What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Bond markets consolidated somewhat over the last week. On the positive side, there is a lower level of issuance than feared a month ago. There is also the theme that financial conditions had tightened to such an extent that the Federal Reserve (Fed) does not need to take any further action. However, there is a limit: as bond yields fall, financial conditions loosen, putting the Fed back on guard. The 10-year yield in the US has fallen nearly 40bps from the recent high, that is probably enough for now.

- Fed Chair Jerome Powell spoke last week about the Fed having to remain vigilant. A tightening bias is still in place. He acknowledged that progress had been made on inflation but there was a “long way to go”. The labour market is moving “into better balance” but remains narrow. He did not talk about tight financial conditions, so there is more reason to turn cautious on bond markets in the short term.

- Equity markets were up last week but all of this came from the mega-caps, equal-weighted indices were down. There is a move towards the cyclical sectors and away from sensitive bond yields. There was some profit making in the Utility and Property sectors. IT and Communication Services were the leading sectors but if bond yields start rising again these sectors will be undermined. In the short-term, consolidation looks likely for equity markets.

Macro views

- Data from the euro area still portrays a weak economic background in the region. Retail sales for September were in line with expectations but are declining down 0.3% month-on-month and are down 2.0% quarter-on-quarter. This is surprising given that wage growth is strong and the big drops in headline inflation have given a further boost to real incomes. The consumer seems unduly cautious in the euro area which does not bode well for growth in the region next year.

- China released its trade data for October last week which gave mixed messages. Exports were weaker than expected, -2.6% month-on-month, but imports were very strong jumping 8.4% month-on-month. We felt that economic momentum was probably levelling off in China and thus we would get some strong and some weak data, which is reflected in the trade data. Indeed strong imports suggests domestic demand is healthy.

- We have almost come to the end of the reporting season. In the US, it has been strong with earnings coming in 6% better than expected. The main negative coming from the reporting season in the US is the change in guidance from companies. More companies are increasing guidance then cutting it but the gap is one of the lowest over the last 10 years. In the euro area, it is a more subdued reporting season: earnings are 1% ahead of expectations but sales growth is weak, 5% lower than forecast.

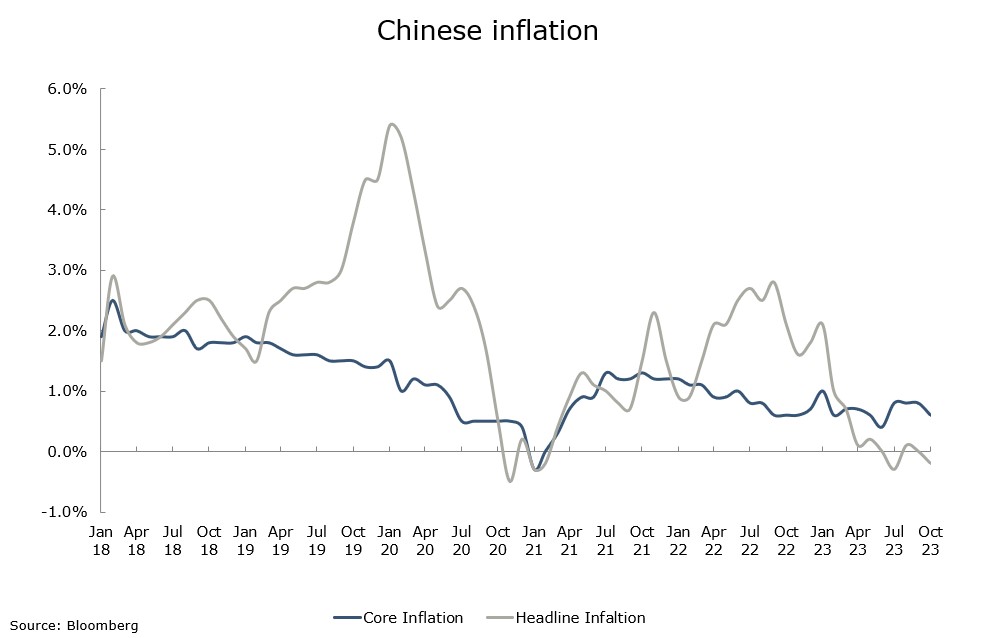

Chart of the week: Watch out?

As the developed world strives to bring inflation under control, China grapples with the opposite problem: how to avoid deflation. At the headline, deflation has returned. At the core level, the news is a little bit better, but it is also uncomfortably close to deflation. Why is this important? If China wants to avoid what happened to Japan it needs to ensure it does not sink into deflation. It has some of the characteristics of Japan in the early nineties (aging problem, high level of personal debt, over reliance on the property market) which will depress the economy if deflation arrives. The lines in this chart need to be moving upwards.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |