What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Volatility continues as central banks react to the inflation background. The European Central Bank (ECB) is the latest to act, putting the market on warning that rates could move this year. The Bank of England moved rates up 0.25%, as expected, but a number of council members wanted a 0.5% hike.

- Euro fixed income was under pressure and 10-year yields were up about 20bp last week, moving back into positive territory. We expected fixed income markets to be vulnerable but remain orderly as central banks started changing policy – and so far, that is the case. Having US exposure helps as well, as we have some protection in a higher running yield, which does not exist in the euro area.

- Equity markets flipped around last week. We started with a shift to defensive growth and ended the week switching back to cyclical growth. If people are worrying about tighter monetary policy, they should be shifting towards defensive growth – that’s what we believe will serve you best.

Macro views

- Data released during the week revealed the impact of the Omicron variant. In the US, the Institute for Supply Management (ISM) manufacturing and non-manufacturing surveys fell in January. However, both surveys remain at high levels at just under 60, indicating that activity is still expanding at a strong pace.

- The US non-farm payrolls number painted a better picture. The number of jobs created in January was well ahead of expectations and there were large upward revisions to previous months, indicating a very robust economy.

- In the euro area, Q4 GDP slowed quarter-on-quarter, but it was not as bad as some feared and all down to softness in mobility-related elements of the economy. The composite Purchasing Managers Index (PMI) for January showed an improvement from the mid-month reading so we could be seeing the Omicron impact passing already.

- The growth indicators have been encouraging. While the spread of the Omicron variant has caused some disruption, it has been limited and seems to pass quickly. So, we can have greater confidence that we will see the global economy continue to grow at an above-trend pace – this is important in times of monetary tightening.

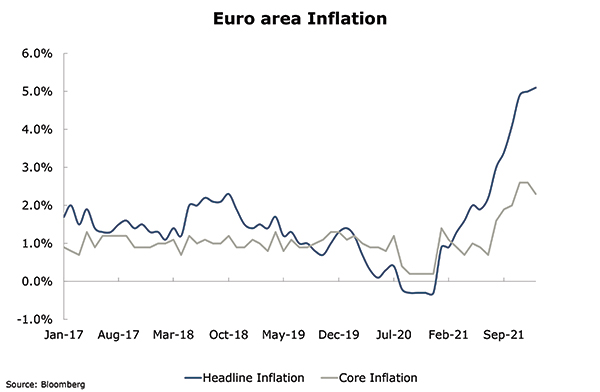

Chart of the week: Inflation is down, but not by enough

In the euro area, there is a tale of two inflation rates: headline inflation hit a new high driven by energy costs, while the core rate subsided though not as much as people expected. Indeed, this has put the ECB on guard. It has been talking about transient elements in the inflation figure. We are seeing some of those coming out of the core figure, but not the headline number. A closer look at core inflation shows that even after the drop, it is still above the target rate – and that has caught the ECB’s attention. If it does not subside quicker, then the ECB will have to act.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |