What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Central banks led markets down last week. At its monthly meeting, the Federal Reserve (Fed) raised rates by 75bps, a move Chair Powell said was unlikely after the previous meeting. It has left the option of raising rates by 75bps at future meetings, although it said adjustments of that magnitude would be unusual and a 50bp move is the more likely outcome.

- The Bank of England raised rates by 25bps and is preparing us for a 50bp hike at the August meeting. The rhetoric has changed. Previously it was concerned about the growth implications of any rate rise but now it must act ‘forcefully’ to control inflation. The European Central Bank (ECB) provided some relief as it held an ‘ad-hoc’ meeting ‘to exchange views’. It outlined measures to avoid disorderly moves in parts of the euro area fixed income market (so called fragmentation). Details are still scant, but its message was: it will act to avoid fragmentation.

- It has been a torrid period in markets as central banks across the developed world increase their target levels of interest rates. On the positive side, these levels are now close to where market expectations are so further moves now become data dependent. We believe that inflation data should start improving from here which should lead to a stabilisation in interest rate forecasts, which should be good for the bond markets.

- Equity markets have de-rated significantly this year and the historic multiple for world equities is now 12% below the median since 2000, so earnings sentiment is poor. Meanwhile, the global economy is proving resilient in the face of the challenges being put to it. Forecasts are coming down, but they remain at respectable levels, so the current fears seem overdone.

Macro views

- Leading on the data front last week was China, where we got further evidence of a strong bounce back in activity after the easing of lockdowns in May. Industrial production was up 3.2% month-on-month and retail sales jumped 3.6% although most of this is concentrated in the goods sector. As we have said before, strong output figures from China are not only good for the local economy but also destressing for global supply chains.

- The euro area was middle of the pack: industrial production (excluding the volatile construction sector) was 1.2% month-on-month despite the ongoing disruptions from the war in Ukraine. This is a very resilient performance from the region – we will wait to see if consumer data follows suit.

- For the inflation watchers in the euro area, there was some relatively benign news. IG Metal, one of the large German unions, settled for a two-year wage increase of close to 3% per annum, which is quite low given the level of inflation and it dampens fears of a wage price spiral beginning.

- The US was the weak spot during the week. Core retail sales were flat month-on-month but were still up 8% year-on year. There were downward revisions to the previous month. While the re-opening of the economy has helped service demand, goods consumption is stalling. We would not expect any forecast changes due to the release.

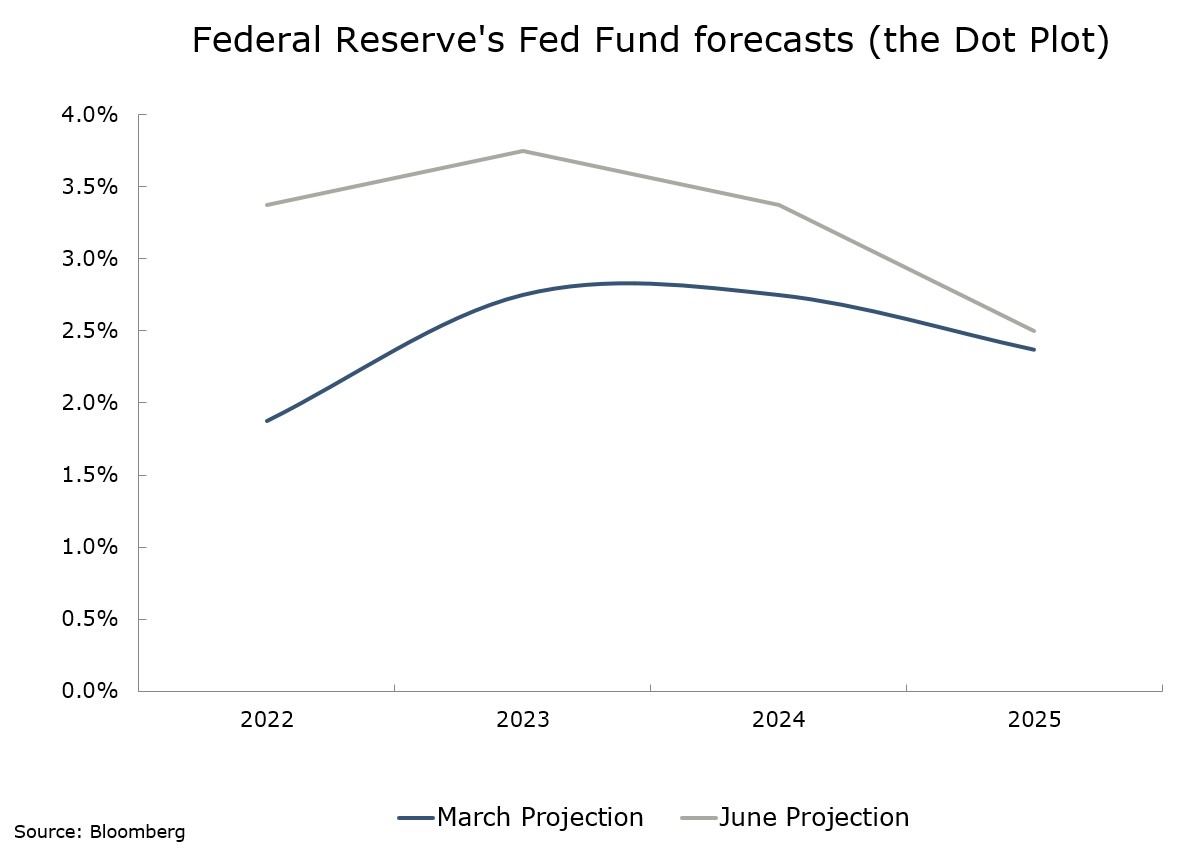

Chart of the week: Fed projections have moved a long way

As part of the FOMC meeting last week, there was an update on where Committee members expect the Fed Funds rate to go to over the next couple of years (the ‘Dot Plot’). Since the last release in March, expectations for this year have moved up by 1.5% and for next year by 1%. Over the period, the Fed Funds future for 2023 (the markets expectations) have changed little, remaining at 3.5% so the Fed now looks like it is ‘on top of the curve’. Thus, we could now be reaching the point of maximum ‘hawkishness’ from the Fed.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |