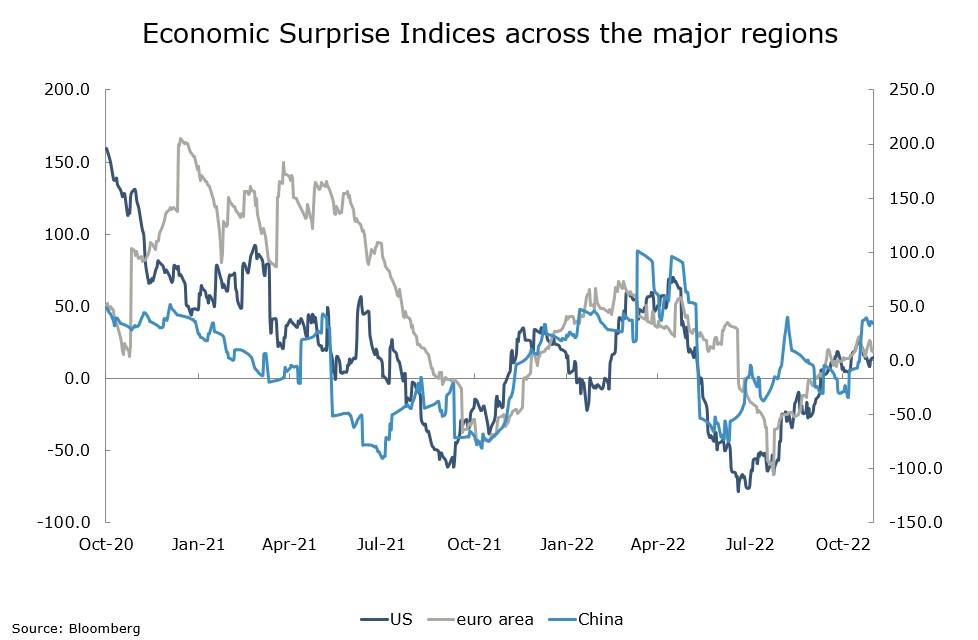

Chart of the week: Too strong??

The outlook for central bank policy across the developed world is the main focus of both equity and bond markets. They corrected last week as the Federal Reserve failed to indicate any change in thinking. Part of the reason for this is that economies are not showing any great growth stress at the moment. Forecast growth rates have been declining but economies have not been slowing as quickly as the forecasts imply. That is why in the chart above the Economic Surprise Indices have moved above zero (the actual data is better than forecast). While that continues, it is difficult for central banks to change their tone. Should these start to decline, we may see some change in central bank commentary.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |