What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- World equities rose about 2% in local currency terms last week. A weak oil price, benign economic releases and talk of further policy support in China bolstered confidence in the global economy.

- The most battered sectors – IT, Communication Services and Consumer Discretionary – led the rebound. For Consumer Discretionary, it resembled a relief rally rather than a change in trend. The IT sector’s performance will depend on results season; results from Samsung helped last week.

- Bond yields were up, but 10-year yields have moved down by 50bps in less than two weeks – and so, some consolidation is to be expected.

- Central bank watching remains the favourite pastime for financial markets. Last week, the minutes were released from the recent European Central Bank (ECB) and Federal Reserve (Fed) policy meetings. Both central banks are focussed on curbing inflation, but the ECB is split on the speed at which policy should be tightened due to the uncertainties that surround the economy. Conversely, the Fed was unanimous in moving fast to a restrictive stance. The net impact was little change to interest rate expectations in the euro area and the US.

- The UK will be getting a new Prime Minister most likely by September. We wait to see what fiscal policy will be like under the new leadership and how the Bank of England will respond to it. We are some distance from being able to answer those questions, but since Boris Johnson’s resignation, the market reaction has been moderately favourable, and sterling strengthened.

Macro views

- Data releases were slightly more benign last week. In the euro area, retail sales rose modestly in May, although excluding food and energy, it recouped all of the losses from the previous month. Retail sales growth was expected to come under pressure as the reopening gathered momentum and people switched to consuming services. And so, a flat outcome for retail in Q2 would not be a disaster.

- The reopening impact is also coming through in the US. The ISM non-manufacturing survey was released last week and showed a marginal decline from the previous month’s reading, slipping from 55.9 in May to 55.3 in June. Consumption is switching from goods to services, pulling down the Manufacturing ISM but leaving the non-manufacturing virtually unchanged.

- Meanwhile, the jobs report for the US (non-Farm Payrolls) was strong. 372,000 jobs were created in June, beating forecasts of 265,000. With this type of performance from the labour market, a recession seems far away.

- There was some optimism coming from China as expectations rose about further fiscal measures. It looks like there will be additional infrastructure spending as well as talk of incentives for consumers to purchase electric cars. China is going through a rebound as the lockdowns are removed but this faded as we went through Q4 and, without some measures, it was unlikely that the government’s growth target would be achieved. It looks like we will be getting some of these measures now.

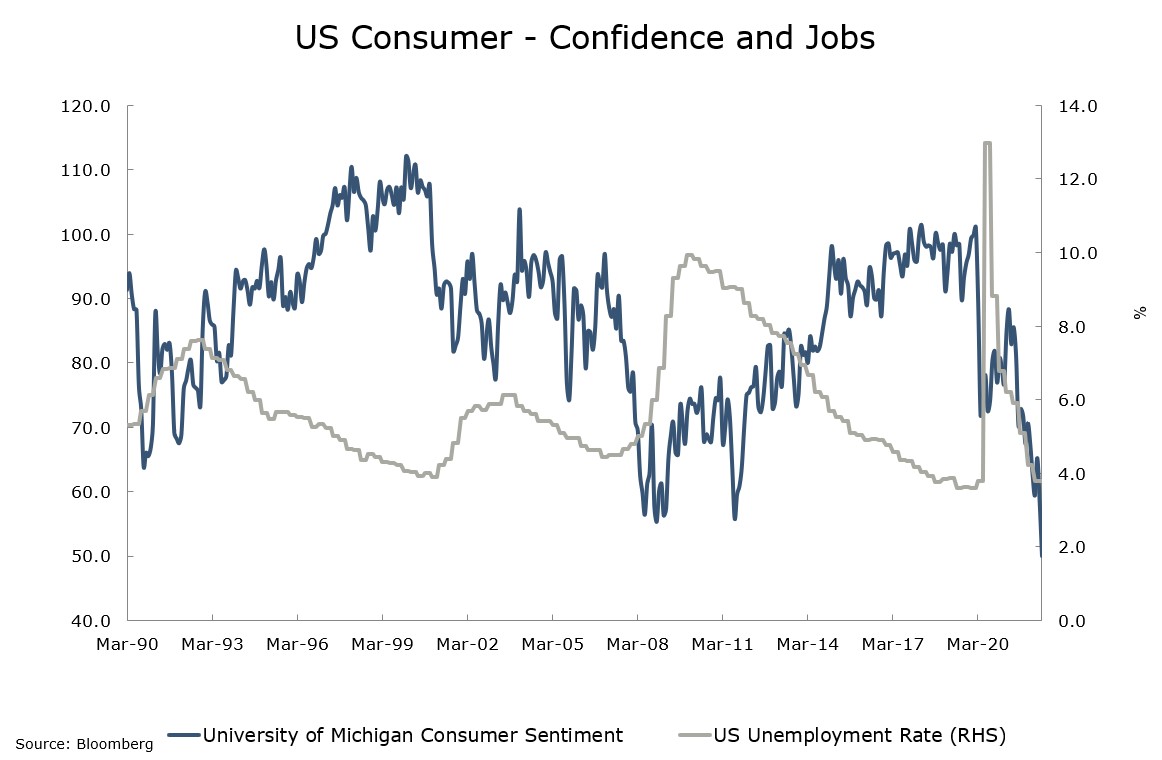

Chart of the week: US consumer confidence and unemployment rate at multi-decade lows

As we pointed out in last week’s Market Pulse, a major element of the recession fears that have arisen is the outlook for the US consumer. Consumer confidence, as measured by the University of Michigan, has hit a multi-decade low and the unemployment rate is moving towards a multi-decade low. This is most unusual; normally, if the unemployment rate is falling, then consumer confidence starts rising. This has not been happening because of higher prices, in particular oil. A drop in prices would lead to a sharp rebound in confidence.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |