After a year of tumult, our Investment Outlook for 2022-2026 takes a look at our outlook for global growth. We also reveal our five-year annual average equity market assumptions and discuss asset allocation and portfolio construction.

Key points:

- We see a positive macroeconomic backdrop in the year ahead, with above-trend growth driven by ongoing consumer recovery.

- Inflation is a concern for both cyclical and structural reasons, but central banks are likely to react slowly.

- We retain a positive view for equities, but have lowered our expected returns after a strong 2021.

- Bond returns are expected to be muted, but they continue to play an important anchoring role for portfolio construction.

Above trend global growth

The Covid-19 crisis erupted and unfolded with immense speed – and with that came tremendous volatility. In 2021, economies shut down as a result of the resurgence of the virus, while policy decisions were made on health grounds.

As we begin the new year, there is some optimism that the pandemic may finally come to an end in 2022 as the more virulent but less severe Omicron strain withers over the coming months – despite cases of Covid-19 rising to record levels over the past week or so. While risks remain, Chief Economist Dermot O’Leary takes a positive stance at the start of 2022.

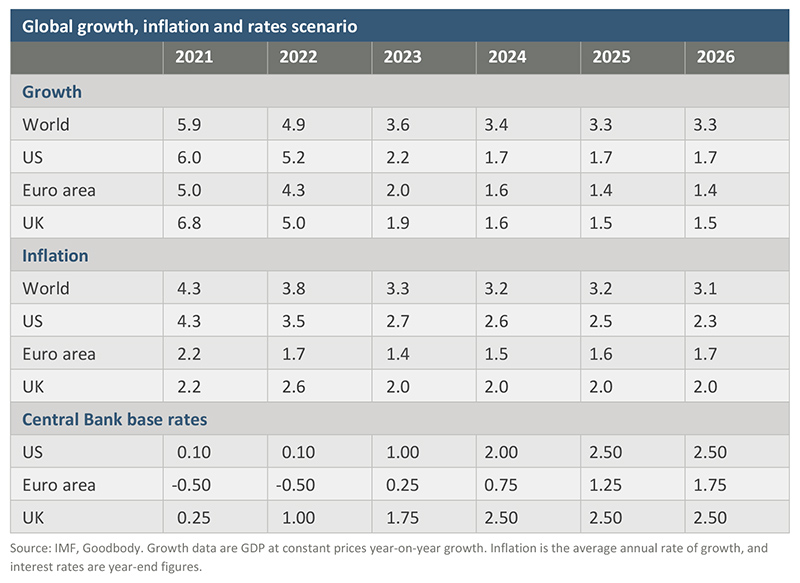

“Global growth will be lower at about 4.5% this year, down from 6% in 2021, but that’s still above trend,” O’Leary explained. He expects global growth will return to trend in 2023.

At a regional level in 2022, O’Leary expects that the euro area will outpace the US in terms of growth, while he has some concerns about China.

“In the last two years, there has been a pivot in terms of the policy focus for the Chinese government. They are trying to reduce the amount of excess property speculation,” O’Leary said.

What will happen to inflation in 2022?

Inflation rates have been rising all over the world and as the topic has dominated news flow in recent months, it is no surprise that it has become a concern for many investors.

O’Leary believes that some of the transitory factors will abate. “We are already seeing that in relation to transport costs, which have started to come down,” he added.

Over the next 12 months, O’Leary says “we could see the headline inflation rate come down, but the underlying inflationary pressures could start to increase”.

Meanwhile, wage inflation pressures are also growing – coming in at over 4% in the US and UK. Looking at the composition of wage inflation pressure, it is interesting to note that lower income quartiles are seeing the highest wage income gains.

“We’ve heard a lot about the inequalities that have built up over the last three decades, so we might be at the early stages of that being reversed,” concluded O’Leary.

Equity market assumptions

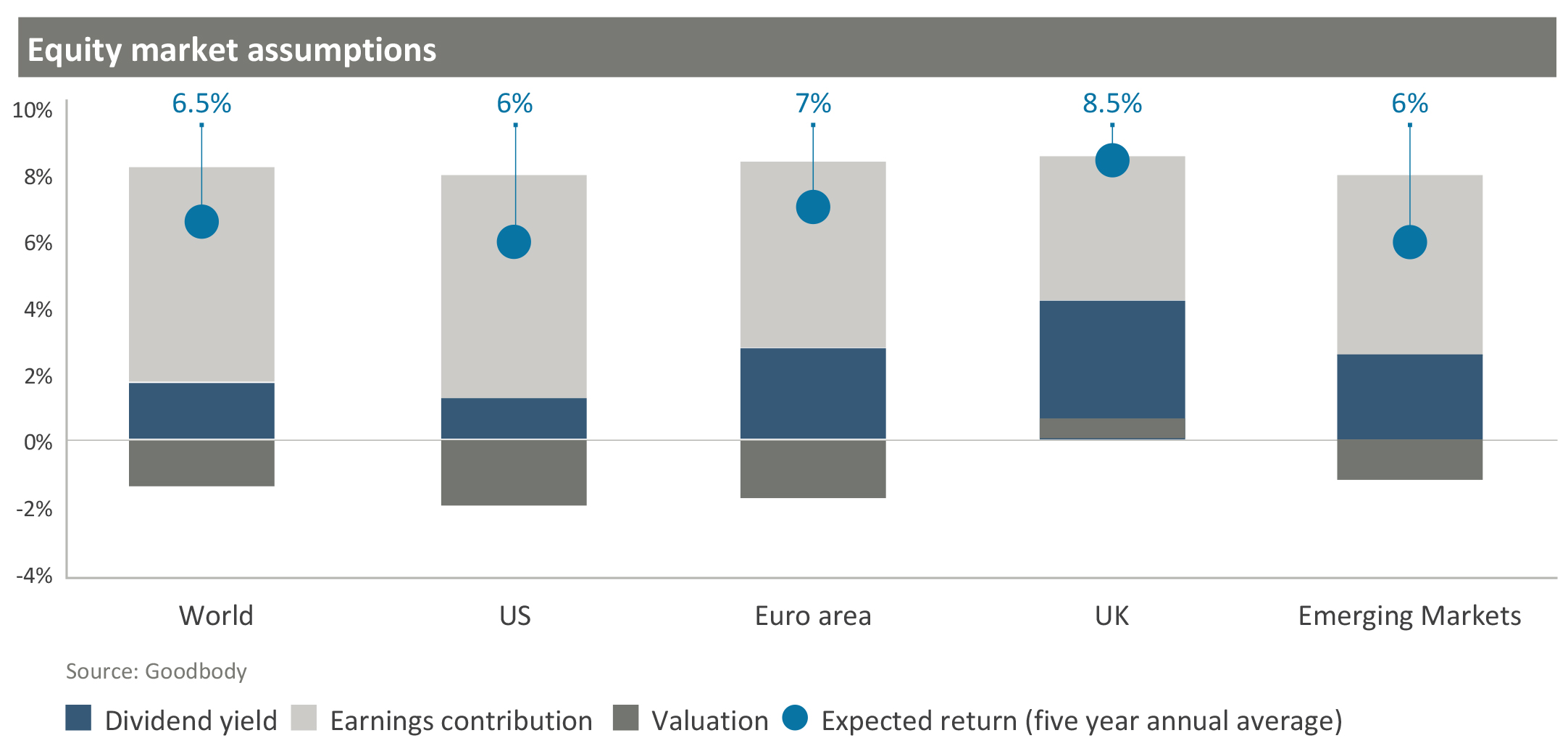

After a very strong year for equity markets in 2021, we have reduced our medium-term expected returns for the asset class.

Chief Investment Officer Bernard Swords explained: “We have brought down our expected returns for equities from 8% per annum over a five-year period last year to 6.5%. This has been driven by two factors: there has been a big move in equity markets, and we are a year into the economic cycle, where we would expect some deceleration in profit growth.”

At 6.5%, our expected five-year annual average equity assumption is still a very decent rate of return against the benign global backdrop and with negative interest rates.

“We’re still expecting above-trend growth in 2022, and so, we still regard this as an equity-friendly environment,” Swords added.

Over the coming years through to 2026, we also expect some devaluation as equity markets ‘grow into’ their historic valuation. We expect devaluation to reduce potential returns by about 1.6% per annum.

At a regional level, we anticipate that Emerging Markets will be the weakest, with subpar returns expected as well as high governance and political risks.

“Normally, the region would be ranked higher because of higher growth rates in emerging economies. But the outlook for China has changed relative to its long-term history, which is probably coming through in our expected emerging market returns,” explained Swords.

Focusing on developed markets, Europe delivers the highest regional returns over the five-year period. Swords says this is driven by two factors: “European markets have less of a valuation drag than the US (the US is a more highly valued market) and a higher initial dividend yield.” However, European markets have higher earnings risk due to a higher exposure to cyclical and financial sectors. Within the region, the UK has a higher expected return than the euro area, thanks to a starting point of lower valuation.

Across the Atlantic, the US has the best earnings outlook, largely due to its sectoral mix, but it faces the largest valuation headwind.

A focus on structural sectors

As we approach a period where growth rates will likely decelerate, investors will start focusing on ‘dependable growth’ – that is, earnings that are not so sensitive to the economic cycle.

“Structural sectors, such as healthcare and IT, will gain more attention as we go into this stage of the economic cycle, where profit growth is not as abundant as it has been in the last two years.

“For us, healthcare stands out as the best sector in terms of sustainability of earnings. It also has no valuation drag relative to other sectors,” said Swords.

Fixed income: an unchanged outlook

Our outlook for fixed income is broadly unchanged on last year. Returns for the fixed income asset class are anchored – i.e., if you buy and hold to maturity, the return is largely pre-determined.

Investment Analyst Niamh O’Leary outlined this by using the example of a five-year German government bond: “Its yield to maturity is about negative 0.6% today – and so, over five years you know that this will be your annualised return. To improve these returns, additional risk could be taken by extending the duration of your fixed income asset. For example, buying a 10-year German bond rather than a five-year one would generate slightly higher starting yield as an investor would get a term premium. But as interest rates rise over the five-year investment horizon, returns for longer-duration or longer maturity bonds may be worse despite that higher starting yield as rising yields affect their value adversely during their life.”

Examining regional diversity in fixed income, we looked at the yield pick-up in buying a US Treasury rather than a European government bond.

“We have seen a divergence in monetary policy in the last number of years. At the moment, hedging rates are relatively low, so on a euro-hedged basis investors can currently get a slightly positive yield on US Treasuries,” explained O’Leary. That said, it is important to assess the risks associated with this: changes in monetary policy as well as in hedging rates can really impact bond returns for a euro-based based investor.

When investors consider how to increase their expected return taking on some risk in credit markets may seem like the obvious answer. But as O’Leary explains: “The overall challenge to the fixed income asset class is that everything is rooted in that low core government bond yield. Investors can look to add premiums but without taking on risk, it’s quite difficult.”

Overall, when it comes to fixed income markets, we think investors cannot expect the returns that they would have generated historically without taking on substantially more risk. “I think getting a return of zero or above is a positive in this environment,” concluded O’Leary.

Portfolio construction

Portfolio construction is a critical balance of risk and reward as well as client objectives and constraints. It is important to ensure that portfolio construction is measured precisely to an investor’s risk profile.

Sarah Quirke, Head of Investment Solutions, explained: “Our first task is to get the balance of equity and safe assets, usually high-quality bonds, right – even if that sacrifices some potential return.

“The second most important thing is to ensure diversification within the asset classes, avoiding too much concentration in one theme or sector. We use the model portfolios prepared by the investment team to do this, but very often an investor has a constraint or preference that means we need to adapt and so, we have to keep these principles in mind.”

For portfolio construction, the possibility of rising rates poses a difficult question because rising rates tend to hurt all asset classes in some way. So, it can be a challenge to diversify this risk.

“One of the main things we do at the moment is to keep our fixed income exposure biased to short maturity bonds. These are much less sensitive to rising interest rates in the short run and over time will even benefit from reinvestment at higher

yields.

“We also have a bias to corporate credit risk, as economic growth stays strong. So, default rates should stay low. Within equities investors should have a diversified exposure across sectors – and ideally not concentrate their exposure in sectors where valuation may be over-extended and interest rate rises may hurt most,” added Quirke. Healthcare, as we mentioned earlier, is an example of where concentration may be preferred.

As financial markets continue to navigate Covid-19-induced volatility, it is important to build a portfolio that suits an investor’s risk profile. Quirke offers some tips: “Have a clear long-term plan that is driven by realistic expected returns and an assumption that the unexpected can and very likely will happen on that journey.

“So, as an investor, if you build the right plan, then it will be robust enough to weather such shocks and you will not be forced to change your mind at just the worst possible time – so have a clear plan, suited to your risk profile and experience, and stick with it.”

This is a marketing communication.