As recession fears mount, many clients and prospective clients are asking us: when should I start my investment journey given the elevated risk of a recession in the near term?

In recent weeks, recession fears have gripped markets: the latest red-hot US inflation reading stoked fears about further aggressive interest rate rises, China released weak economic data, the economic outlook in Europe has darkened amid the ongoing war in Ukraine and oil prices have tumbled.

But, as we mentioned in our latest edition of Wealth Matters, we believe the volatility experienced in the first half of the year should not deter investors from their strategic course.

Nevertheless, during periods of heightened stock market volatility, it’s human nature to be concerned. And so, many of our clients and prospective clients are asking us: when should I start my investment journey given the elevated risk of a recession in the near term? Will long-term returns be materially affected by the timing of my entry into markets?

Time, not timing, is what matters

If experience tells us anything, it’s that investing really is all about time in the market, not timing the market.

Let me explain. Using the definition and timing of recessions by the National Bureau of Economic Research in Washington, we’ve analysed US market data extensively. It shows that there were six recessions since 1970, excluding the Covid-induced recession in 2020. We’ve used these periods to evaluate equity and fixed income market performance.

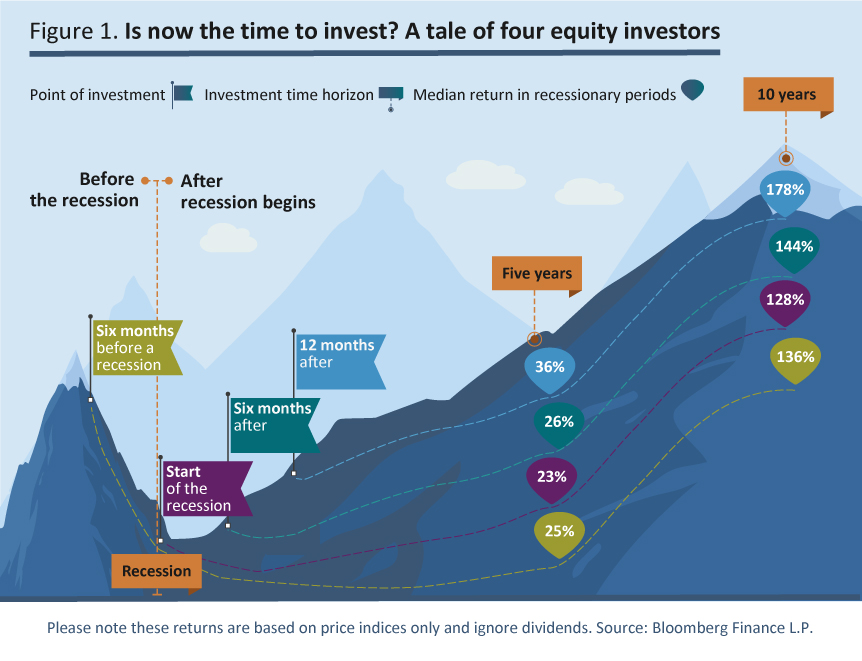

In Figure 1, we show some stylised scenarios for the S&P500, assuming four investors decide to invest at different starting points – six months before the onset of the recession, at the onset of the recession, six months after the recession began and 12 months after the start of the recession. All investors have the same investment end date.

Let time be your friend

Figure 1 demonstrates that even though all investors invested around the time of a recession, the returns they generated over a long-term time horizon are significantly positive.

By staying fully invested for five years since the onset of a recession, you would have earned a median return of 22.9%. Across a 10-year time horizon, you would have achieved a median return of 128%. Choosing to invest six months after the onset of a recession would have generated returns of 26% and 144% over a four- and nine-year time horizon, respectively.

So, the performance different across the various investment points is not enormous. If you can, spreading your entry points during the recessionary period is a sensible strategy.

The scenario above assumes a recession will begin in six months’ time, but what if it doesn’t? The performance of the S&P500 in the first six months of 2022 is unusual: since 1930, there have only been five such instances where the S&P500 declined more than 15% in the first half of the calendar year. The median decline in those periods was 20% and the median return in the second half of the year +15%. If we avoid recession, history suggests a significant rebound is possible.

So, this suggests you shouldn’t attempt to wait to invest 12 months after the onset of a possible recession because it may never occur, and even if it does, the advantage to waiting is not so large over five years.

What about fixed income?

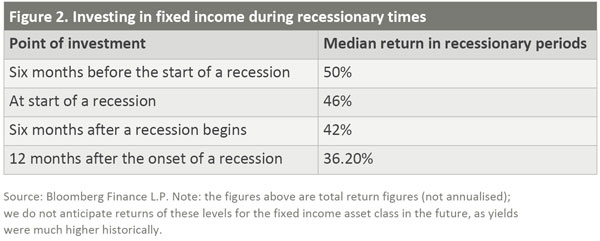

When it comes to fixed income investing, our analysis – as depicted in Figure 2 – shows that entering the market ahead of a recession delivers a higher return in the long term. However, the performance difference across various time periods is not huge. Looking at the US fixed income market for the same time periods as above, the best time to invest was when a recession was approaching i.e., six months before a recession starts. The five-year returns are lower the later you invest but much of this is due to less income due to shorter holding periods rather than movement in bond prices.

Stay focused and stay invested

For many, investing is about helping you achieve what you want out of life. Often, that’s a comfortable retirement, ensuring your children are financially secure, or providing for future generations. These are long term goals, for which we need time in the market.

Right now, markets are on recession watch – and the uncertainty may unnerve many investors. But as our analysis shows starting your investment journey – or staying invested – during recessionary times can serve investors well.

What’s more, spreading out your equity investments across time and starting your investment journey when there is an elevated chance of a recession makes sense. Afterall, a recession may never come to pass!

This is a marketing communication.