What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Central banks, most notably the US Federal Reserve (Fed), dominated the week in financial markets as participants grappled with the uncertain path of rates and the global economy. While policymakers across Europe and the US are certainly hawkish and tightening policy, it is the markets’ expectations of where policy rates could be and how fast they could change that impact asset values most.

- So, although the Federal Open Market Committee (FOMC) delivered an expected 75bp hike, the focus was more on its projections of where the target rate could go – the so-called “dot plot”. This has jumped sharply since their last projection in June. Members now see the median rate at 4.4% by end of the year, up from 3.4% in June. This implies a strong chance of another 75bp hike at the next meeting in November, which would be the fourth in a row and faster and steeper than the market expects.

- Elsewhere, the Bank of England raised rates by 50bps as expected and confirmed it would start selling down its stock of bonds on its balance sheet. Rates were also raised by central banks in Sweden, Norway, and Switzerland, while European Central Bank (ECB) president Christine Lagarde said that the bank could take rates into restrictive territory to curb inflation. The Bank of Japan was alone in leaving its rate unchanged, as expected. Clearly, global monetary policy is on a firm tightening path.

- In response, both equities and bonds fell sharply, which has been a feature of this year in general. In equities, the selloff saw cyclicals faring worst although all sectors saw declines. In bond markets, the US yield curve flattened further – meaning the spread between the US 10-year and two-year yields widened by 11bps - indicating lower confidence in the US economic outlook.

- Nonetheless, the US economy has proved resilient so far and expectations are for inflation to fall significantly over the coming year, as supply driven bottlenecks continue easing and the economic slowdown naturally squeezes demand growth. In this context, softer economic news would likely be bullish for markets to the extent that it reduces the need for higher rates.

Macro views

- In the US, the flash manufacturing and services Purchasing Managers’ Indices (PMIs) for September beat expectations (51.8 vs 51.2 and 49.2 vs 45 expected, respectively) with both indicating a rebound in new orders as well as slower cost inflation. The US economy continues to be relatively resilient.

- It’s a different story in Europe. The composite PMI in the euro area fell to 48.2 as expected but it is the third consecutive monthly reading below the neutral level of 50. In the UK, the flash composite PMI was also lower at 48.4 versus 49 expected. Cost of living and rising energy costs were the key themes of the survey.

- In response to the macro environment, the UK announced a large fiscal stimulus in its budget on Friday, with the package expected to cost about £160bn over five years. Many of the policies were already known in advance but UK gilts and sterling faced increased pressure on concerns about the sustainability of the measures.

- Back to the US and on housing, the NAHB Housing Market Index, a monthly survey of homebuilders fell to 46, indicating a cooling housing market. Housing starts rose strongly in August, but the more forward-looking housing permit issuance fell. Finally, existing home sales were down 0.4% on the month in August. It is not surprising that the housing market in the US is softening in response to rising rates.

- On the inflation front, there was further evidence of upward pressures globally. In the eurozone, German PPI (producer prices) accelerated to 7.9% on the month in August, although this was on the back of high energy prices which have moderated since. In Japan, inflation rose to 3% year-on-year in August.

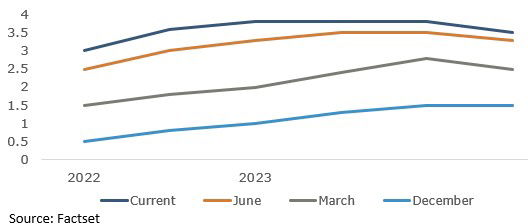

Chart of the week: Changes in consensus estimates for the US policy rate

The extent of the rate shock during 2022 is illustrated by our chart of the week. It helps to explain much of the volatility in financial markets this year, especially in fixed income. The pace of interest rate increases by the Fed has been the significant factor in markets this year. With the Fed itself now projecting 4.4% by year end and no cuts next year, these estimates are sure to move higher. However, US recessions typically do not start until after the Fed pauses its hiking cycle and begins to cut rates. Moreover, equities generally do not start to make new lows until at or close to the onset of a recession. Therefore, any signals that inflation is falling, including softer economic data, should be bullish for markets.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |