In the five months since we published our 2022-2026 investment outlook much has changed. Russia’s invasion of Ukraine has clouded the investment outlook, adding to inflation and interest rate concerns, and, against this backdrop of increased uncertainty, some of our assumptions have changed. Yet, some of the key themes we discussed in December and during our investment update call in March – such as inflation and slowing growth – continue to dominate news flow.

Here we tackle six key questions about our investment outlook.

1. How has our global economic outlook evolved since the start of the year?

Our theme for our 2022-2026 investment outlook was Lower returns and higher volatility ahead? We expected global growth to moderate in 2022 but remain above trend. Today, a confluence of factors are driving downward momentum on global growth forecasts and impacting the regions in different ways:

- The euro area is being hardest hit by Russia’s invasion of Ukraine, particularly through the energy channel.

- US growth forecasts have evolved, with the biggest change to 2023 forecasts rather than 2022, as the impact of Federal Reserve (Fed) tightening impacts with a time lag.

- China’s reaction to the spread of COVID – further restrictions and lockdowns in major cities, such as Shanghai, as well as its zero-COVID policy – will cause short-term issues for the country as well as globally.

As a result, consensus global growth forecasts have now been cut to about 3.5% for this year – but we think there’s further downside risks because of these factors.

From a markets perspective, the biggest change we’ve seen to the outlook since the start of the year is in relation to interest rate dynamics. There’s been significant changes in the opinions of the markets in terms of how far interest rates will rise. This has been a significant drag on both equity and bond markets.

2. Inflation remains a dominant theme – how have the views on inflation dynamics evolved?

Coming into 2022, we feared inflation would be the biggest theme – and it remains so. However, the views on inflation dynamics have evolved significantly. From Q2 2021, we discussed how inflation was becoming more embedded but central bankers were slow in coming to that conclusion. Of course, they have now clearly concluded that inflation will not be transitory unless they act swiftly against it.

There are some transitory factors, such as the supply chain issues that we have been experiencing in the global economy because of the pandemic. But there are underlying inflation issues as well. For example, in the US wage inflation is picking up very strongly at 6% or so. Underlying inflation pressures and core inflation pressures in the US economy are well above targets – and central banks need to be concerned about this. While it is less so the case in the euro area, it is still somewhat concerning.

So, inflation is more embedded than we thought – and that’s what central bankers are going to tackle in the coming months.

3. Has the likelihood of a recession increased?

Yes, the probability of a recession has increased. It’s still a relatively low probability, but there’s no doubt some of the factors we’ve mentioned above, and particularly the force with which central banks are going to fight against inflation expectations certainly do raise the risk of a recession – and that’s reflected in our change in equity view moving to a more neutral position (which we’ll get to in question four).

4. How has our asset allocation changed?

Since our March investment update call, equity markets have returned nearly 5% in euro terms, while at the same time, bond markets have struggled. The big change over this period came from central banks: there was more aggressive language from the Fed and the expectations about the number, speed and the ultimate end point of interest rates in the US and to a lesser extent the euro area have continually increased over the last month as central banks became more focused on controlling inflation.

And so, given the different performances between the asset classes, we decided to reduce our equity weighting to a neutral position (for more detailed commentary on our recent asset allocation changes, click here to read Top Down). We are not turning negative, but we believe equities are less attractive than they were previously given the heightened uncertainty.

For context, we expected to move to a neutral position in equities in the middle of this year but with the earnings cycle maturing faster than we expected, we have arrived at this position earlier than anticipated.

Regionally, we reduced our exposure to the euro area owing to short-term headwinds this year, particularly the conflict in Ukraine, but also due to lingering long-term concerns. One longer term implication of Russia’s invasion of Ukraine is that the euro area will have to spend more on physical and energy security. This will boost growth as it happens but may also cause a drag on the potential growth rate as it is less-productive spending thereby reducing the longer-term attraction of the region. On balance, we remain somewhat overweight the euro area and it still has a relatively attractive valuation compared to the rest of the world.

5. What sectors are most attractive?

During the recent rebound in equity markets it wasn’t the more cyclical parts of the market that led the way but rather the more defensive sectors, such as healthcare, utilities, IT and communication services. The more cyclical sectors such as financials and industrials were among the laggards. We think this trend will continue from here – and we’ll see a much more defensive equity performance.

With this in mind, our big focus remains healthcare. It has a higher growth rate than other defensive sectors. And as part of our asset allocation changes, we recently reduced our exposure to consumer discretionary after a strong rebound and cut our exposure to industrials and financials as we believe investors will be focusing on more defensive and more structural growth.

6. How has our fixed income strategy changed?

Given our changed outlook on equities, and higher interest rates, bonds have become more attractive in both relative and absolute terms. And so, we have reduced our underweight position in fixed income markets.

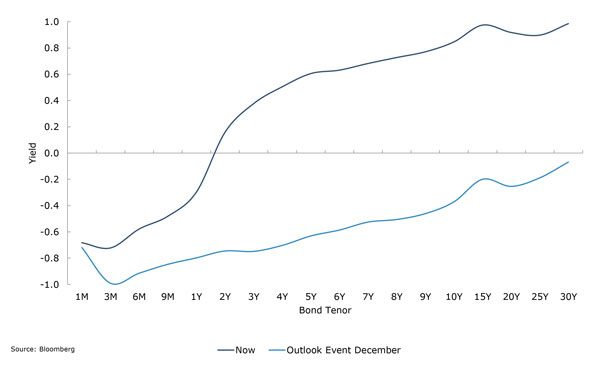

Of course, bonds have had a terrible year so far but there is cause for optimism. When bond values go down, the yields increase and that improves the expected return outlook for fixed income. At our December investment outlook event, we discussed how low and negative government bond yields were anchoring fixed income expected returns lower. However, as those bond yields have moved up, the expected return outlook has improved. For example, a German five-year government bond was yielding -60bps in December. It’s now yielding +60bps – that’s a significant shift in the prospective returns for fixed income markets.

What’s more, when you’re thinking about capital preservation, a higher starting yield for core government bonds should provide a portfolio with a bit more cushion on the downside if there is a growth scare. There’s both a higher yield and more room for bonds to rally.

It’s also worth noting that since December the front and middle part of the euro yield curve has steepened (see Figure 1). This has been driven by the change in tone from the European Central Bank in late January. Central banks have shifted their focus from promoting growth and easy monetary policy to controlling inflation expectations – and they are focusing on rapid tightening now in order to secure stability later. Meanwhile, the yield curve is much flatter as you move out the curve reflecting that future potential interest rate stability.

If central banks succeed and manage to control inflation, the yield curve may reflect fair value. But if they fail, longer-dated bonds are going to be vulnerable to an upswing in yields which will result in capital losses for holders of those bonds. With this in mind, we see the middle part of the curve as the best value, reflecting higher and positive yields as well as in our view less market risk.

Figure 1. Steepening of the German yield curve

Finally, we still have a preference for corporates as they offer a respectable additional yield with relatively low risk. As we are in a mature part of the cycle, we are focusing on higher quality assets – and so, for the most part, that’s investment-grade credit.

Further down the credit spectrum, high-yield credit is less favourable. Given we are later in the cycle, default ranges tend to be more volatile, and spreads are quite low relative to history. In addition, the war in Ukraine may create pockets of pressure for corporates. Together these factors create a less favourable environment for high yield in our view. So, for us, we see the biggest opportunity in the middle part of the investment grade curve – and that’s where we have been adding to allocations recently.

This is a marketing communication.