What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- The good mood continues in financial markets, euro area fixed income has returned nearly 2% this month and world equities are up over 4% in euro terms (nearly 7% in local currency terms). On the positive side, the retail sales report (see comment below) painted a picture of a cooling economy but still registering a respectable level of growth. The oil price is down over 5% this month, easing inflation pressures and boosting disposable income. Lastly, the US avoided a government shutdown as Congress agreed another temporary spending plan.

- One of the props for bond markets over the last few weeks has been the theme that rising bond yields had completed the required monetary tightening and the US Federal Reserve would not have to do any more. We always said there was a limit to how far that theme could push the market. Last week, two of the Federal Governors expressed fear that bond markets were now getting ahead of themselves and that it is not certain that current policy will get inflation back to 2%. Perhaps the bond market should pause now.

- Equity markets followed the bond market’s lead and is also starting to look at only the good things and ignoring any problems out there. It feels like the equity market believes next year will be a ’Goldilocks’ outcome for the US, inflation cooling sufficiently to allow interest rate cuts but growth remaining high enough to deliver double digit earnings. That may come to pass, but it is a leap of faith at the moment.

Macro views

- Inflation data from the US dominated the headlines. The consumer price index came in 0.1% lower month-on-month than expected, at both the headline and core level. To add to the positive sentiment, the weakest was in services inflation, which has been the stickiest part of inflation. The optimism on cooling inflation got further support from the Producer Price Index report which also came in below expectations. Headline inflation is just above 1% year-on-year and core inflation is at 2.4%, both close to the levels of the 2010s.

- Everyone was expecting some softness in the US Retail Sales Report for October after a surge in September. However, core retail sales were up 0.2% month-on-month, a softening but it is still showing good momentum. With a holiday period coming up, US consumption is bound to remain firm. The industrial production report was weak. During the month, industrial output rose 0.1% for ex-motors and has been close to flat over the last six months but output is distorted by strikes. While contraction has stopped, the manufacturing sector remains somewhat moribund.

- In the challenged regions of the world the news flow remains downbeat. Industrial production in the euro area dropped month-on-month over 1% and down nearly 5% quarter-on-quarter on an annualised basis. Even the motor industry which had got back into recovery mode slumped in the month. A weaker China and weak euro area consumer is weighing on the sector. Another month of falling house prices in China did not help. These need to stabilise to shore up consumer confidence.

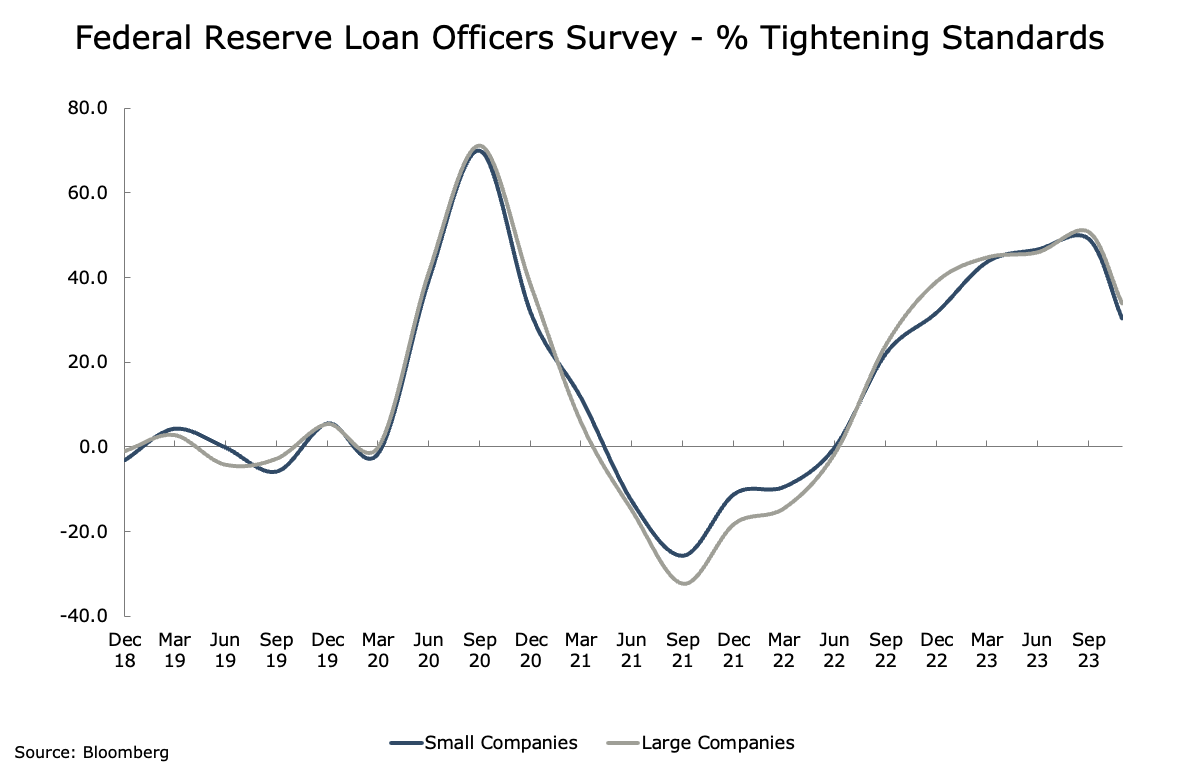

Chart of the week: Some chinks of light

One of our concerns looking ahead to 2024 about the US economy is the delayed impact of rising interest rates that have been implemented. Tighter lending standards from banks leads to lower lending growth and ultimately a slower economy. In the chart above, you can see that lending standards started to tighten as the Federal Reserve raised interest rates. The last reading gave some relief with noticeable easing for both large and small companies, however it is still high, and does not bode well for lending growth. Perhaps we have passed the worst.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |