What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

Minutes of the March FOMC (interest rate setting committee of the Federal Reserve) were released last week. The policy rate was increased by 0.25% but it was a close call. Many members were inclined to increase rates due to the stronger growth data until the news of the bank failures. Some thought that tighter financing conditions following Silicon Valley and Signature Bank could mean there was no need to raise rates. In the end, the policy rate was increased even with the Federal Reserve’s economic forecasts assuming a mild recession this year in the US.

Some of the largest US banks reported Q1 2023 results late last week. The smaller banks that are more exposed to recent issues will report over the next few weeks. The large banks’ Q1 2023 earnings are up ~40% year-over-year and are ~15% ahead of forecasts mainly due to higher interest rates, which boosted net interest income more than anticipated. As expected, management outlooks are cautious, but sanguine. Interest rates will continue to boost revenue through 2023, with large guidance upgrades for some. Future moves from the Federal Reserve and deposit competition remain significant risk factors. Credit quality has remained strong but is expected to deteriorate; all the banks have added provisions to reflect this. There are clouds on the horizon, but the banks seem well positioned to weather the issues and known risks appear well discounted in current low valuations.

Some confidence is returning to financial markets, but it remains tentative. In the euro area, fixed income market yields have risen a little this month and investment grade is outperforming sovereign. In equity markets the shift is more defensive. Energy is the best performing sector post the surprise output cuts from OPEC+. Financials have recovered this month after the results from the US banks. In third place is defensive sectors (Healthcare, Utilities, Consumer Staples). We expect these to be the dominant sectors until we get clear evidence that the global economy is heading back towards trend.

Macro views

US inflation reports held some surprises. On the positive side headline Consumer Price inflation dropped much more than expected, from 6.0% year-on-year to 5.0%, as energy price declines accelerated. On the negative side, the core rate rose on a year-on-year basis but not more than expected, which gave some relief. Producer prices came in lower than expected at core and headline which is some evidence of easing inflationary pressures.

A lot of growth data was released in the US over the last couple of weeks. The Non-Farm Payrolls figures was in line with expectations although the unemployment rate dropped, which was a surprise. The labour market remains robust and probably too tight for the Federal Reserve’s liking. Retail Sales and Industrial Production softened from a very strong January report but less than was expected. The US economy remains stronger than forecast in the first quarter.

Elsewhere in the world growth data was mixed. In the euro area, Retail Sales for February were weak declining 0.58% month-on-month. Slower motor sales were a large component of this so underlying consumption is more robust. Export figures from China for March were very strong. Some of this is due to production picking up as the Covid restrictions were lifted but also due to stronger overseas demand.

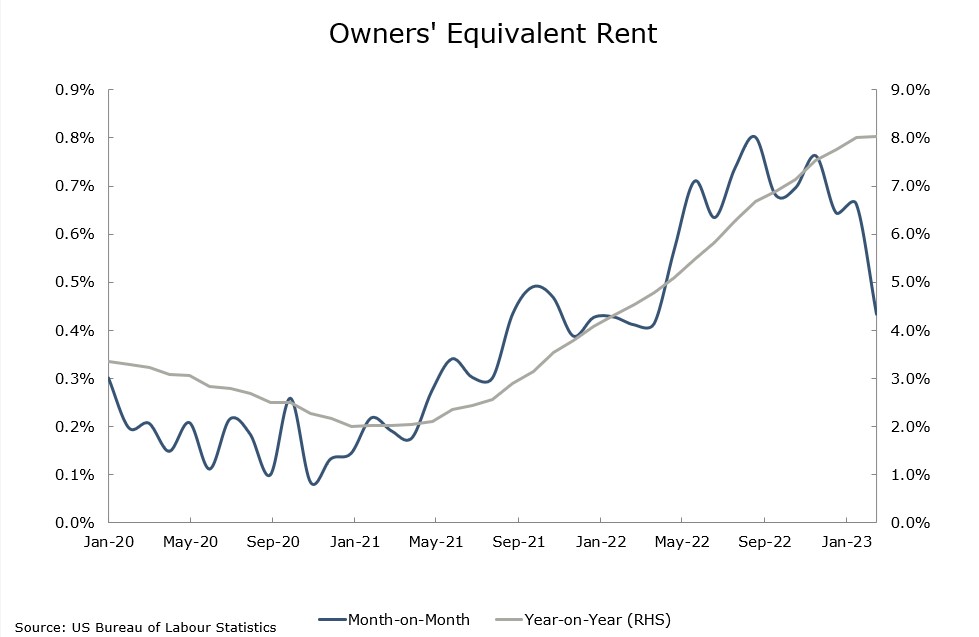

Chart of the week: A bright spot

Much of the CPI report from the US last week was in-line with expectations but there were some interesting points in it. Core inflation has been ‘stickier’ than people expected and a major component of this has been Owners’ Equivalent Rent (a measure of the cost of housing for the individual) which accounts for over 20% of CPI. March was the first time since mid-2021 that this did not rise on a year-on-year basis. As you can see from the chart, it has been decelerating on a month-on-month basis since the end of 2022 and this should now start to pull down the annual rate.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |