What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- A very volatile week in financial markets, with both bonds and equities down during the week. The strong inflation figure from the US was the primary driver but it was added to by strong growth figures in the US (retail sales and consumer sentiment were both ahead of expectations). The Fed Funds rate is now expected to rise to 5.0%. In some ways, it is surprising that financial markets were not weaker. Perhaps much of the bad news is priced in.

- A positive during the week was a recovery in UK assets and currency. The 10-year yield was down 0.25% last week and almost 0.5% from last week’s highs. A new Chancellor and a reversal of some of the proposed fiscal changes have provided some calm to UK markets. But, as we have said previously, this is an evolving story – and that remains the case. Policy and political uncertainty are still very high. We have to see what the government’s mid-term plan is now and then what the Bank of England makes of it all.

- As we pointed out above, there has been a significant increase in interest rates, and the bond markets are providing value now. Equity markets were also under pressure but the third quarter results season, which is just starting, could provide some relief. Some of the major US banks reported last week, beating expectations and leading to earnings upgrades. If this continues, then equity markets should recover some ground.

Macro views

- All eyes were on the release of US CPI data last week. It was a strong figure with the core rate going to a new high for this year of 6.6%. While goods prices did not change on the month, this was more than compensated by stronger figures from rental and accommodation costs in particular. The CPI data along with the robust payrolls number released the previous week means there is unlikely to be any let-up from the Federal Reserve in the near future.

- In the euro area, the monthly reading on Industrial Production showed that the headline figure was very strong, up 1.5% month-on-month. However, this was flattered by a very strong performance in Ireland which also tends to be very volatile due to the impact of the export sector. Excluding Ireland, the rise was a modest 0.4% – a bit lower than expected. All of the weakness was concentrated in Germany, particularly the energy intensive industries. Most other countries (in particular France and Italy) were better than forecast. Economic growth forecasts have been coming down for the region – and this release suggests that is the right thing to do. However, there will be some relief that the economy is not shuddering to a stop.

- In China, the Caxin Services PMI was weak, dropping back below 50. China is just coming back from its Golden Week holiday – and that’s normally good for travel and consumer spending and, in turn, for the Services PMI. But recurring bouts of Covid outbreaks has reduced mobility and subdued the consumer putting a question mark over China’s economic performance. The statement from President Xi, at the Party Congress, that the Covid policy will remain in place adds to the pressure on consumption.

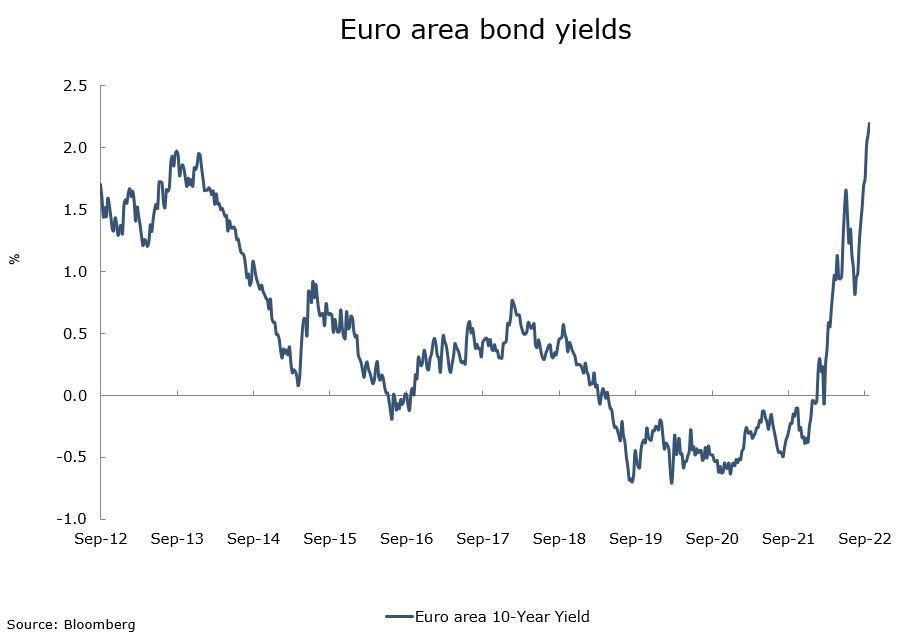

Chart of the week: increasing our exposure to fixed income again

As we have been saying over the last number of weeks the changes in interest rate expectations have had a dramatic effect on all asset markets. In the euro area, there has been another dramatic increase in yields across the bond market. We started the year with a negative view of bond markets and a light positioning in them. We have been increasing our exposure as yields have been rising. This week, we are increasing our exposure. Yields are reflecting the higher interest rate expectations, which could decline, and they are providing an opportunity to add some positive return to our portfolios.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |