What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- It was a recovery week for financial markets as more evidence came through of a cooling in the US economy. Last week, lower than expected inflation spurred things. US fixed income markets led the recovery with the 10-year yield down 30bps, shorter maturity yields fell even more. Better news on inflation increases the likelihood that, whether there is one or two further interest rate hikes in the US, that will be the end of them. However, it gives no clue as to how long higher rates will stay.

- Equity markets followed the fixed income lead, although it was the one which fell the most (the euro area) which bounced the hardest. Sectoral leadership moved back towards the cyclical sectors as belief in a soft landing increased. However, if there is a cooling in the US economy there could be a preference for defensive sectors. A low growth/low inflation combination (à la the 1990s) is not a good mix for cyclical sectors.

- The second quarter earnings season has started and last Friday the major banks reported. They were better than expected partly due to improved net interest income as customers switched to quality banks post the regional bank failures in March. However, the share prices were little changed on the day despite the good results. Sentiment is high going into this result season so a strong outcome may just keep the equity market where it is rather than drive it further.

Macro views

- US inflation took centre stage with releases of the Consumer Price Index (CPI) and Producer Price Index (PPI) for June. The CPI was the important one and there was a welcome step down in the annualised rate of inflation. At the core level it dropped to 4.8% from 5.3% last month. Much of the surprise came from the more volatile elements (car prices and airfares) but it was still welcome. The PPI was also a positive report. Core PPI inflation dropped to 2.6% year-on-year (it reached a high of 7.1%) and the headline is now flat on a year-on-year basis. Goods inflation does look under control.

- Staying in the US, the University of Michigan Survey of Consumer Sentiment was published. The index bounced hard in the month of June, jumping over 8 points to 72.6. It was also well ahead of the forecast level of 65.5 and the highest level since September 2021. This indicates a consumer in good health which could leave the Federal Reserve fretting over a ‘hot’ economy.

- News flow from China continues to underwhelm. Last week trade data was worse than expected with both imports and exports down year-on-year. Weakness in exports indicates continued soft demand, globally, and declining imports indicate a weakening domestic economy. GDP for the second quarter released this morning was also lower than expected. The government may have to introduce some sort of stimulus package to halt the deceleration.

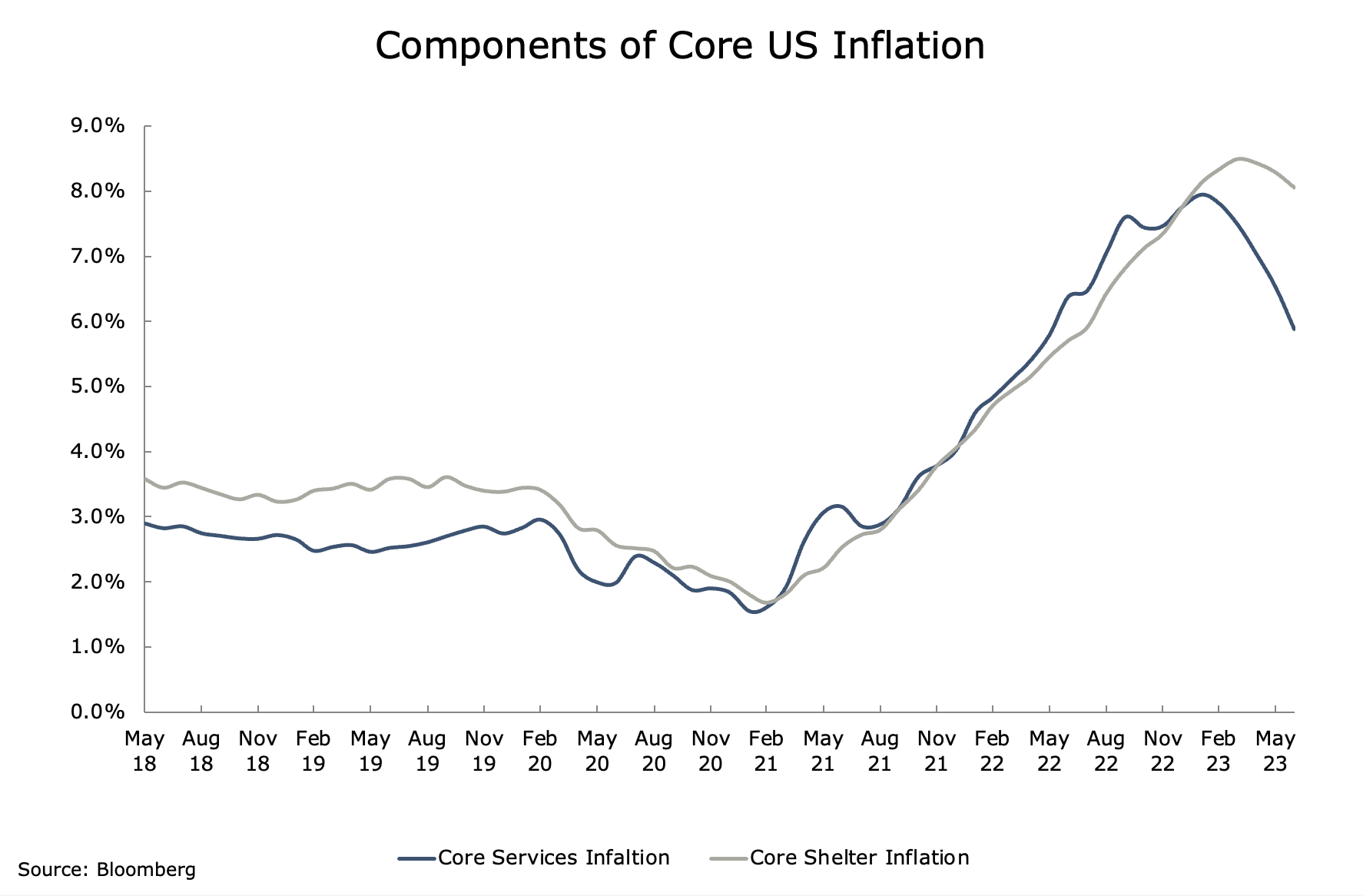

Chart of the week: A step in the right direction but still more to do

The Consumer Price Index report from the US brought relief to financial markets but one should be wary about reading too much into it. A lot of the undershoot in June’s figure was due to volatile parts of the index. The chart above shows some of the movement in the index’s more stable parts. There has been a good step down in core services inflation, but it is still well above target levels. Shelter is only ‘gliding’ down. The fact that they are now declining probably means we are close to the peak in interest rate, but they must decline by quite a lot before interest rates cuts can be considered.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |